- United States

- /

- Machinery

- /

- NYSE:WTS

Watts Water Technologies (WTS): Exploring Valuation as Shares Hold Near Highs After Strong 2024 Run

Reviewed by Simply Wall St

See our latest analysis for Watts Water Technologies.

Watts Water Technologies has climbed steadily in 2024, with a 36% year-to-date share price return and a robust 44% total shareholder return over the past year. This highlights real long-term momentum. While shares have eased slightly in recent weeks, investors seem to be recalibrating after substantial multi-year gains and strong financial growth.

If you’re curious where similar momentum might be building, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Watts shares hovering near their recent highs and growth metrics remaining healthy, the key question now is whether the current price reflects all that future momentum or if investors still have a buying opportunity.

Most Popular Narrative: Fairly Valued

Watts Water Technologies’ most followed narrative points to a fair value of $277.80, almost identical to the recent closing price of $273.07, highlighting a market consensus that the stock is currently priced about right. This sets the stage for a closer look at what’s driving analyst conviction about Watts’ future earnings and market opportunity.

The accelerating rollout and success of Nexa, Watts' intelligent water management platform, positions the company to capture the growing demand for advanced, data-driven water conservation, efficiency, and regulatory compliance solutions. This is expected to drive higher-margin, recurring revenue and support long-term earnings and margin expansion.

Curious what assumptions drive this razor-thin fair value margin? The narrative’s ultra-optimistic earnings outlook hinges on digital innovation, margin expansion, and aggressive growth forecasts. But what’s the catch behind these aggressive numbers? Dive in to see the details shaping this razor's edge valuation call.

Result: Fair Value of $277.80 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent European market weakness or slower adoption of smart water technologies could quickly challenge the current optimism and lead analysts to reassess their outlooks.

Find out about the key risks to this Watts Water Technologies narrative.

Another View: Multiples Hint at Rich Valuation

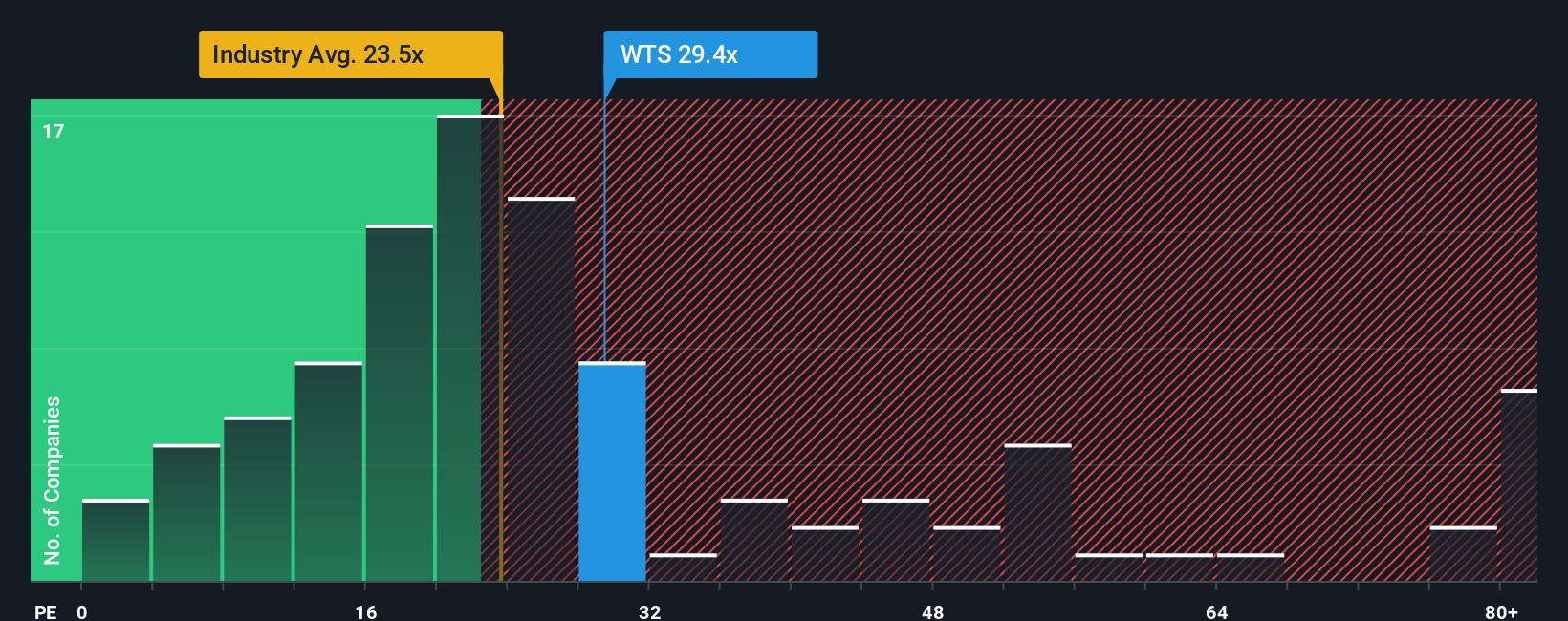

While consensus points to fair value, looking at company valuation through a price-to-earnings lens raises questions. Watts trades at 29.2x earnings, noticeably higher than both the industry average of 24.6x and the peer average of 28.7x. The fair ratio, which could be the level the market moves toward, is just 21.1x. This premium signals the market expects outsized growth or rewards quality. However, it may also set a higher bar for future performance.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Watts Water Technologies Narrative

If you prefer to analyze the numbers yourself or want to chart a different story, it’s easy to build your own perspective in just minutes, and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Watts Water Technologies.

Looking for More Smart Investment Ideas?

If you want an edge in the market, don't wait for tomorrow's headlines. Tap into new trends right now using the Simply Wall Street Screener. Smart investors make the first move, not the last!

- Uncover potential with these 834 undervalued stocks based on cash flows to spot companies trading below their real worth before the crowd catches on.

- Power up your portfolio by targeting passive income through these 24 dividend stocks with yields > 3% and find stocks offering impressive yields above 3%.

- Catalyze your growth strategy and seize the momentum with these 26 AI penny stocks, featuring picks at the intersection of artificial intelligence innovation and rapid financial upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watts Water Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTS

Watts Water Technologies

Supplies systems, products and solutions that manage and conserve the flow of fluids and energy into, though, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives