- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

Raised Revenue Guidance and AI Leadership Could Be a Game Changer for ExlService Holdings (EXLS)

Reviewed by Sasha Jovanovic

- ExlService Holdings recently reported third quarter 2025 earnings, showing year-over-year increases in sales to US$529.59 million and net income to US$58.16 million, and also raised its full-year revenue guidance to between US$2.07 billion and US$2.08 billion, expecting a 13% rise from 2024 levels.

- In addition to these results, ExlService completed a share repurchase program amounting to over US$385 million and has been recognized as a leader in Generative AI services, reflecting its ongoing investments in technology and shareholder returns.

- Let's explore how the raised full-year revenue forecast reinforces ExlService Holdings' investment narrative and earnings growth outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

ExlService Holdings Investment Narrative Recap

To consider ExlService Holdings as an investment, it’s important to believe in the company’s long-term ability to transition its core business toward higher-value AI and data services, while managing the challenges posed by technological change and operating costs. The recent raised revenue outlook and year-over-year improvements in both sales and net income provide clear support to the near-term earnings growth story, reinforcing the key catalyst of sustained demand for ExlService’s digital transformation offerings. At this time, these results do not significantly change the most pressing risk: ongoing cost pressures due to wage inflation and competition for skilled talent.

Among the company’s recent updates, ExlService’s completion of a US$385 million share repurchase program stands out as most relevant to shareholders following the earnings release. By reducing the share count and returning capital, this action can offset potential margin pressures stemming from higher employee costs or industry competition, connecting directly to the factors driving both growth catalysts and operational risks.

However, investors should also be mindful of the growing cost of talent and how it may impact margins over time, especially if...

Read the full narrative on ExlService Holdings (it's free!)

ExlService Holdings' outlook points to $2.7 billion in revenue and $326.3 million in earnings by 2028. This is based on a 10.9% annual revenue growth rate and a $90 million increase in earnings from the current $236.3 million.

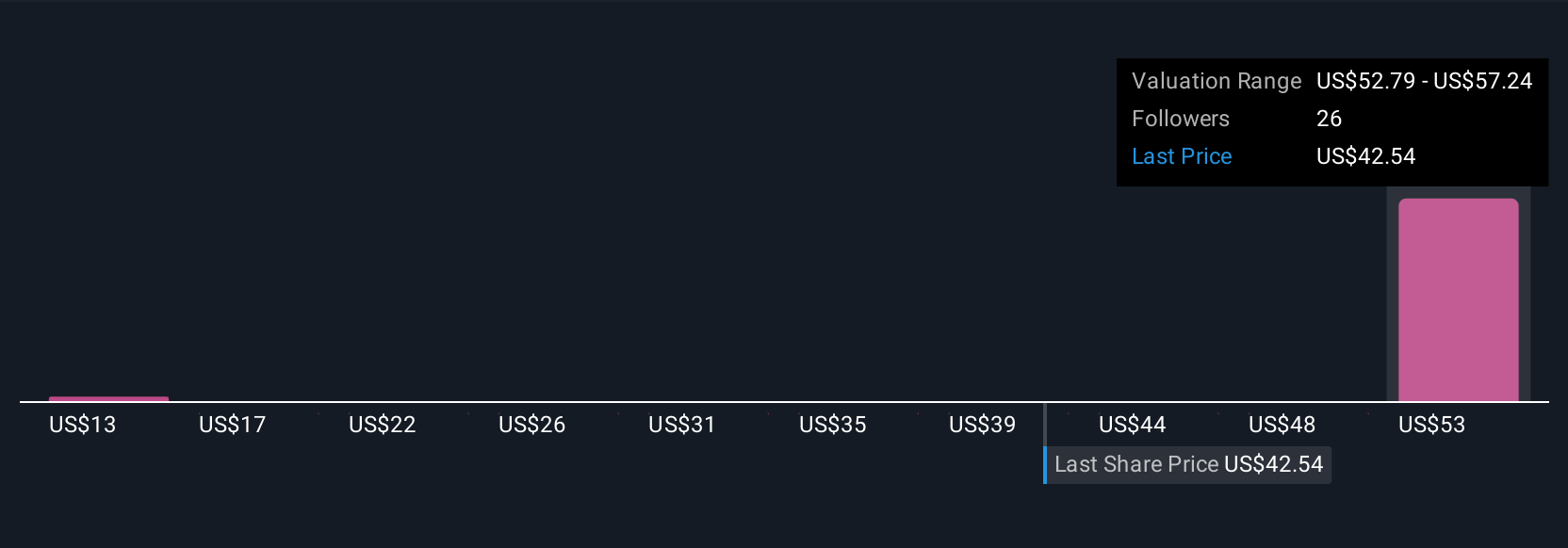

Uncover how ExlService Holdings' forecasts yield a $53.29 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members valued ExlService Holdings in a narrow range from US$53.29 to US$57.29, with two perspectives included. While most see upside, persistent wage inflation and skilled labor shortages could influence earnings quality going forward, so you may wish to compare these insights against shifting industry fundamentals.

Explore 2 other fair value estimates on ExlService Holdings - why the stock might be worth as much as 48% more than the current price!

Build Your Own ExlService Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ExlService Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ExlService Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ExlService Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives