- United States

- /

- Building

- /

- NYSE:WMS

Advanced Drainage Systems (WMS): Assessing Current Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

Advanced Drainage Systems (WMS) has seen some fluctuations over the past week; however, its performance remains up for the month and the year. Investors are watching closely to see how recent moves affect its long-term trajectory.

See our latest analysis for Advanced Drainage Systems.

Advanced Drainage Systems’ share price momentum has cooled a bit after recent gains, but it is still up 25.4% year-to-date, and the total shareholder return over the past twelve months stands at 12.3%. With strong multi-year performance in the rearview, the latest dip could be a breather rather than a shift in the long-term trend as investors weigh the company’s growth prospects and valuation.

If you’re curious where else value and growth meet, now is a perfect chance to expand your radar and discover fast growing stocks with high insider ownership

With a recent pullback but solid long-term gains, the pressing question now is whether Advanced Drainage Systems is trading below its true worth or if the market has already accounted for all future growth prospects. Could there still be a buying opportunity?

Most Popular Narrative: 16.6% Undervalued

Advanced Drainage Systems’ last close of $143.34 comes in well below the narrative's estimated fair value of $171.78. This sizable gap raises eyebrows and sets the scene for a deeper exploration of what underpins this valuation.

Ongoing climate change and increasing frequency and severity of extreme weather events are driving up the necessity for advanced stormwater management and resilient drainage infrastructure, underpinning structural, long-term volume growth and supporting sustained revenue acceleration. Rising regulatory emphasis on water quality and sustainable construction, with more stringent stormwater and pollution controls, is increasing adoption of high-margin, innovative solutions such as the recently launched Arcadia hydrodynamic separator and EcoStream Biofiltration products. This is likely to expand net margins and boost revenue mix over time.

Want to know what’s fueling this double-digit valuation upside? The numbers behind this view hinge on surging earnings and bold margin forecasts. Intrigued by the financial leaps and underlying assumptions that drive this bullish stance? Discover the specific projections powering this narrative’s higher price target.

Result: Fair Value of $171.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in construction demand or a spike in material costs could quickly challenge the bullish margin and growth assumptions that are currently reflected in valuations.

Find out about the key risks to this Advanced Drainage Systems narrative.

Another View: What the DCF Model Suggests

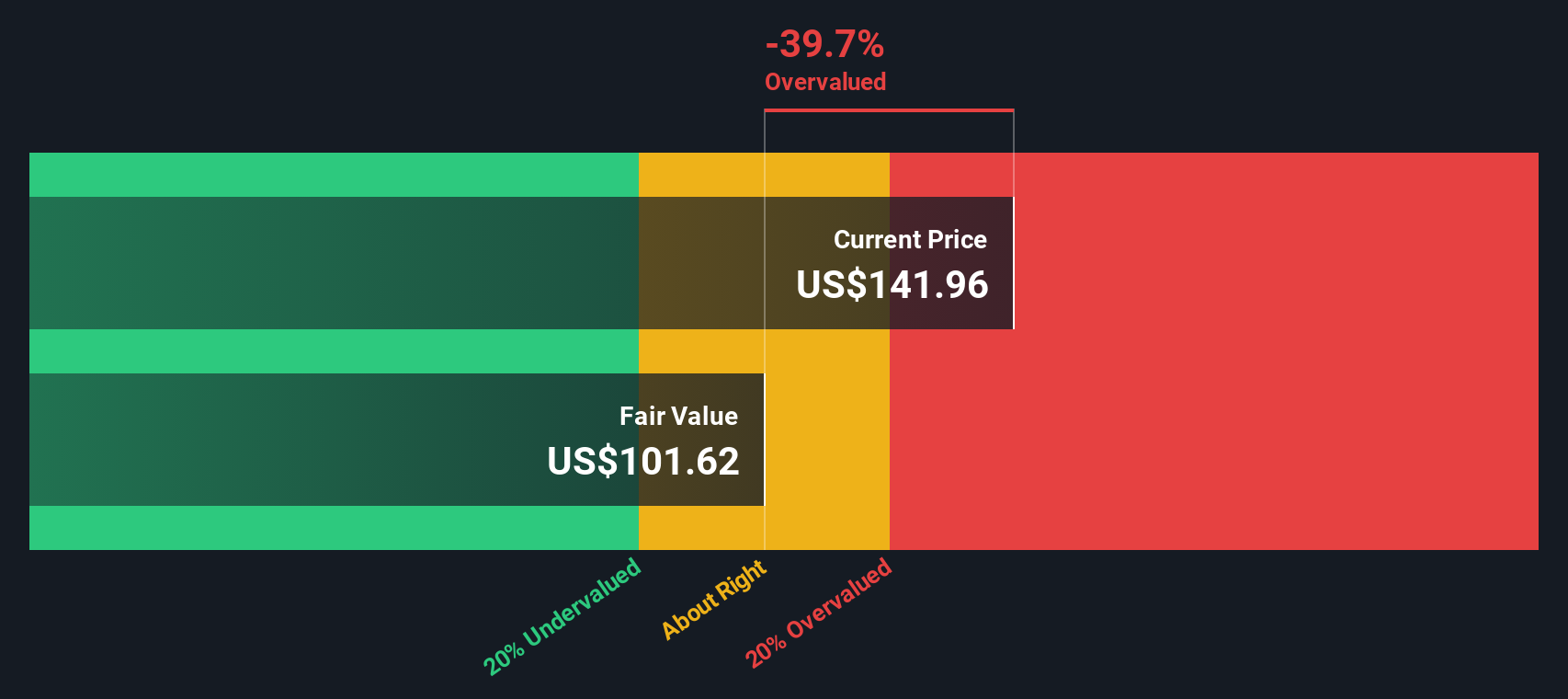

Looking at Advanced Drainage Systems through the lens of the SWS DCF model, a different picture emerges. In this analysis, the share price of $143.34 trades above our DCF fair value estimate of $108.55, which may indicate a possible overvaluation. Could the market’s optimism be outpacing the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advanced Drainage Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advanced Drainage Systems Narrative

If you think there’s more to uncover or want to chart your own course through the data, you can craft your own analysis in just a few minutes: Do it your way

A great starting point for your Advanced Drainage Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Ready to make the most of your next investing move? Let Simply Wall Street’s powerful screeners open the door to high-potential stocks that fit your strategy.

- Unlock growth by checking out these 898 undervalued stocks based on cash flows, which is filled with companies trading below their potential and positioned for a possible re-rating.

- Boost your portfolio’s income stream when you browse these 15 dividend stocks with yields > 3%, featuring businesses offering attractive yields above 3%.

- Stay ahead of emerging trends as you scan these 30 healthcare AI stocks, connecting you to firms at the forefront of AI innovation in healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives