- United States

- /

- Trade Distributors

- /

- NYSE:WCC

Why WESCO (WCC) Is Up After Surging Data Center Growth Reshapes Its Revenue Mix

Reviewed by Sasha Jovanovic

- Earlier this month, WESCO International presented at the Baird 55th Annual Global Industrial Conference in Chicago and reported strong third-quarter 2025 results, including raised financial guidance and robust growth in its data center business.

- This sector experienced very large growth and now accounts for 14% of the company's revenues, reflecting a clear shift in WESCO's business mix.

- We’ll explore how the surge in WESCO’s data center segment impacts the company’s investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is WESCO International's Investment Narrative?

For anyone considering WESCO International from an investment standpoint, the big picture now centers around whether the surge in the data center business, now making up 14% of overall sales, signals a lasting shift in the company’s growth drivers. After WESCO reported strong third-quarter results, raised its full-year guidance, and highlighted 70% growth in data center revenues, market sentiment turned more optimistic, as evident in recent analyst upgrades and a price target move. This new momentum could bring forward the timeline for revenue and margin improvement, making accelerating trends in high-growth verticals like data centers a front-and-center catalyst, while tempering concerns over previously slowing net income and moderate revenue growth forecasts. However, risks such as the recent uptick in supplier price pressures, ongoing margin volatility, and some insider selling remain relevant, though their significance may be dulled if the strong performance and guidance upgrades prove sustainable.

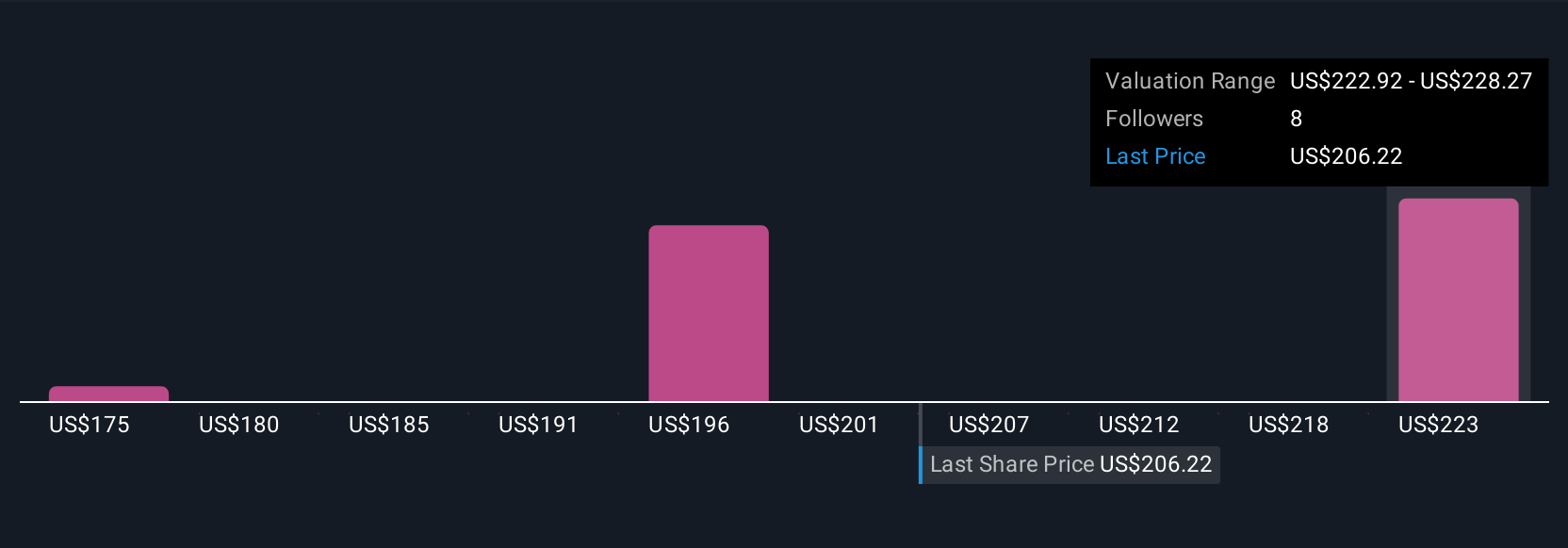

But with supplier price increases running high, margin risk is not off the table. Despite retreating, WESCO International's shares might still be trading 12% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on WESCO International - why the stock might be worth 31% less than the current price!

Build Your Own WESCO International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WESCO International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WESCO International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WESCO International's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives