- United States

- /

- Machinery

- /

- NYSE:XYL

Xylem (XYL): Valuation Insights Following Raised Outlook and Strong Q3 Performance

Reviewed by Simply Wall St

Xylem (XYL) grabbed attention after posting third-quarter results that exceeded expectations, with revenue growth reported across several divisions. The company also raised its full-year outlook, highlighting management’s optimism heading into year-end.

See our latest analysis for Xylem.

Xylem’s strong quarterly update and raised full-year outlook seem to have energized investor sentiment, with the stock’s latest share price at $151.31 and a year-to-date share price return of 30.5%. In the bigger picture, momentum is building. Over the past year, Xylem has rewarded shareholders with a total return of 23.1%, and its five-year total return now sits at an impressive 68.4%.

If Xylem’s rising momentum caught your interest, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares hovering near recent highs, the big question for investors is whether Xylem is still trading at an attractive valuation, or if all that future growth is already reflected in the price. Is there a buying opportunity, or has the market already priced in everything?

Most Popular Narrative: 7.3% Undervalued

With Xylem closing at $151.31 and the narrative fair value seen at $163.24, the market appears to be trailing the consensus view. This sets the stage for a debate around whether projected improvements are fully priced in.

The company's operational simplification and implementation of the 80/20 model is already delivering record on-time performance, increased productivity, and measurable margin improvements, signaling sustainable cost efficiencies and enhanced net margins moving forward.

Want to know why analysts are so optimistic despite lofty profit multiples? The narrative hinges on a sweeping transformation, ambitious earnings improvements, and bold forecasts. Unpack the blockbuster financial assumptions and see what is really driving that fair value projection.

Result: Fair Value of $163.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in China and delays in infrastructure funding could challenge Xylem’s growth trajectory and put recent optimism to the test.

Find out about the key risks to this Xylem narrative.

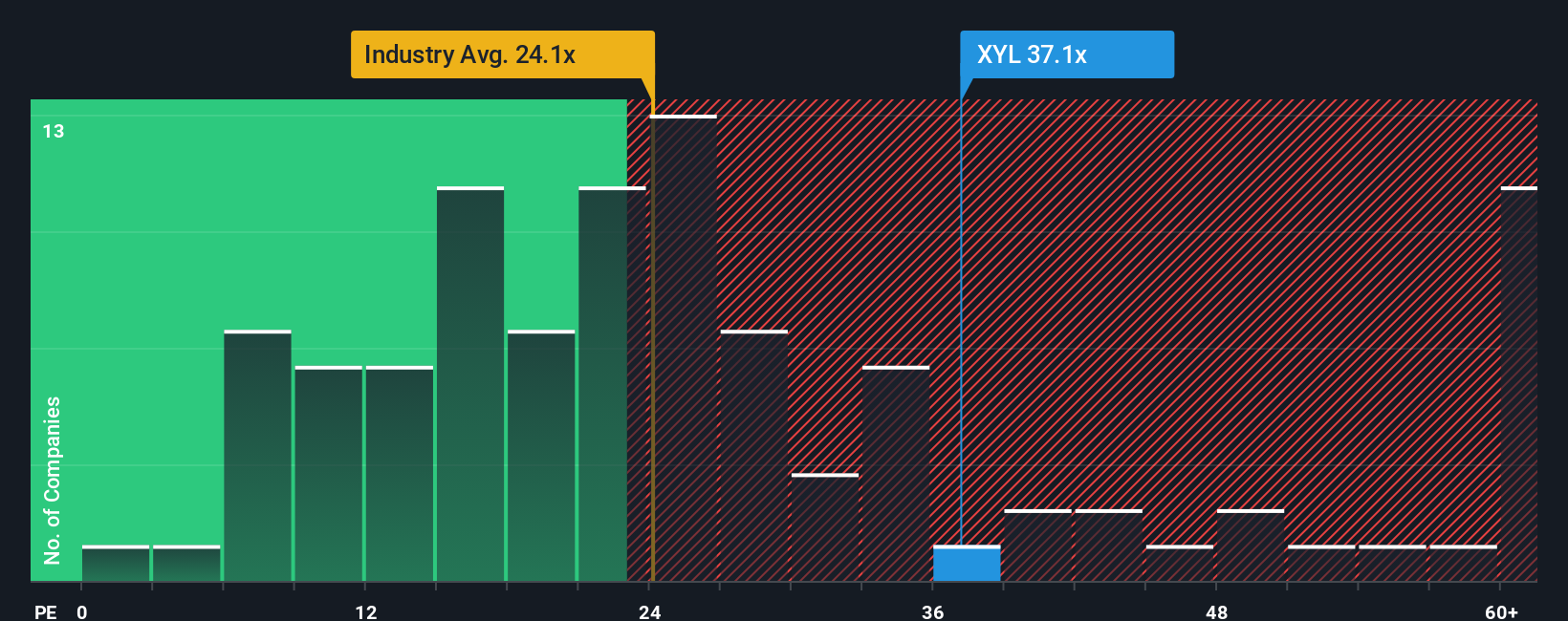

Another View: High Multiples Demand Scrutiny

Looking at Xylem's valuation from a different angle, the company trades at a price-to-earnings ratio of 38.9x, which is much higher than the industry average of 24.1x and above its fair ratio of 28.4x. This premium suggests investors are paying up for growth, but it also exposes them to more downside risk if expectations are not met. Could future results justify these steep multiples, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xylem Narrative

If you see things differently or prefer to dig into the numbers yourself, you can craft your own view in just a few minutes, so Do it your way.

A great starting point for your Xylem research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at one opportunity? Take charge of your investment strategy and scan the market for powerful trends and untapped potential with these hand-picked ideas:

- Unlock the potential for superior long-term gains with these 874 undervalued stocks based on cash flows by using in-depth cash flow analysis so you can spot value others might miss.

- Target growth at the intersection of medicine and artificial intelligence with these 32 healthcare AI stocks, where innovative breakthroughs are changing the face of healthcare.

- Secure your portfolio with steady income opportunities by investigating these 16 dividend stocks with yields > 3% with yields above 3% to help keep your returns on track.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives