- United States

- /

- Trade Distributors

- /

- NYSE:WSO

Regulatory Shift and Earnings Miss Could Be a Game Changer for Watsco (WSO)

Reviewed by Sasha Jovanovic

- In October 2025, Watsco, Inc. reported third quarter sales of US$2.07 billion and net income of US$161.6 million, both lower than the prior year, attributing the shortfall to the industry-wide transition to A2L refrigerant products.

- Despite these challenges, Watsco achieved record gross profit and operating cash flow for the quarter, signaling resilience through a period of regulatory disruption and significant portfolio change.

- We'll now explore how Watsco's earnings miss and regulatory transition could shape its investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Watsco Investment Narrative Recap

To be a Watsco shareholder, you need confidence in its ability to translate industry shifts, like the large-scale transition to A2L refrigerants, into renewed growth and stronger margins. The latest quarterly results reflected near-term pressure from this transition, but with disruption now largely complete, the short-term catalyst of A2L adoption remains on track, while lingering risks tied to inventory and supply chain management are still present, though not materially worsened by recent events.

Among recent announcements, Watsco’s record gross profit and operating cash flow for the quarter stand out, as they demonstrate some cushioning effect during a period of regulatory change. This resilience supports the ongoing catalyst: a shift toward more efficient, higher-margin A2L products that could enhance future revenue and profitability once the transition period settles.

However, against that positive momentum, investors should watch for ongoing risks around supply chain issues tied to A2L systems, as even with much of the disruption behind them...

Read the full narrative on Watsco (it's free!)

Watsco's outlook anticipates $9.1 billion in revenue and $758.2 million in earnings by 2028. This implies a 6.5% annual revenue growth rate and a $262.7 million increase in earnings from the current $495.5 million.

Uncover how Watsco's forecasts yield a $437.80 fair value, a 19% upside to its current price.

Exploring Other Perspectives

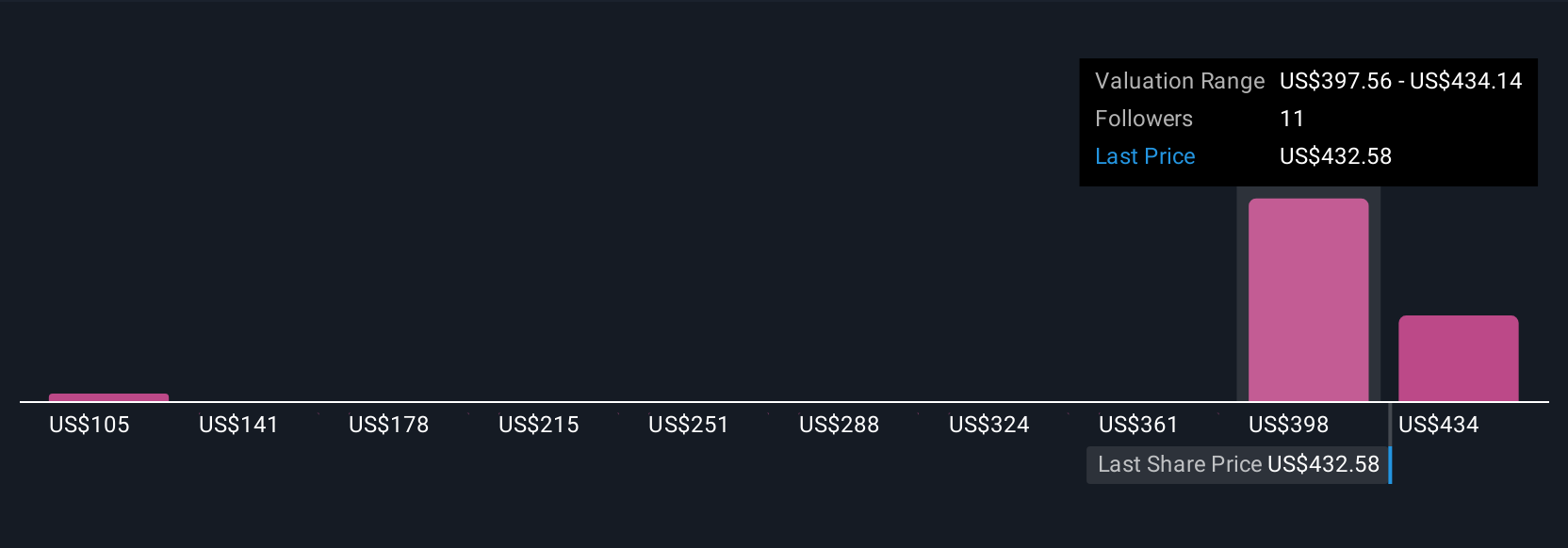

Simply Wall St Community members posted three fair value estimates for Watsco ranging from US$104.90 to US$437.80 per share. While many expect margin expansion from the A2L rollout, the wide spread of target prices reflects sharply different confidence levels about regulatory transition impacts and long-term profitability.

Explore 3 other fair value estimates on Watsco - why the stock might be worth as much as 19% more than the current price!

Build Your Own Watsco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Watsco research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Watsco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Watsco's overall financial health at a glance.

No Opportunity In Watsco?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watsco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSO

Watsco

Engages in the distribution of air conditioning, heating, and refrigeration equipment, and related parts and supplies in the United States, Canada, Latin America, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives