- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

How Investors Are Reacting To Automatic Data Processing (ADP) Steady Earnings Growth and Russell 1000 Influence

- In recent days, Automatic Data Processing (NASDAQ:ADP) reported earnings per share growth of 13% per year over the last three years and a 7.1% increase in revenue to US$21 billion, with EBIT margins holding steady and insider ownership valued at US$78 million.

- ADP’s reinforced role in the Russell 1000 index and sustained institutional interest highlight its operational efficiency, technological advancements, and influence within the technology sector.

- Now, we’ll assess how ADP’s consistent revenue growth and strong index presence shape the latest investment narrative for the company.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Automatic Data Processing Investment Narrative Recap

To be a shareholder in Automatic Data Processing, you need to believe in the long-term demand for outsourced, cloud-based HR and payroll solutions as businesses digitize operations. The recent results, showing stable margins and healthy revenue gains, reinforce the view that ADP’s core franchises remain resilient. These updates do not appear to materially affect the key short-term catalyst for ADP, sustaining growth in advanced technology product adoption, nor do they significantly shift the main risk: ongoing competitive pressure and delayed deal closures. Among recent company news, ADP’s product launches, particularly the rollout of ADP® Embedded Payroll for SMB software providers, aligns closely with the company’s growth catalysts. This move supports ADP’s efforts to increase customer lock-in and expand its addressable market through technology adoption, potentially offsetting booking slowdowns or sales cycle delays if widely embraced. Yet, the growing influence of newer, SaaS-native competitors could lead to an acceleration in pricing pressure and pipeline delays, which investors should be aware of as...

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing is projected to reach $24.3 billion in revenue and $5.1 billion in earnings by 2028. This outlook depends on a 5.7% annual revenue growth rate and a $1.0 billion increase in earnings from the current level of $4.1 billion.

Uncover how Automatic Data Processing's forecasts yield a $314.17 fair value, a 11% upside to its current price.

Exploring Other Perspectives

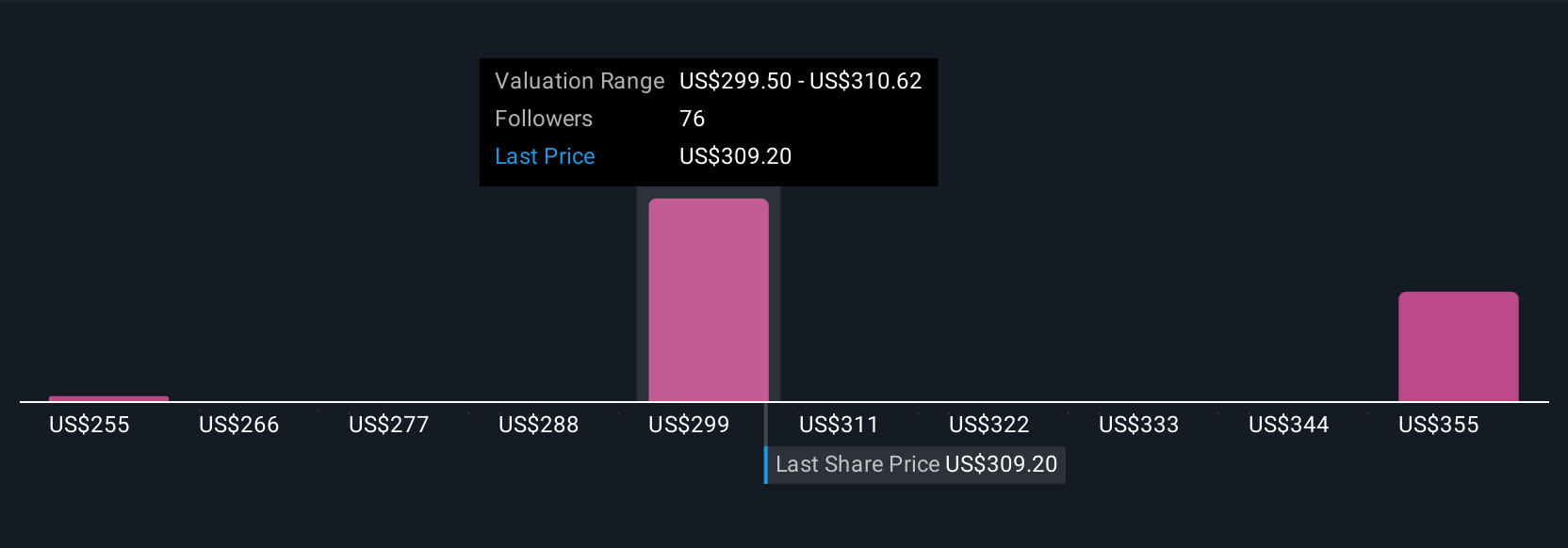

Private fair value estimates from eight Simply Wall St Community members for ADP range widely from US$235 to US$387 per share. With deal cycle delays posing a real risk, you may want to review how others see pressure points shaping future results.

Explore 8 other fair value estimates on Automatic Data Processing - why the stock might be worth 17% less than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.