- United States

- /

- Commercial Services

- /

- NasdaqGS:CWST

Casella Waste Systems (CWST): Evaluating Valuation After Q3 Earnings Beat and Raised Guidance

Reviewed by Simply Wall St

Casella Waste Systems (CWST) just delivered a strong third-quarter report, highlighted by higher sales and earnings. Management raised the lower end of full-year revenue guidance and pointed to solid performance across several initiatives.

See our latest analysis for Casella Waste Systems.

Following a solid run-up to its earnings release, Casella Waste Systems’ recent updates and upbeat guidance gave shares a short-term boost, with a notable 6.6% 7-day share price return. That said, momentum has been uneven in 2025, as reflected in a year-to-date share price decline of 15.25% and a 1-year total shareholder return of -17.08%. Despite the recent dip, long-term investors are still ahead with a 49% total return over five years. This shows that while sentiment can swing with news and guidance shifts, the bigger picture still reflects substantial value creation over the long haul.

If Casella’s turnaround efforts have you thinking about what else is gaining attention, now is the perfect time to discover fast growing stocks with high insider ownership

With upbeat analyst ratings and a valuation still below many price targets, the question now is whether Casella Waste Systems is a bargain for forward-looking investors or if the market has already factored in its future growth.

Most Popular Narrative: 23.2% Undervalued

Casella Waste Systems’ current share price sits well below the most widely followed narrative fair value estimate, suggesting a substantial potential upside if analyst projections play out. The valuation reflects a dynamic mix of recent earnings gains and major strategic bets on market expansion and operational efficiency.

The heightened focus among municipalities, universities, and commercial clients on sustainability and ESG-driven solutions is increasing demand for Casella's Resource Solutions segment. This is strengthened by recent investments in upgraded recycling facilities and innovative processing capabilities, supporting top-line revenue growth and resiliency against commodity price swings.

Wondering what's powering this surprising gap between fair value and the market price? The answer lies in bold revenue and earnings forecasts, plus assumptions about future profit margins that echo high-growth sectors. Want to see which ambitious financial goals are driving this bullish view?

Result: Fair Value of $115 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent integration challenges in new regions and rising labor costs remain real hurdles. These factors could undermine Casella’s growth outlook over the medium term.

Find out about the key risks to this Casella Waste Systems narrative.

Another View: Is the Market Pricing Too High?

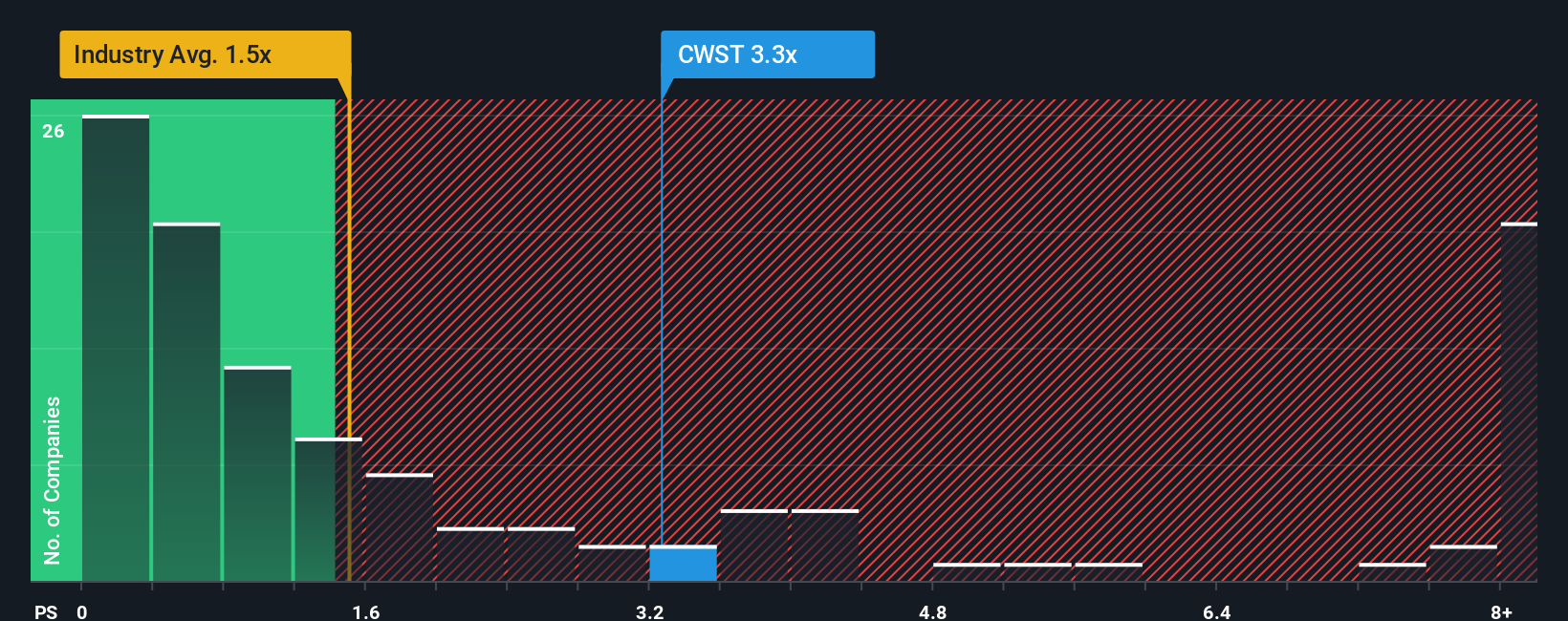

Looking through the lens of the price-to-sales ratio, Casella Waste Systems appears expensive. Its 3.1x multiple is significantly above both the US Commercial Services industry average of 1.2x and its own fair ratio of 1.6x. This could mean valuation risk if market expectations slip. So, is there more downside if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casella Waste Systems Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own take on Casella’s outlook in just a few minutes. Do it your way

A great starting point for your Casella Waste Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great investors never stop seeking better opportunities. Don’t limit yourself; expand your watchlist with strategies that might give you the edge you need over the market.

- Tap into tomorrow’s growth engines by following these 24 AI penny stocks, where cutting-edge companies are using artificial intelligence to transform industries.

- Lock in reliable income and stability as you check out these 17 dividend stocks with yields > 3%, focusing on stocks with attractive yields above 3%.

- Seize opportunities with strong upside potential by scanning these 861 undervalued stocks based on cash flows, which highlights stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CWST

Casella Waste Systems

Operates as a vertically integrated solid waste services company in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives