- United States

- /

- Building

- /

- NYSE:WMS

Advanced Drainage Systems (WMS): Valuation in Focus as Impactive Capital Reveals Stake and Bullish Outlook

Reviewed by Simply Wall St

Advanced Drainage Systems (WMS) is getting fresh attention after Impactive Capital disclosed a new stake and expressed confidence in the company’s recent structural shifts. The fund sees potential for margin expansion and earnings growth, even as the construction industry faces challenges.

See our latest analysis for Advanced Drainage Systems.

Impactive Capital's endorsement has come at a pivotal time for Advanced Drainage Systems, as the stock has shown strong momentum in recent months but remains down year-over-year. After rallying over 17% in the past 90 days and returning more than 70% to shareholders over three years, current investor interest suggests the market is warming up to the company's improved earnings potential and margin expansion story, despite some near-term volatility.

If you're curious where else investors are spotting opportunity, this is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The real question facing investors now is whether Advanced Drainage Systems is trading at a compelling value with room for upside, or if the recent gains mean the market has already accounted for future growth.

Most Popular Narrative: 14.5% Undervalued

Based on the most closely followed narrative, Advanced Drainage Systems is trading below its estimated fair value of $161.22, with the last close at $137.80. This sets expectations high and invites a closer look at the ambitious growth story supporting this price target.

Ongoing climate change and increasing frequency and severity of extreme weather events are driving up the necessity for advanced stormwater management and resilient drainage infrastructure. This underpins structural, long-term volume growth and supports sustained revenue acceleration. Rising regulatory emphasis on water quality and sustainable construction, with more stringent stormwater and pollution controls, is increasing adoption of high-margin, innovative solutions such as the recently launched Arcadia hydrodynamic separator and EcoStream Biofiltration products. This is likely to expand net margins and boost revenue mix over time.

Want to see what really powers this valuation? The narrative’s fair value hinges on a future profit surge and a bold forecast for margins and earnings. There is a surprising twist in how industry challenges and product innovation factor into the upside. Curious what assumptions make the math work? The full narrative reveals the numbers that back this target.

Result: Fair Value of $161.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity cost increases or stagnating core market demand could quickly undermine both the optimistic growth outlook and the margin expansion story.

Find out about the key risks to this Advanced Drainage Systems narrative.

Another View: What Do the Numbers Say?

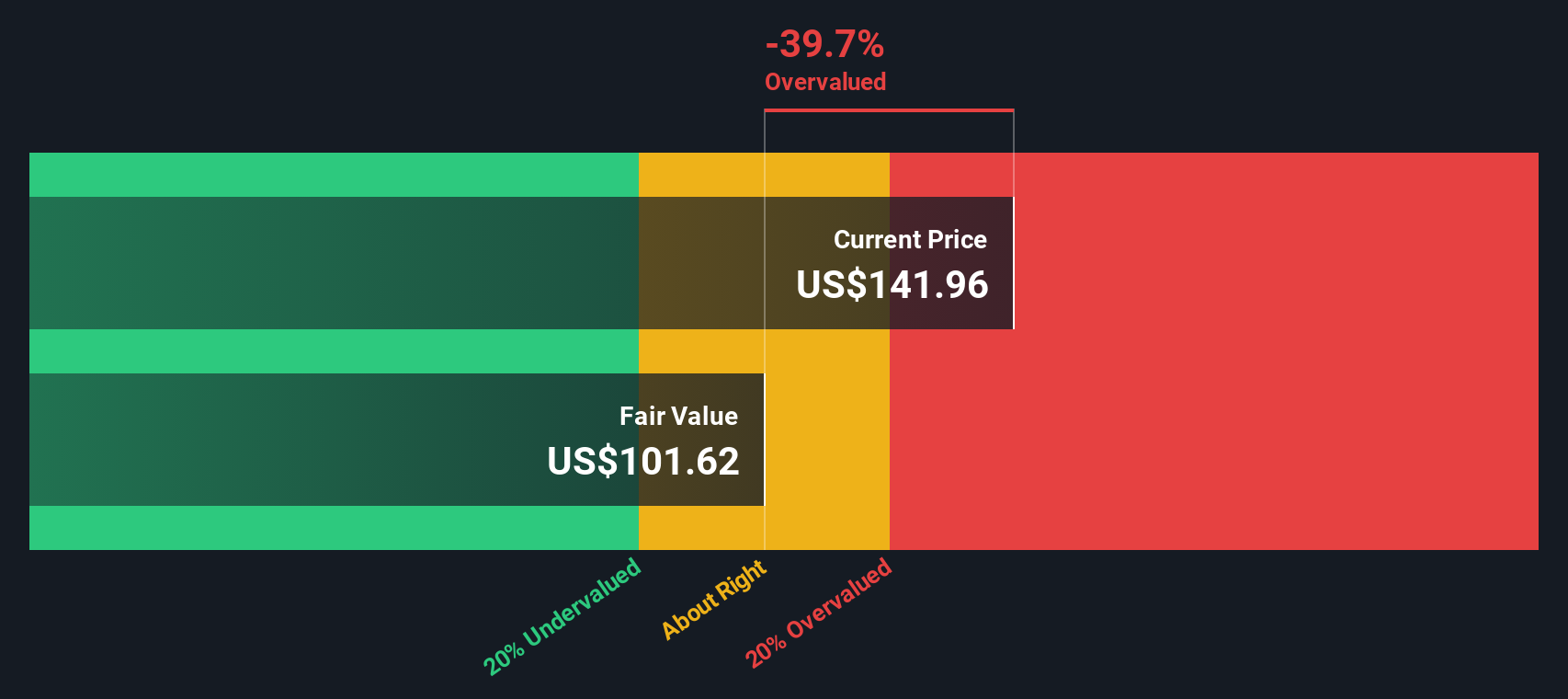

Our SWS DCF model offers a different angle. According to this discounted cash flow approach, Advanced Drainage Systems is actually trading above its estimated fair value, suggesting its shares might be overvalued relative to future cash flows. Does this method capture risks the popular narrative has overlooked, or is it being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Advanced Drainage Systems Narrative

If you see the story differently or want a hands-on look at the numbers, you can easily shape your own view in just a few minutes. Then Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Advanced Drainage Systems.

Looking for more investment ideas?

Let the market work for you by targeting stocks that match your strategy. Take action now, or you could miss tomorrow’s biggest opportunities.

- Supercharge your search for high-yield income with these 18 dividend stocks with yields > 3%, which consistently deliver yields above 3% and stand out for robust financial health.

- Grow your portfolio faster by jumping into these 27 AI penny stocks, which are primed to benefit from the explosive growth of artificial intelligence and automation trends.

- Target tomorrow’s breakthroughs with these 28 quantum computing stocks, which are leading transformations in next-generation computing, security, and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives