- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

ExlService Holdings (EXLS): Evaluating Valuation After Earnings Guidance Boost and Strong Q3 Results

Reviewed by Simply Wall St

ExlService Holdings (EXLS) just raised its earnings guidance for 2025, while also sharing third quarter results that showed notable increases in both revenue and net income over the past year. These updates provide a clear signal of ongoing business strength.

See our latest analysis for ExlService Holdings.

After a stretch of volatility this year, ExlService Holdings’ latest guidance upgrade and robust quarterly results have helped the stock recover some ground, with a 2.04% one-day share price gain and a 1.13% return over the past week. However, the company’s total shareholder return for the past twelve months remains down 13.54%. This reminds investors that momentum is still rebuilding after a challenging start to the year, even as long-term holders have seen over 140% total returns over five years.

If growth stories like this one have you curious about what else is out there, it's a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With analyst targets sitting well above the current share price and robust growth projections in place, is ExlService Holdings trading at a discount that investors should seize? Or is all of its upside already reflected in the stock?

Most Popular Narrative: 25.8% Undervalued

ExlService Holdings is currently trading at $39.54, while the prevailing narrative puts fair value at $53.29. This gap reflects substantial operating momentum thanks to technology and sector partnerships.

*EXL introduced EXLdata.ai, an agentic AI suite developed with Databricks, to help enterprises modernize data management, accelerate AI adoption, and provide modular, AI-native solutions for both structured and unstructured data.*

Curious why a transformation in data management matters so much? The current fair value hinges on assumptions about margins, revenue expansion, and the market’s willingness to pay a premium. The real surprises are in the future profits these innovations could bring. Find out which bold forecast forms the core of this narrative’s valuation logic.

Result: Fair Value of $53.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including rising global compliance costs and increasing competition in AI services. These factors could pressure margins and challenge ExlService’s growth narrative.

Find out about the key risks to this ExlService Holdings narrative.

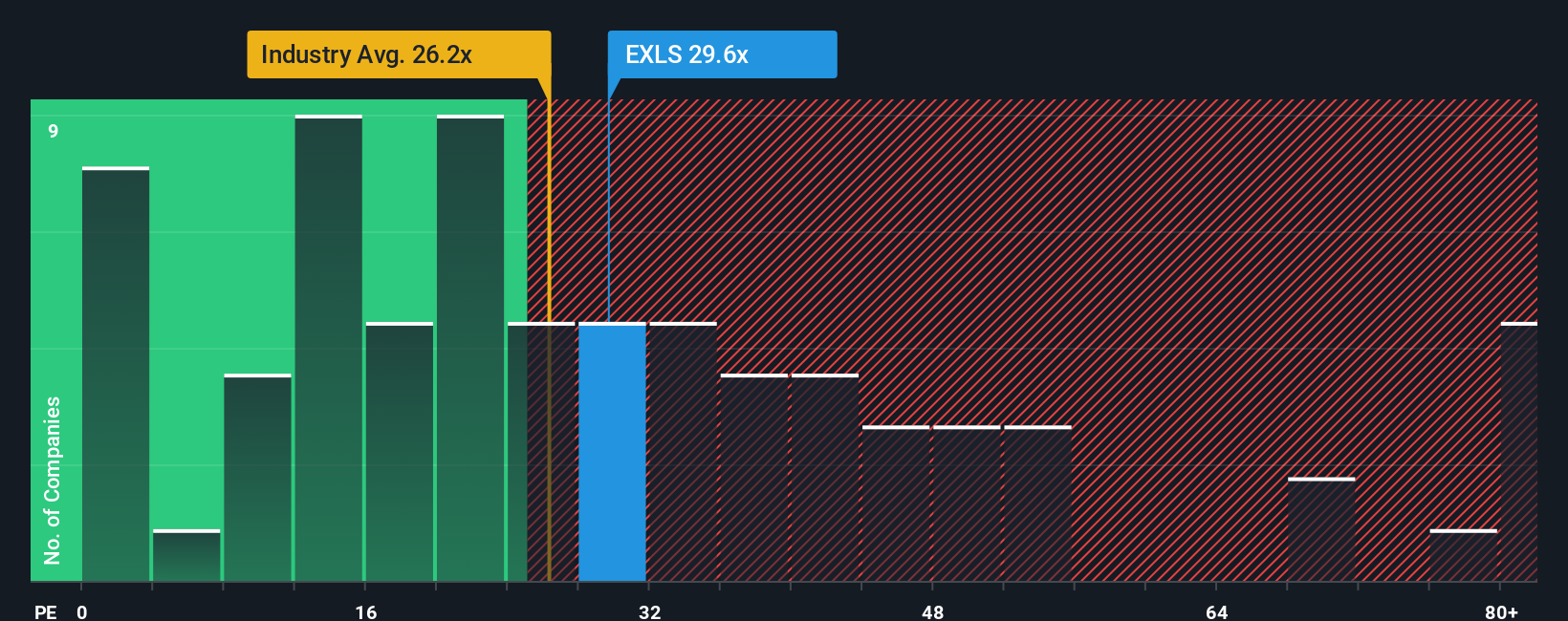

Another View: The Market Multiple Test

While fair value estimates point to ExlService Holdings as undervalued, current trading suggests a more cautious stance. The company's price-to-earnings ratio stands at 26x, which is above the US Professional Services industry average of 24.5x and the fair ratio of 23.9x. This means investors are already paying a premium compared to peers and what the market could reasonably move toward. Does this premium signal untapped potential or extra valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ExlService Holdings Narrative

If this perspective doesn’t quite align with your own, or if you’d rather dive into the numbers firsthand, you can shape a custom narrative from scratch in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ExlService Holdings.

Looking for More Investment Ideas?

Unlock tomorrow’s biggest opportunities now with Simply Wall Street’s Screener, your fast track to sectors and stocks offering growth, income, or innovation potential.

- Tap into real growth by checking out these 876 undervalued stocks based on cash flows, which is packed with stocks trading below intrinsic value but backed by strong fundamentals.

- Catch the next wave in healthcare technology as you browse these 32 healthcare AI stocks featuring companies reshaping patient care with transformative AI solutions.

- Boost your portfolio with reliable income when you explore these 16 dividend stocks with yields > 3%, offering consistently high yields above 3% from industry-leading businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives