- United States

- /

- Electrical

- /

- NYSEAM:KULR

KULR Technology Group (KULR): Evaluating Valuation After Standout Q3 Growth and Ongoing Profitability Challenges

Reviewed by Simply Wall St

KULR Technology Group (KULR) just reported its third-quarter results, drawing attention for an impressive 116% jump in revenue compared to last year. Expanded product lines and new partnerships contributed to this growth, even as higher expenses continued to pressure margins.

See our latest analysis for KULR Technology Group.

Despite standout Q3 revenue growth and a flurry of product launches in AI data centers and unmanned aircraft systems, KULR Technology Group’s stock has struggled. Recent share price momentum remains negative following a year-to-date share price return of -90.62%. Even with encouraging total shareholder return over the last year at -31.65%, multi-year returns paint a tougher long-term picture. This reflects a company with exciting new opportunities that is still working to regain market confidence.

Want to find other companies fighting for growth in fast-evolving markets? Now’s the perfect time to discover fast growing stocks with high insider ownership.

With shares down sharply even as revenues soar and new markets beckon, the big question for investors is whether KULR is now trading below its true value or if the market is already factoring in all future potential growth.

Most Popular Narrative: 79.3% Undervalued

With the latest fair value estimate significantly above KULR Technology Group's last close price, the narrative sets expectations for a dramatic rebound if projections play out. The key to this upside lies in moves beyond the core business and into new verticals with potentially superior margins.

Strategic partnerships with leading defense contractors, NASA, and exclusive distribution of advanced robotics (for example, Exia exoskeleton with German Bionic) are positioning KULR to secure high-value, recurring contracts and enter new commercial and government verticals. These developments could substantially boost top-line growth and support a shift to recurring, higher-margin sales.

Curious what assumptions are fueling this bullish narrative? One crucial lever involves a major forecast shift in profit margins and unprecedented growth rates driving the implied fair value sky-high. Want to see what bold projections back up this optimism? Read the full story for all the surprising details.

Result: Fair Value of $11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shareholder dilution from equity financing or unpredictable demand for new launches could quickly undermine recent optimism around KULR’s growth story.

Find out about the key risks to this KULR Technology Group narrative.

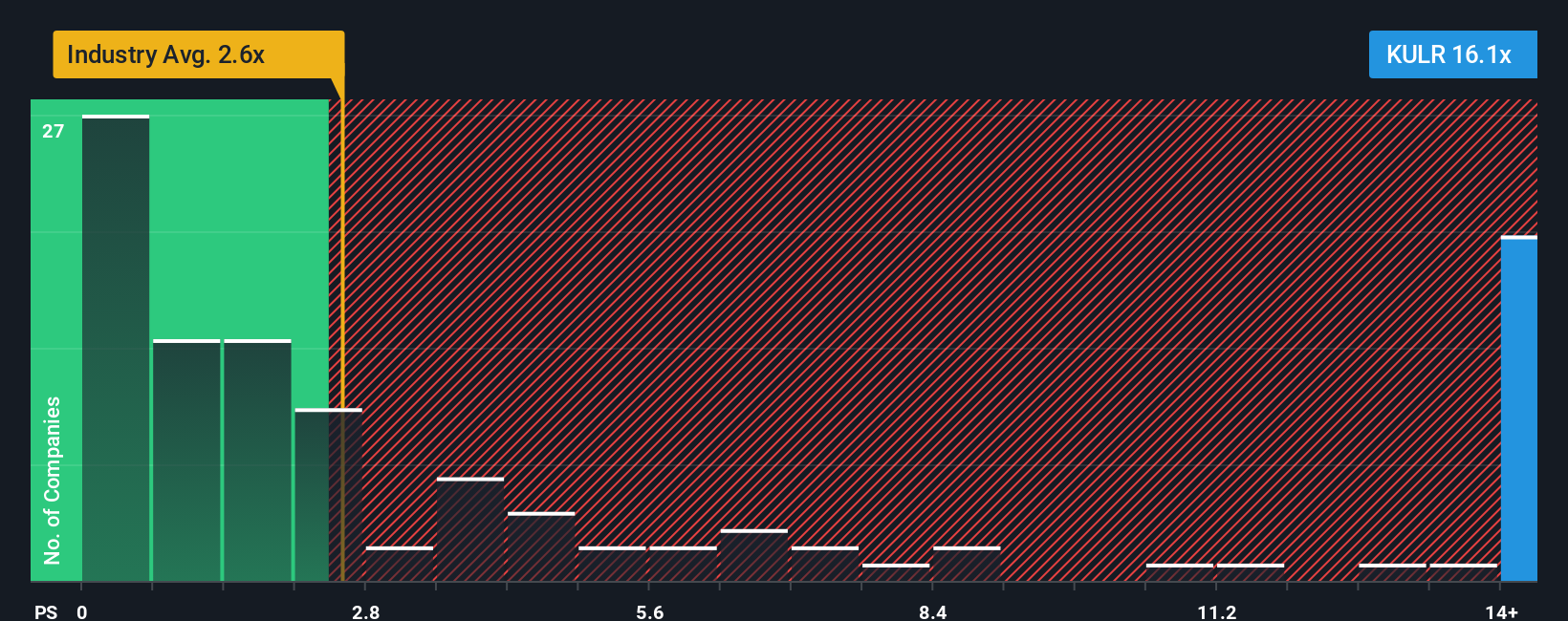

Another View: Market Multiples Challenge Optimism

While analysts suggest KULR is deeply undervalued based on future growth expectations, a look at its price-to-sales ratio tells a more cautious story. Trading at 6.2 times sales, KULR is more expensive than both its peer average of 5.4x and the US Electrical industry average of 1.8x. Even the fair ratio the market could move towards is lower at 5.8x. This puts valuation risk front and center and raises the question: is the market signaling concerns that the growth narrative misses?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KULR Technology Group Narrative

If these views do not match your perspective, you can always dive into the data and shape your own narrative in just a few minutes with Do it your way.

A great starting point for your KULR Technology Group research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip by and supercharge your investing journey with handpicked stock ideas designed to match different goals and strategies, all in one powerful platform.

- Capture tomorrow’s technology leaders by scanning these 25 AI penny stocks poised for rapid growth in artificial intelligence and smart automation.

- Maximize steady income streams when you check out these 16 dividend stocks with yields > 3% offering yields above 3% for consistent passive returns.

- Ride the momentum in breakthrough digital assets by pursuing these 81 cryptocurrency and blockchain stocks fueling innovation in crypto and blockchain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KULR Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:KULR

KULR Technology Group

Through its subsidiary, KULR Technology Corporation, develops and commercializes thermal management technologies for electronics, batteries, and other components applications in the United States.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives