- United States

- /

- Trade Distributors

- /

- NYSE:WSO

Should Investors Reconsider Watsco After Its 23.7% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Watsco is worth a closer look for your portfolio? You are not alone, as many investors are trying to figure out whether the current price reflects real value or lurking risks.

- Watsco stock has slipped recently, down 2.8% in the last week and 12.7% over the past month, adding up to a year-to-date drop of 23.7%. That is a notable turn considering the stock had delivered gains of 52.5% over three years and 76.4% over five years. However, it is now sitting 28.9% lower than a year ago.

- Recently, the HVAC industry has seen strong demand thanks to record summer heat waves and changing climate patterns. This has driven increased investor attention to suppliers like Watsco. At the same time, supply chain constraints and evolving energy efficiency regulations have contributed to price swings and uncertainty across the sector.

- When looking at straight-up valuation, Watsco currently scores only 1 out of 6 on our undervaluation checks. There is clearly room for debate about its pricing. We will cover the classic ways to value a business next, but stick around for a different approach that could help you see the full picture by the end of this article.

Watsco scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Watsco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to present value. This approach helps investors see what a business might realistically be worth based on its ability to generate cash over time.

For Watsco, the most recent Free Cash Flow is $516 million. Analyst forecasts expect Free Cash Flow to grow steadily, reaching $664 million by 2027. Longer-term projections, built on analyst input and trend extrapolation, suggest Free Cash Flow could rise to approximately $1 billion in 2035. All figures are in US dollars. These numbers indicate solid, consistent growth in Watsco's core cash generation over the next decade.

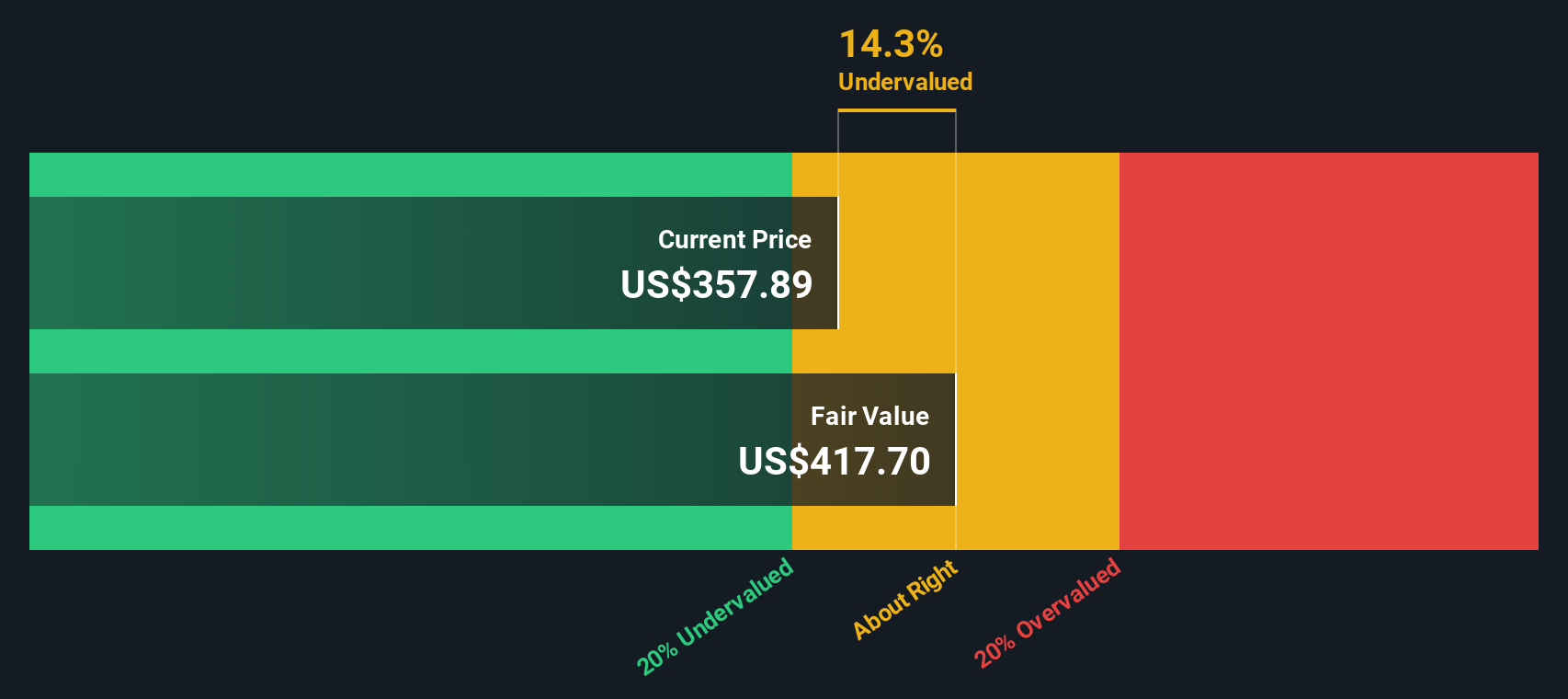

Based on this 2 Stage Free Cash Flow to Equity model, Watsco’s intrinsic value is calculated at $417.70 per share. This is roughly 14.3% higher than its current trading price, which suggests that the stock is currently undervalued by the market according to DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Watsco is undervalued by 14.3%. Track this in your watchlist or portfolio, or discover 845 more undervalued stocks based on cash flows.

Approach 2: Watsco Price vs Earnings

For profitable companies like Watsco, the Price-to-Earnings (PE) ratio is a widely used and relevant valuation metric. It shows how much investors are willing to pay for each dollar of current earnings, making it especially useful for established businesses with consistent profitability.

What counts as a "fair" PE ratio depends on several factors. Companies with strong expected earnings growth or lower risks can justify higher PE multiples. In contrast, slower growth or higher risk typically leads to lower PE ratios. Industry context also matters, since some sectors naturally trade at higher or lower multiples.

Watsco currently trades at a PE ratio of 28x. For comparison, the average PE for its peers is around 18.1x, while the broader Trade Distributors industry sits at 21.0x. On the surface, this suggests Watsco appears more expensive than both its direct competitors and the industry as a whole.

That is where Simply Wall St’s proprietary Fair Ratio comes in. Rather than relying solely on simple industry or peer averages, the Fair Ratio incorporates factors such as Watsco’s own profit growth outlook, risk profile, profit margins, size, and industry trends to arrive at a tailored benchmark. For Watsco, the Fair Ratio is calculated at 24.1x. This makes it a better reference point for investors wanting a more complete view of value.

Comparing Watsco’s current PE ratio of 28x with its Fair Ratio of 24.1x, the stock trades above what would be considered fair value using this approach. The difference of about 3.9x points to Watsco being priced on the high side relative to its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Watsco Narrative

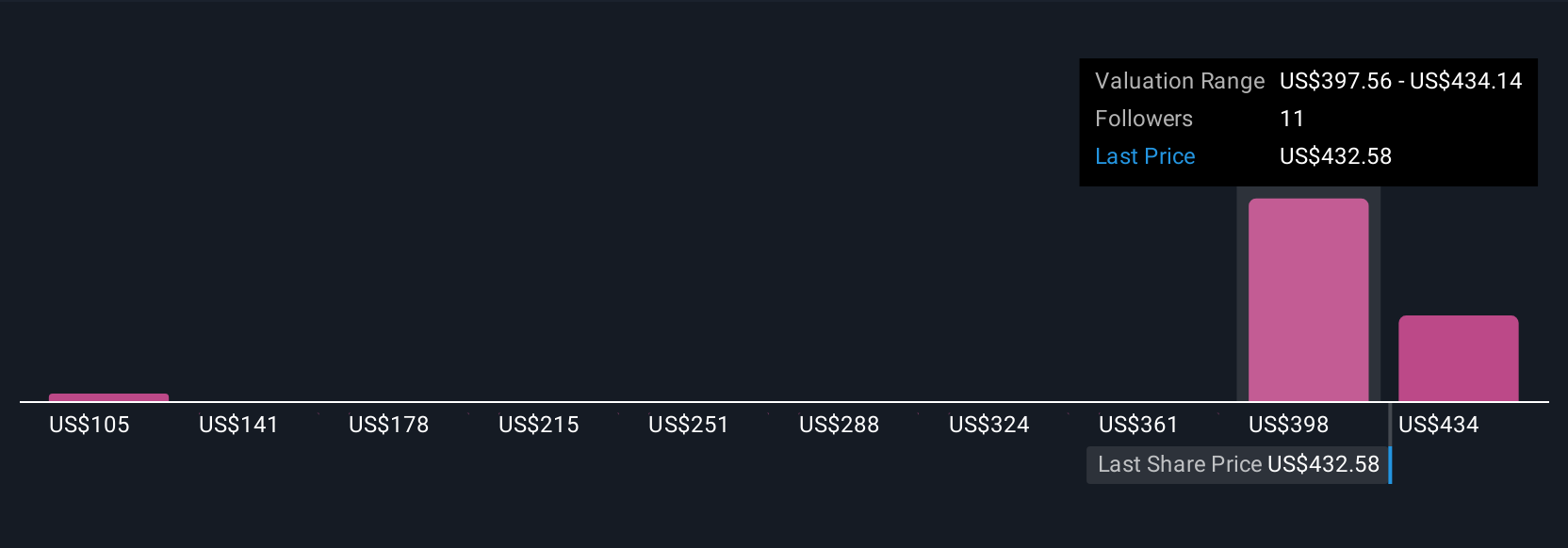

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personal investment story about a company. It connects your perspective on Watsco’s future with estimates for things like revenue, earnings, and margins, and translates those insights into a fair value. Narratives make financial analysis more approachable by tying together the company's story, a forecast, and what you believe the stock is worth.

Millions of investors use Narratives on Simply Wall St’s Community page, where it is easy to craft, share, and compare your outlooks. Narratives empower you to decide when to buy or sell by revealing the gap between your Fair Value and the current Price. They even update automatically as new events, company results, or industry shifts come in, ensuring your view stays up to date.

For Watsco, some investors are bullish, projecting strong adoption of new high-efficiency and A2L products and setting fair values as high as $550. Others focus on supply chain challenges or weaker demand, landing much lower with price targets closer to $368. By building your own Narrative, you get a tailored valuation that matches your unique view of Watsco’s potential.

Do you think there's more to the story for Watsco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watsco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSO

Watsco

Engages in the distribution of air conditioning, heating, and refrigeration equipment, and related parts and supplies in the United States, Canada, Latin America, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives