- United States

- /

- Machinery

- /

- NYSE:XYL

Did Xylem's (XYL) Upbeat Guidance and Q3 Results Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- In late October 2025, Xylem Inc. raised its full-year guidance after reporting third quarter revenue of US$2.27 billion and net income of US$227 million, reflecting growth from prior-year results.

- Following strong financial performance and increased guidance, analysts widely expressed greater confidence in Xylem's market outlook and earnings power.

- We'll take a look at how Xylem's improved full-year outlook may influence key expectations for its earnings growth and margin expansion.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Xylem Investment Narrative Recap

To be a shareholder in Xylem, you need to believe in accelerating demand for water infrastructure upgrades, digital solutions, and services expansion, especially as urbanization and climate pressures intensify around the world. The recent guidance raise further supports short-term optimism around revenue and margins, but the largest risk remains delays and unpredictability in government infrastructure funding cycles, which could introduce year-to-year revenue swings even as end-market drivers appear strong. Of the recent announcements, the raised 2025 revenue guidance stands out, as it directly relates to Xylem’s capacity to translate resilient end-market trends and a multiyear project backlog into tangible top-line growth. This increase in outlook could support optimism around higher earnings and margin expansion, though future results remain sensitive to the timing of public project funding in key developed markets. Yet, despite the improved guidance, investors should be aware of potential disruptions from shifts in government funding cycles that...

Read the full narrative on Xylem (it's free!)

Xylem's outlook anticipates $10.2 billion in revenue and $1.4 billion in earnings by 2028. This scenario assumes 5.2% annual revenue growth and a $462 million increase in earnings from the current level of $938.0 million.

Uncover how Xylem's forecasts yield a $163.24 fair value, a 8% upside to its current price.

Exploring Other Perspectives

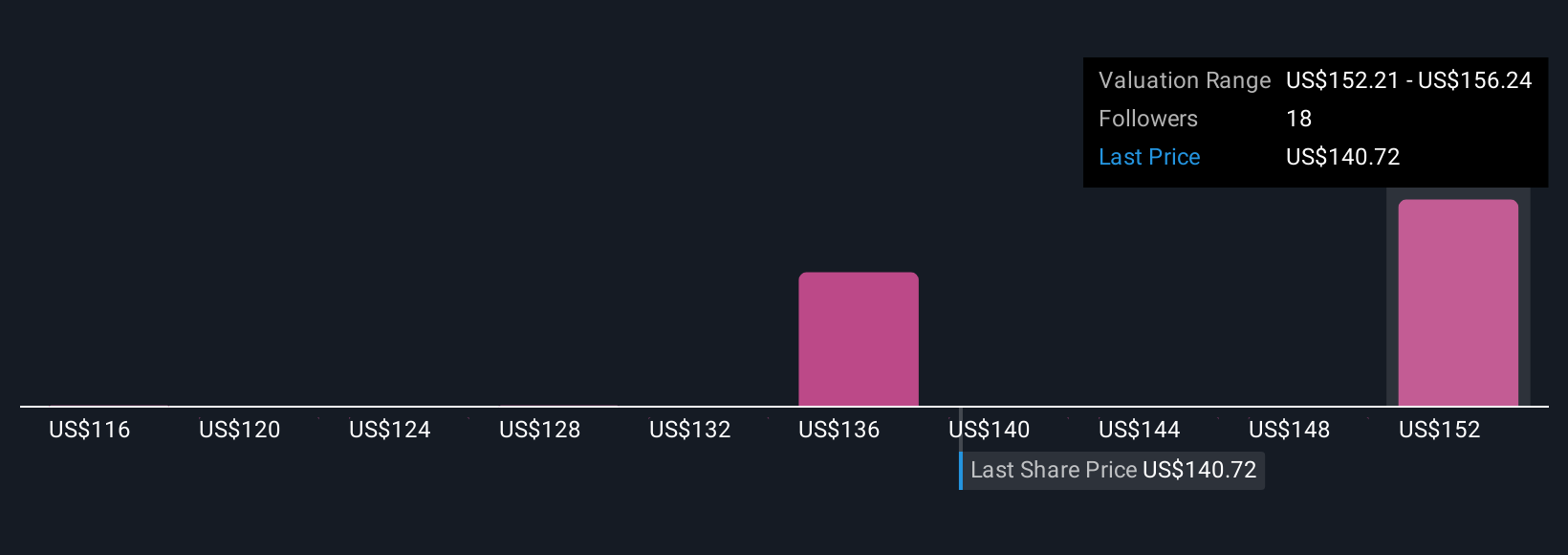

Four fair value estimates from the Simply Wall St Community range from US$116 to nearly US$163, highlighting highly varied outlooks. While some community members see room for growth, the risk of unpredictable swings in public infrastructure funding could affect Xylem’s future results, explore how other investors are thinking about this.

Explore 4 other fair value estimates on Xylem - why the stock might be worth 23% less than the current price!

Build Your Own Xylem Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xylem research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xylem research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xylem's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives