- United States

- /

- Commercial Services

- /

- NasdaqGS:CPRT

Copart (CPRT): Evaluating Valuation as Share Momentum Slows in 2024

Reviewed by Simply Wall St

Copart (CPRT) has continued to attract investor attention given its performance over the month, with shares recently closing at $40.51. The company’s business metrics and year-to-date moves are fueling new conversations about current valuation.

See our latest analysis for Copart.

After a strong run in previous years, Copart’s share price momentum has cooled in 2024, with a 1-day gain of 1.33% offering little relief from its year-to-date decline of 28.07%. Despite this, long-term shareholders are still in the green, as Copart’s three- and five-year total shareholder returns stand at 31.6% and 37.7%, respectively. This suggests that while sentiment has shifted lately, the business has rewarded patience over time.

If Copart’s recent twists have you interested in what else is out there, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With Copart’s shares trading well below analyst targets and profit growth persisting, investors now face a crucial decision: is the recent drop a rare entry point, or is the market correctly factoring in all future prospects?

Most Popular Narrative: 27.7% Undervalued

With Copart’s fair value set at $56 and the last close at $40.51, the narrative presents the shares as meaningfully discounted relative to business prospects. The gap creates a key consideration for anyone weighing the accuracy of market skepticism against brighter long-term forecasts.

Accelerating digital adoption in vehicle auctions and heavy investment in proprietary, AI-enabled platforms are expected to enhance Copart's competitive advantage in transaction efficiency, supporting higher net margins and greater buyer/seller engagement.

Want to know the hidden assumptions driving this optimistic price target? One major factor is profit growth that outpaces revenue, tied to bold efficiency bets. Wondering which numbers could push shares higher soon? Dive in to uncover the drivers that have analysts convinced value remains unlocked.

Result: Fair Value of $56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing advances in vehicle safety and shifting insurance trends could reduce accident volumes. This could in turn impact Copart's auction supply and growth prospects.

Find out about the key risks to this Copart narrative.

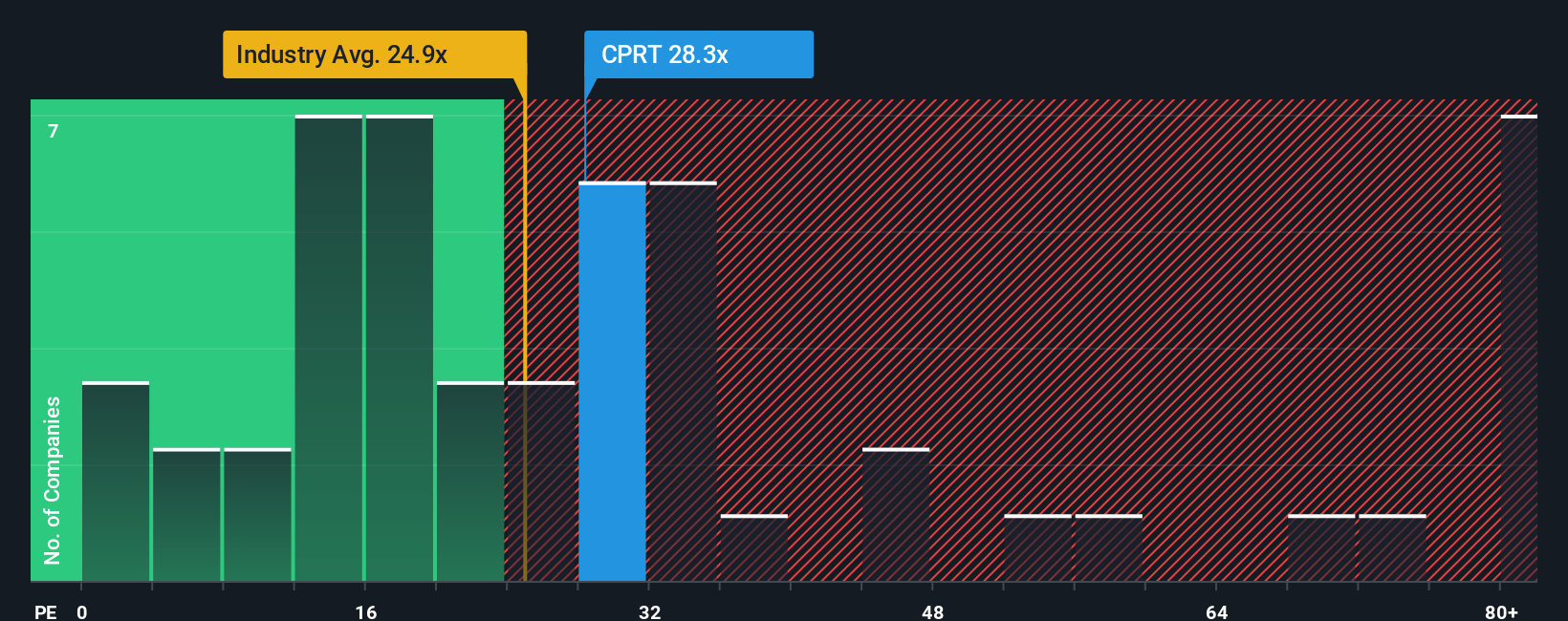

Another View: Earnings Multiple Signals Mixed Messages

The current price-to-earnings ratio for Copart stands at 25.3x. This is higher than the industry average of 22x but lower than the average among direct peers of 33.7x. Compared to the fair ratio of 27.5x, Copart trades at a slight discount, but not without risk. Could this suggest the market is being cautious, or are investors missing out on a value opportunity? The answer may depend on what you expect from sector sentiment and growth rates ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Copart Narrative

If you see things differently or prefer to dig into the details on your own terms, you can analyze the numbers and form your own view in just a few minutes, then Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Copart.

Looking for more investment ideas?

Don’t let great opportunities slip by while you focus on just one stock. Smart investors expand their search to unlock even more potential wins.

- Step into tomorrow’s technology by tapping into these 27 quantum computing stocks. Quantum computing innovators are setting the pace for breakthroughs.

- Power up your passive income plans by targeting high-yield potential with these 16 dividend stocks with yields > 3%, which offers robust returns and consistent payouts.

- Stay ahead of the curve in artificial intelligence by following these 24 AI penny stocks, as these companies reshape industries and drive exceptional growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPRT

Copart

Provides online auctions and vehicle remarketing services in the United States, the United Kingdom, Germany, Brazil, Canada, the United Arab Emirates, Spain, Finland, Oman, the Republic of Ireland, and Bahrain.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives