- United States

- /

- Trade Distributors

- /

- NYSE:WCC

WESCO International (WCC): Margin Pressure Tests Bullish Narratives Despite Valuation Discount

Reviewed by Simply Wall St

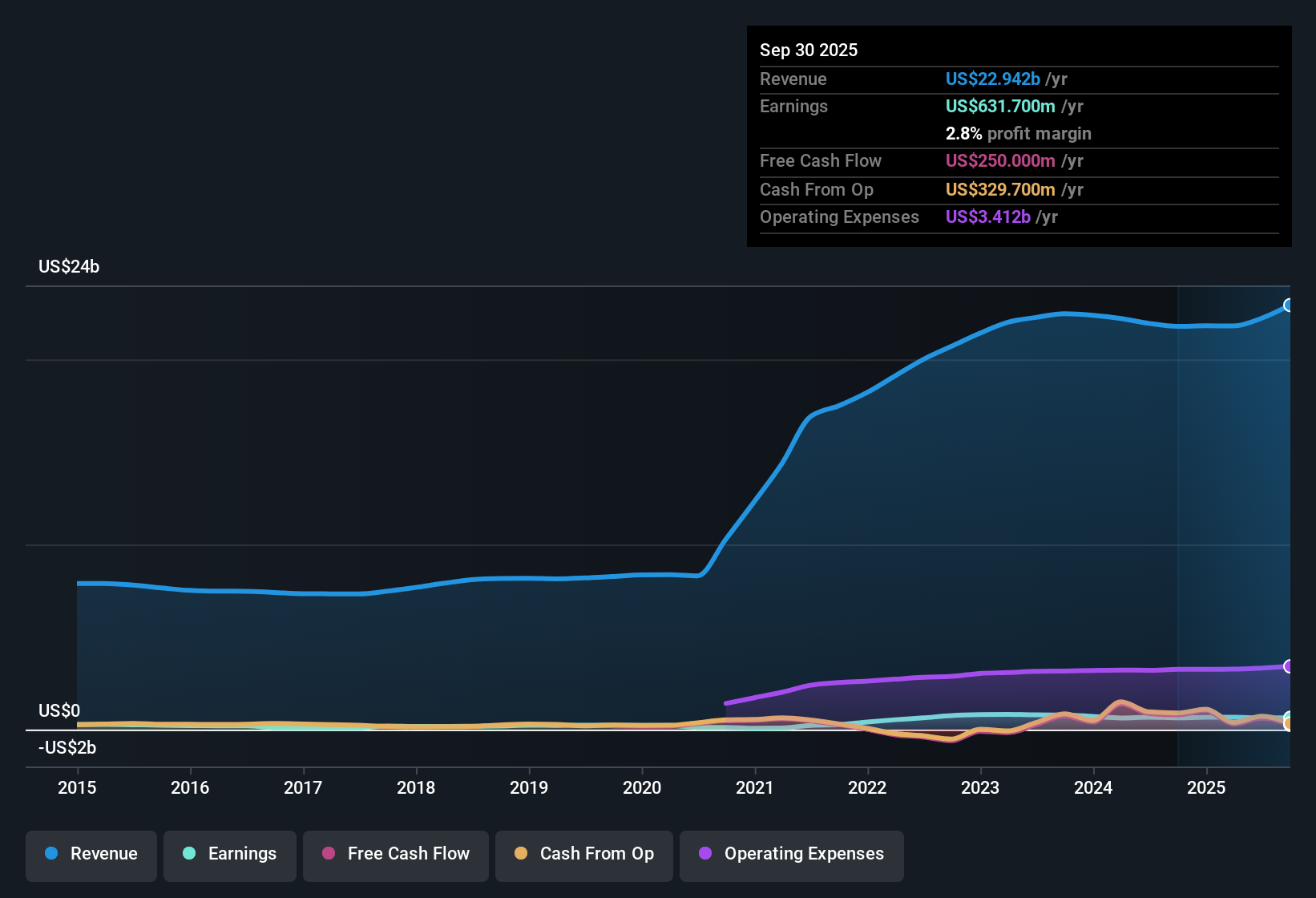

WESCO International (WCC) delivered annual earnings growth of 8% and revenue growth of 4.6% per year, both trailing the broader US market’s expectations of 15.7% and 10.3% respectively. The company’s net profit margin came in at 2.9%, a slight decrease from last year’s 3%, while its share price stands at $252.27, above an estimated fair value. Against a backdrop of robust 23.5% annual earnings growth over the past five years, investors now weigh slower forecasts and margin pressures alongside good relative value and continued underlying growth.

See our full analysis for WESCO International.Now let’s see how these headline numbers stack up against the most widely held market narratives. There is a good chance some expectations will be confirmed, while others may get re-examined.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Slip with Slower Growth Forecast

- WESCO’s net profit margin edged down to 2.9%, just below last year’s 3%, and both its forward earnings growth (8% per year) and revenue growth (4.6% per year) are projected to lag the broader US market’s 15.7% and 10.3% averages.

- The prevailing market view highlights that, while WESCO’s historical 23.5% annual earnings growth over five years reveals a track record of strong execution, the deceleration in forecasted profit growth and margin compression creates tension for those looking for clear evidence of continued structural strength.

- Strong historical momentum now faces a reality check as industry growth expectations pull ahead. This puts added weight on management’s ability to defend margins.

- Even minor slippage in profitability can surprise investors used to WESCO’s faster pace, so bulls must grapple with moderation in core financial drivers.

Valuation Gap Widens Despite Peer Discount

- WESCO trades at a P/E of 19.4x, undercutting both the industry (22x) and peer (20.7x) averages, but its share price of $252.27 sits meaningfully higher than its DCF fair value of $204.19 and even above the analyst price target of $244.75.

- According to the prevailing market view, this sets up a sharp valuation debate: investors benefit from a sector-relative discount based on profit, but the premium to DCF fair value triggers caution about how much further the valuation can stretch before future growth must deliver.

- Consensus typically cheers a P/E discount, but upside is limited as the current share price already exceeds the modeled intrinsic value by $48.

- The tension builds if margins contract further or growth forecasts slip, as that gap to fair value could quickly harm sentiment among cautious buyers hunting for true upside.

Financial Position Flags as Key Risk

- WESCO’s overall financial position is specifically flagged as a concern in the risks data, which contrasts with the company’s presentation of “good value” and “ongoing profit or revenue growth” in the rewards assessment.

- The prevailing market view points out that, despite attractive valuation signals and a track record of navigating industry shifts, balance sheet risks stand out as a material watch item.

- Investors must decide if the rewards of relatively inexpensive valuation and consistent expansion outweigh the flagged financial leverage or risk metrics now under the spotlight.

- Bears may focus on how sector shocks could be amplified if these underlying risks crystalize, especially with margin buffers under pressure.

Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on WESCO International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

WESCO’s slowing earnings growth, slipping margins, and flagged financial health raise concerns about the resilience of its balance sheet in tougher conditions. If managing risk matters to you, consider companies with stronger financial footing and lower debt by checking out solid balance sheet and fundamentals stocks screener (1984 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives