- United States

- /

- Building

- /

- NYSE:ZWS

TIME’s Sustainability Honor Could Be a Game Changer for Zurn Elkay Water Solutions (ZWS)

Reviewed by Sasha Jovanovic

- Zurn Elkay Water Solutions was recently named to TIME’s 2026 list of the World’s Best Companies for Sustainable Growth for the second consecutive year, ranking No. 229 globally, No. 40 among U.S.-based firms, and No. 1 in Wisconsin.

- This achievement underscores the company’s growing leadership in sustainability and innovation, particularly as it addresses global water challenges with long-term financial goals.

- We’ll explore how recognition as TIME’s top Wisconsin company for sustainable growth could influence Zurn Elkay’s investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Zurn Elkay Water Solutions Investment Narrative Recap

To own Zurn Elkay Water Solutions stock, you need conviction in growing demand for sustainable water solutions, product innovation, and steady exposure to robust non-residential end markets. TIME’s recognition for sustainable growth may reinforce confidence in Zurn Elkay’s brand and strategy but does not materially change the main short-term catalyst, successful rollout and adoption of new filtration products, or the biggest risk, which remains future revenue volatility as recent growth included customer order pull-forward ahead of price increases.

The October launch of Zurn Elkay’s Liv EZ Built-In Filtered Water Dispenser is timely given the company’s enhanced focus on sustainability and innovation. This product expansion aligns directly with their efforts to capture addressable market gains from evolving water safety standards and filtration requirements, making adoption rates an important near-term indicator for those focused on growth catalysts.

By contrast, investors should be aware of the implications if true end-market demand does not match the recent order volumes and...

Read the full narrative on Zurn Elkay Water Solutions (it's free!)

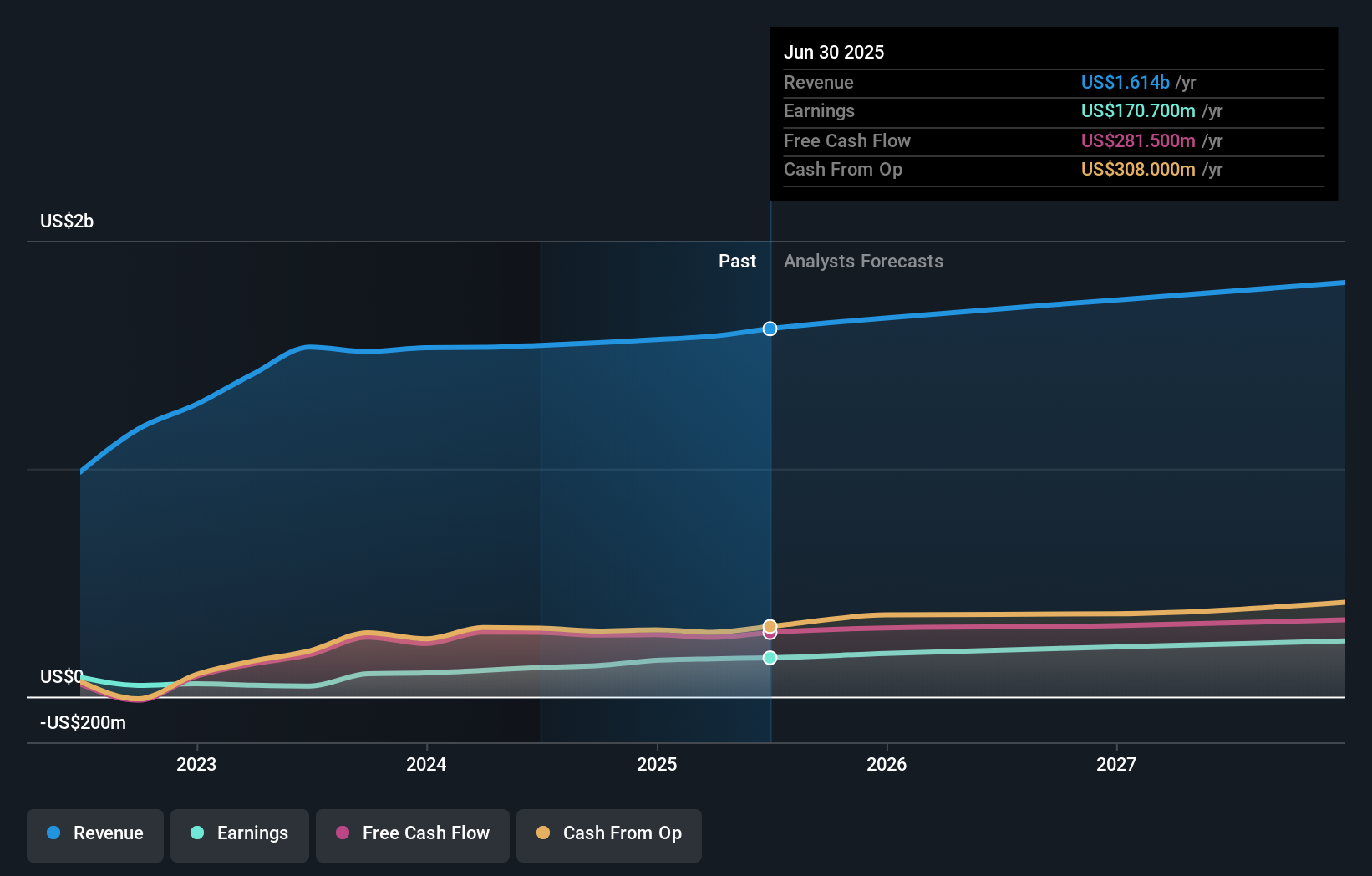

Zurn Elkay Water Solutions is projected to reach $1.9 billion in revenue and $266.9 million in earnings by 2028. This outlook assumes a 5.1% annual revenue growth rate and a $96.2 million increase in earnings from the current $170.7 million.

Uncover how Zurn Elkay Water Solutions' forecasts yield a $50.29 fair value, a 8% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for Zurn Elkay range from US$47.68 to US$50.29, based on 2 independent valuations. While some forecast strong progress in advanced filtration as a key growth lever, others point to patchy end-market demand as a source of uncertainty, so it is worth considering several viewpoints before deciding on your stance.

Explore 2 other fair value estimates on Zurn Elkay Water Solutions - why the stock might be worth as much as 8% more than the current price!

Build Your Own Zurn Elkay Water Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zurn Elkay Water Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zurn Elkay Water Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives