- United States

- /

- Trade Distributors

- /

- NYSE:WCC

WESCO International (WCC): Valuation Insights Following Strong Q3 Growth and Upgraded 2025 Outlook

Reviewed by Simply Wall St

WESCO International (WCC) just reported third-quarter earnings that caught investor attention, with strong sales growth across every business segment. The company also raised its 2025 guidance, indicating confidence supported by positive industry trends.

See our latest analysis for WESCO International.

Backed by robust quarterly results and a boost in 2025 sales guidance, WESCO International’s share price has surged, rallying nearly 17% over the last month and up more than 44% year-to-date. Its one-year total shareholder return sits at an impressive 21.9%, and the longer-term total returns have been even stronger. This reveals that momentum is picking up alongside renewed optimism for future growth.

If WESCO’s momentum has you considering what other companies are catching investor attention, it could be the perfect moment to discover fast growing stocks with high insider ownership

The critical question now is whether WESCO’s strong momentum and improved outlook mean the stock remains undervalued, or if the market has already priced in all of this future growth. This could potentially leave limited room for further gains.

Price-to-Earnings of 19.8x: Is it justified?

WESCO International currently trades at a price-to-earnings (P/E) ratio of 19.8x, which suggests the stock is attractively valued relative to both its immediate peers and the broader industry. At the last close of $256.59, the company is positioned below typical market multiples for similar trade distributors.

The P/E ratio is a widely used metric that compares a company's current share price to its earnings per share. For distribution businesses like WESCO, which have stable cash flows but often operate on thin margins, the P/E ratio offers insight into how much investors are willing to pay for each dollar of current or future earnings and how growth prospects are being priced in.

WESCO's P/E is not only below the Trade Distributors industry average of 20.9x, but also the peer average of 20.2x. More notably, it trades at a significant discount to its estimated fair P/E ratio of 29.2x, a level the market could move toward if positive momentum and guidance hold.

Explore the SWS fair ratio for WESCO International

Result: Price-to-Earnings of 19.8x (UNDERVALUED)

However, wage pressures or economic slowdowns could impact earnings growth and present risks that may temper WESCO International’s recent strong momentum.

Find out about the key risks to this WESCO International narrative.

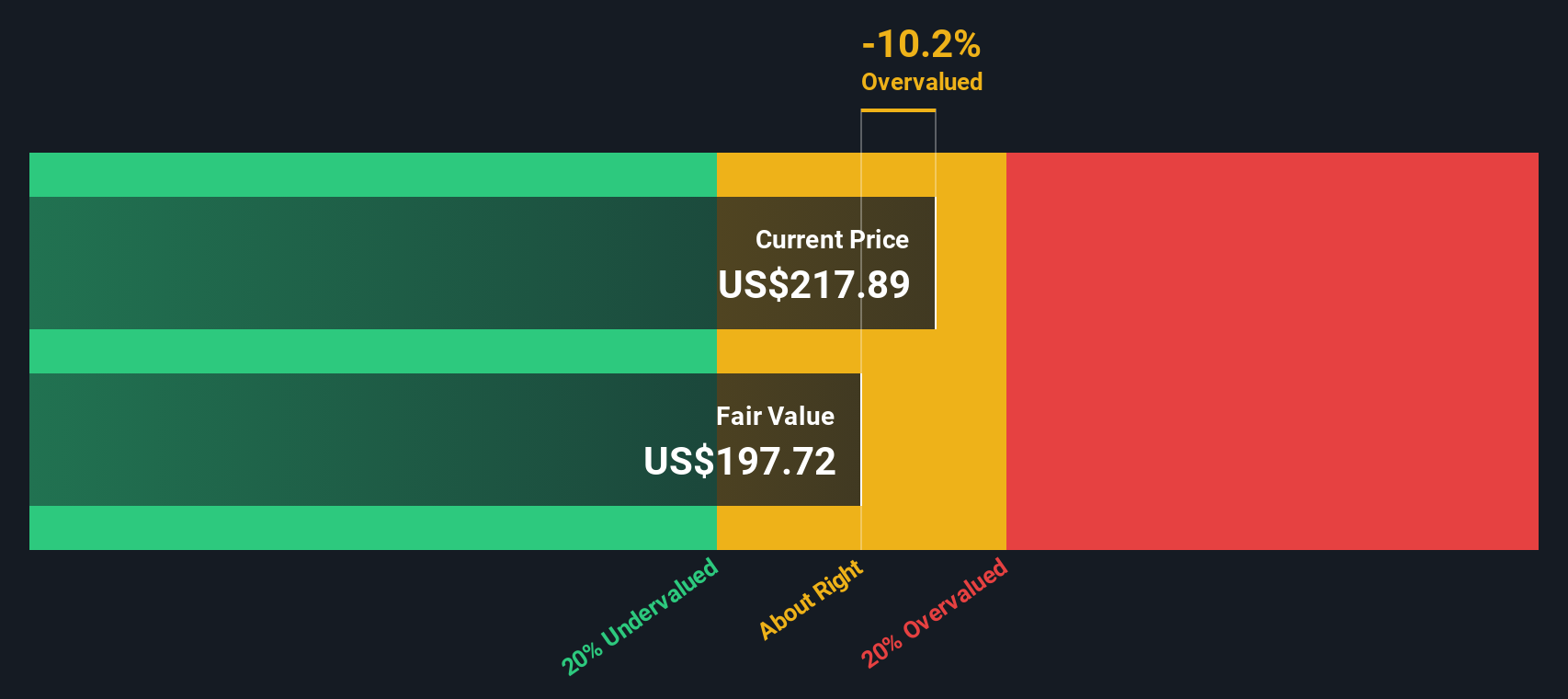

Another View: Discounted Cash Flow Perspective

Looking from a different angle, our DCF model suggests WESCO International is trading about 10% below its estimated fair value of $285.44 per share. This cash flow-based approach also points to the stock being undervalued. Will both methods prove right as the year unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WESCO International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 836 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WESCO International Narrative

If you prefer drawing your own conclusions or want to investigate the numbers for yourself, you can put together your own story in just a few minutes with Do it your way.

A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass you by while others act. The Simply Wall Street Screener provides fast access to stocks with high growth, resilience, and forward-looking rewards.

- Target growing yields and reliable income as you browse these 20 dividend stocks with yields > 3%, a tool built for strong dividend payouts above 3%.

- Spot the next wave of innovation by reviewing these 26 AI penny stocks, featuring companies that are shaping artificial intelligence trends and breakthroughs in every sector.

- Accelerate your portfolio with these 27 quantum computing stocks, a resource for uncovering pioneers set to benefit from the quantum computing revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives