- United States

- /

- Aerospace & Defense

- /

- NYSE:VVX

Could V2X (VVX) Board Changes Reveal a New Direction in Governance and Growth Strategy?

Reviewed by Sasha Jovanovic

- V2X, Inc. recently completed a follow-on equity offering of 2,250,000 shares and, in connection with this, saw two directors designated by a selling shareholder resign from its board, reducing board size from nine to seven members as of November 13, 2025.

- This change alters V2X's governance structure and signals a shift in its ownership dynamics, with the selling shareholder no longer able to nominate directors.

- We’ll explore how the board reshuffle and equity raise could affect V2X’s investment outlook and future growth assumptions.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

V2X Investment Narrative Recap

To be a shareholder in V2X, you need to believe in the company's ability to capture a rising share of expanding global defense budgets through contract wins and an expanding service portfolio. The recent board changes and follow-on equity offering are not expected to meaningfully affect the most important near-term catalyst, large contract awards needed to replenish backlog, or to materially shift the risk that future award timing or protests could delay revenue growth.

Of recent company events, the board reduction from nine to seven members following the selling shareholder’s exit stands out as most relevant. This shift removes a concentrated ownership block from governance, potentially increasing board independence as V2X approaches critical periods for contract capture and execution, two factors influencing both catalysts and execution risk.

Yet, against a backdrop of new governance, investors should be aware that risks tied to episodic and potentially delayed contract awards remain a key consideration if revenue growth is to...

Read the full narrative on V2X (it's free!)

V2X's narrative projects $5.0 billion revenue and $148.8 million earnings by 2028. This requires 4.8% yearly revenue growth and a $78 million earnings increase from $70.6 million today.

Uncover how V2X's forecasts yield a $65.36 fair value, a 25% upside to its current price.

Exploring Other Perspectives

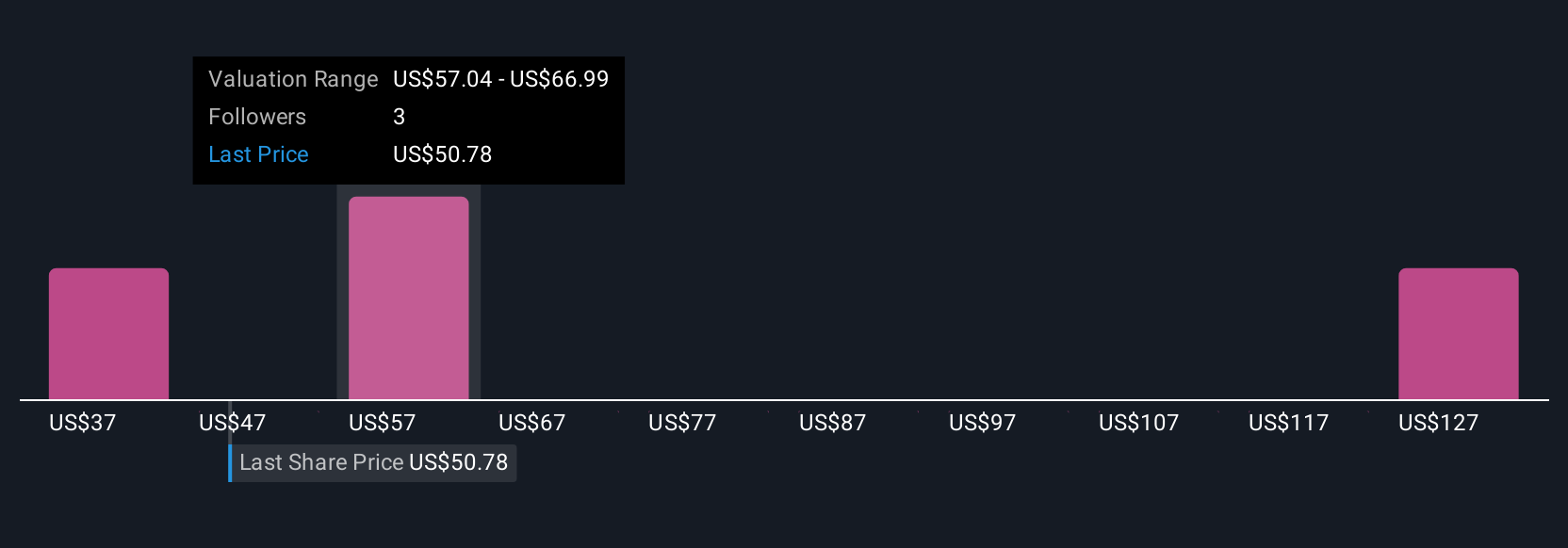

Private fair value estimates for V2X from four Simply Wall St Community members range from US$37.14 to US$142.08 per share. As you consider this broad spectrum of opinion, keep in mind that the company’s outlook still hinges heavily on its ability to secure and deliver on critical contract awards.

Explore 4 other fair value estimates on V2X - why the stock might be worth 29% less than the current price!

Build Your Own V2X Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V2X research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free V2X research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V2X's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VVX

V2X

Provides critical mission solutions and support services to defense customers worldwide.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives