- United States

- /

- Electrical

- /

- NYSEAM:KULR

KULR (KULR) Is Down 16.8% After Record Revenue Paired With Growing Losses and Asset Impairments—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- KULR Technology Group reported record third-quarter revenue of US$6.88 million, more than doubling sales compared to the same period last year, but net loss increased to US$6.97 million amid higher asset impairments and credit losses following a strategic investment insolvency.

- Despite the robust sales growth, the company faces continued profitability pressures and operational hurdles as it pushes into new markets and expands its product portfolio, including initiatives in unmanned aircraft systems and Bitcoin mining.

- We'll look at how KULR's record revenue growth and escalating losses influence its future investment narrative and operational outlook.

Find companies with promising cash flow potential yet trading below their fair value.

KULR Technology Group Investment Narrative Recap

Investors considering KULR Technology Group must believe in the company’s ability to leverage its rapid product and market expansion to achieve sustainable revenue growth, despite widening net losses and heightened cost pressures. The record sales in the third quarter highlight strong demand, but the increased net loss and recent impairment charges underline that the path to profitability remains complex; the biggest near-term catalyst is growth in product revenue, while the greatest risk is continued shareholder dilution if operational cash flow doesn’t improve, a concern not materially changed by this news, but underscored by escalating losses.

Among recent announcements, the delay in filing the 10-Q report by the SEC deadline is closely tied to operational and financial hurdles highlighted in the quarterly results. This delay reinforces the importance of robust financial management as KULR balances aggressive expansion with reporting obligations, directly impacting investor perception around its ability to deliver on growth catalysts.

But looking closer, it’s the ongoing risk of shareholder dilution from capital raises that investors should pay particular attention to...

Read the full narrative on KULR Technology Group (it's free!)

KULR Technology Group's outlook projects $73.8 million in revenue and $7.5 million in earnings by 2028. Achieving this would require a 78.5% annual revenue growth rate and an earnings increase of $24.8 million from the current loss of $-17.3 million.

Uncover how KULR Technology Group's forecasts yield a $11.00 fair value, a 344% upside to its current price.

Exploring Other Perspectives

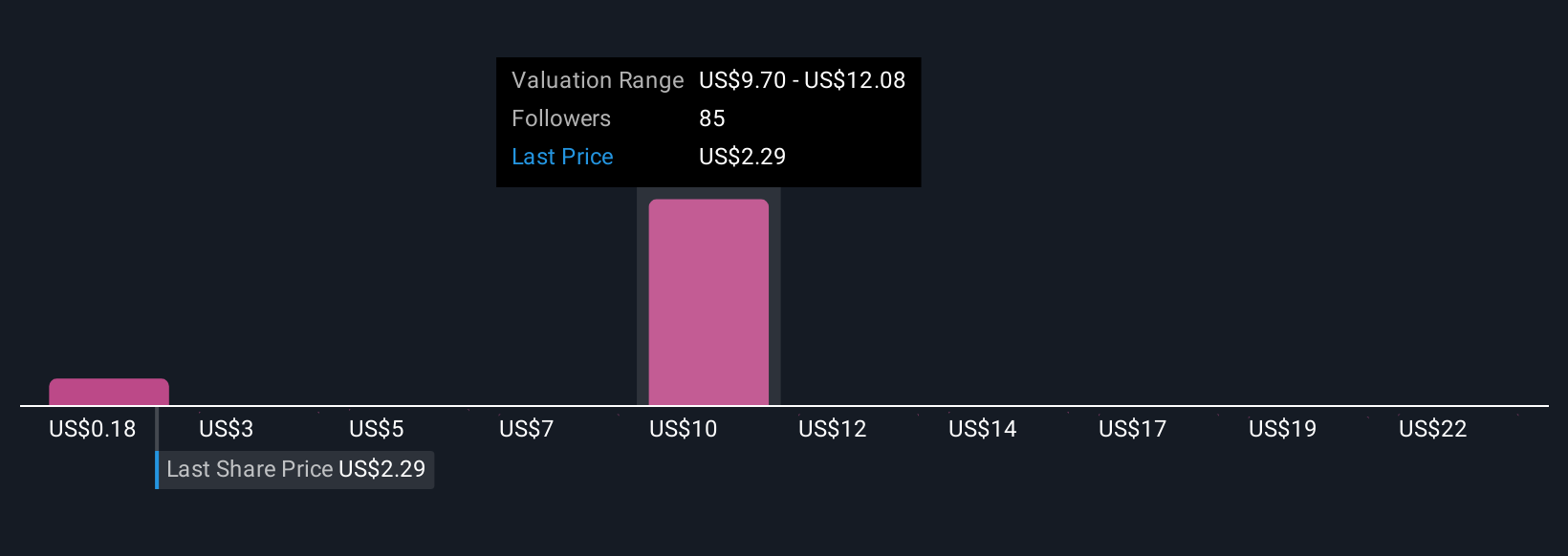

Simply Wall St Community members submitted 29 unique fair value estimates for KULR, ranging widely from US$0.18 to US$23.98 per share. In the face of accelerating revenue but persistent losses, the broad disparity in these views reflects how opinions on future cash flow and dilution risk can differ sharply.

Explore 29 other fair value estimates on KULR Technology Group - why the stock might be worth over 9x more than the current price!

Build Your Own KULR Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KULR Technology Group research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free KULR Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KULR Technology Group's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KULR Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:KULR

KULR Technology Group

Through its subsidiary, KULR Technology Corporation, develops and commercializes thermal management technologies for electronics, batteries, and other components applications in the United States.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives