- United States

- /

- Commercial Services

- /

- NasdaqGS:CMPR

Cimpress (CMPR): Assessing Valuation After Profitability Return and 2026 Guidance Reaffirmation

Reviewed by Simply Wall St

Cimpress (CMPR) shares are drawing attention after the company reported a return to profitability for the latest quarter and reaffirmed its revenue and earnings guidance for 2026, which highlights confidence in sustained growth.

See our latest analysis for Cimpress.

Cimpress’s return to profitability and confident 2026 outlook appear to be driving fresh optimism. The share price is up over 6% in the past month and 12% for the last quarter. However, total shareholder return for the past year remains down more than 20%, which serves as a reminder that the recent positive momentum is just the first step in recovering from a longer period of underperformance.

If you’re watching for other stocks gaining momentum after turnarounds, consider broadening your search and discover fast growing stocks with high insider ownership

With shares still trading about 28% below analyst targets despite the recent uptick, the question for investors now is whether Cimpress is undervalued or if the market has already accounted for its recovery and growth potential.

Most Popular Narrative: 21.8% Undervalued

With Cimpress's fair value set at $83.50 by the most widely followed narrative, well above the latest close of $65.28, debate is heating up over whether the recent gains are just the beginning for investors.

The company's growing focus on acquiring and retaining high-value customers, coupled with rising per-customer lifetime value (LTV) from broader product adoption, should enhance both gross profit dollars and reduce acquisition and advertising costs as a percentage of revenue, driving stronger net margins over time.

Want to know what’s fueling this bullish perspective? The narrative’s future earnings and margin projections are bolder than you might expect for this sector. Discover which numbers and strategic shifts support their case, and what could send shares even higher or lower. The full breakdown awaits.

Result: Fair Value of $83.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued declines in legacy print or disappointing returns from new investments could create challenges for Cimpress as it works to sustain its recent turnaround.

Find out about the key risks to this Cimpress narrative.

Another View: What Do Multiples Say?

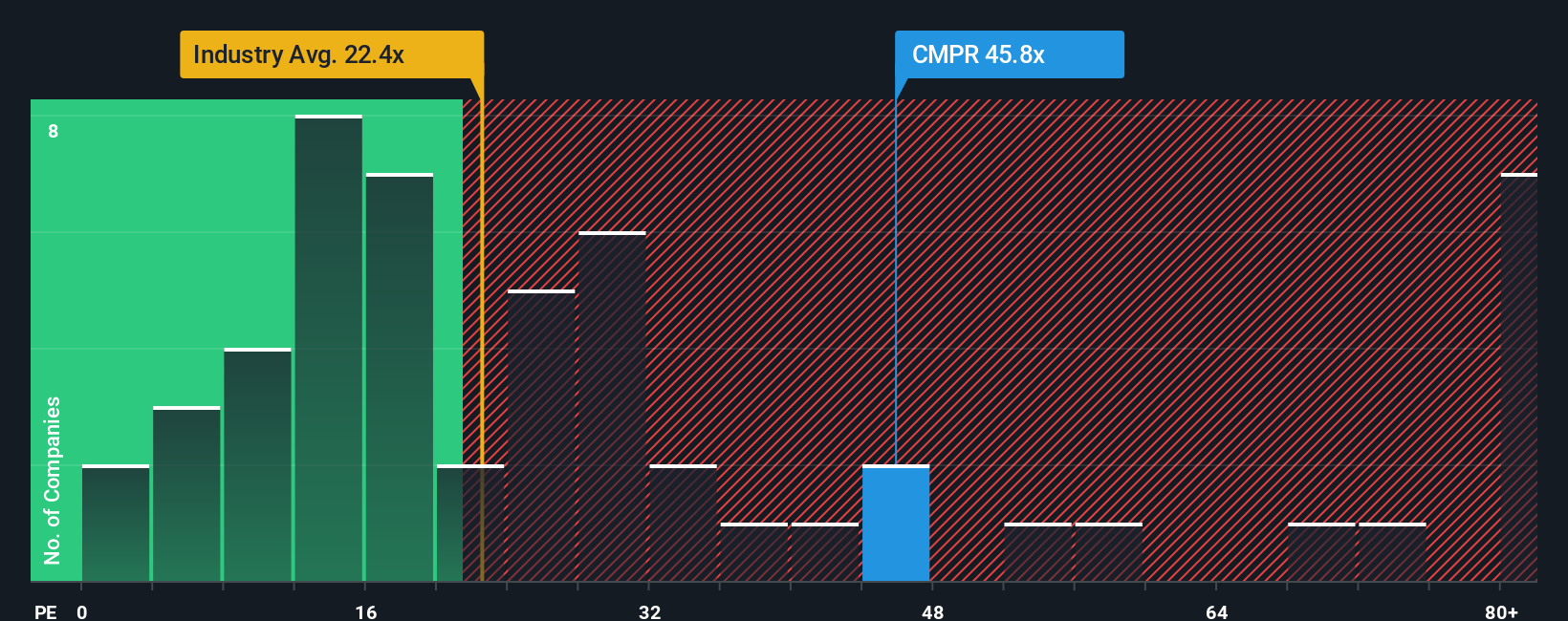

While narrative-driven analysis sees Cimpress as undervalued, the company’s current price-to-earnings ratio of 45.8x stands far above both its industry average (22.2x) and its own fair ratio (25.2x). This premium could limit near-term upside if growth falls short. Does recent optimism justify paying so much more than peers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cimpress Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can quickly craft your own take on Cimpress in just a few minutes. Do it your way

A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for a single opportunity when there are so many trends to capitalize on. Unlock your edge today with these handpicked paths:

- Supercharge your income strategy by securing reliable payouts from these 16 dividend stocks with yields > 3% offering yields above 3% in today’s market.

- Capture upside ahead of the crowd by backing innovation with these 24 AI penny stocks powering next-generation automation and disruption.

- Take advantage of undervalued diamonds in the rough by reviewing these 865 undervalued stocks based on cash flows primed for strong cash flow growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMPR

Cimpress

Provides various mass customization of printing and related products in North America, Europe, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives