- United States

- /

- Trade Distributors

- /

- NYSE:WCC

WESCO International (WCC) Lifts 2025 Sales Outlook Amid Profit Dip Is Growth Momentum Strengthening?

Reviewed by Sasha Jovanovic

- WESCO International recently announced third quarter 2025 results, reporting sales of US$6.20 billion and net income of US$187.5 million, while also updating its full-year guidance to an expected organic sales growth of 8% to 9%.

- This guidance boost, despite a year-over-year dip in net income and earnings per share, signals growing management confidence in ongoing business momentum.

- We’ll look at how WESCO International’s raised sales outlook enhances its investment narrative amid mixed earnings results.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is WESCO International's Investment Narrative?

Belief in WESCO International as an investment hinges on confidence in the company’s ability to capture organic growth despite recent earnings softness. The latest third-quarter results bring a key update: while net income and EPS edged down year-over-year, a sharp uplift in sales and a raised organic sales growth outlook for 2025 suggest growing momentum. This guidance increase, now 8% to 9%, could help reset near-term expectations and boost sentiment, especially after recent strong share price gains. If this sales momentum continues, it could offset short-term risks around margin pressure and earnings trend reversals, which had been the main concerns pre-announcement. That said, with net income still trending slightly lower than last year, there’s less clarity around how sustainably higher sales might filter into profit growth in coming quarters. On the flip side, management’s optimism faces the challenge of improving net margins from recent declines.

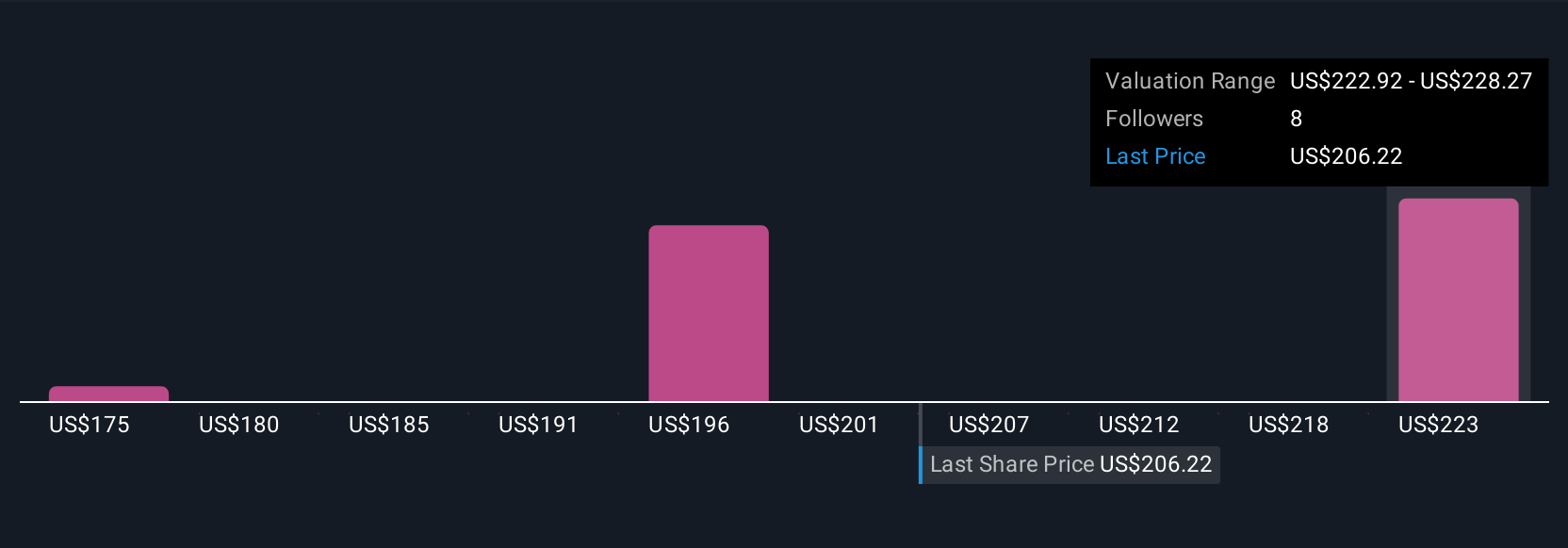

WESCO International's shares have been on the rise but are still potentially undervalued by 6%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on WESCO International - why the stock might be worth 33% less than the current price!

Build Your Own WESCO International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WESCO International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WESCO International's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives