- United States

- /

- Electrical

- /

- NYSE:VRT

The Bull Case For Vertiv (VRT) Could Change Following Data Center Power Partnership With Caterpillar—Learn Why

Reviewed by Sasha Jovanovic

- Vertiv and Caterpillar recently announced a collaboration to deliver integrated power generation and cooling solutions for data centers, combining Vertiv’s modular infrastructure expertise with Caterpillar’s power and CCHP technologies for faster, more efficient deployments.

- This partnership enables clients to lower energy usage and accelerate project timelines, addressing the increasing need for grid-independent, reliable energy solutions as AI centers proliferate worldwide.

- We’ll explore how Vertiv’s partnership with Caterpillar strengthens its position in providing integrated, on-site power and cooling for growing AI-driven data centers.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vertiv Holdings Co Investment Narrative Recap

For those considering Vertiv Holdings Co., the core thesis relies on the accelerating demand for integrated, energy-efficient solutions for AI-powered data centers. The recent Caterpillar partnership supports Vertiv’s position as a critical supplier, but its ability to keep up with rapid technological advancements in cooling and power solutions remains both the central catalyst and a persistent risk, a factor which could materially affect its market share if not proactively managed.

Alongside the Caterpillar agreement, Vertiv’s Q3 earnings update is especially relevant, reinforcing the near-term catalyst of strong AI-driven order growth. Management has raised guidance, reflecting confidence in sustained demand and Vertiv’s role in the evolving data center market, even as execution risk remains a key issue for investors.

By contrast, investors should watch for signals that fast-moving technology cycles might erode Vertiv’s pricing power or margin expansion ambitions...

Read the full narrative on Vertiv Holdings Co (it's free!)

Vertiv Holdings Co's outlook forecasts $13.9 billion in revenue and $2.3 billion in earnings by 2028. This projection is based on a 15.2% annual revenue growth rate and a $1.49 billion increase in earnings from the current level of $812.3 million.

Uncover how Vertiv Holdings Co's forecasts yield a $192.66 fair value, a 21% upside to its current price.

Exploring Other Perspectives

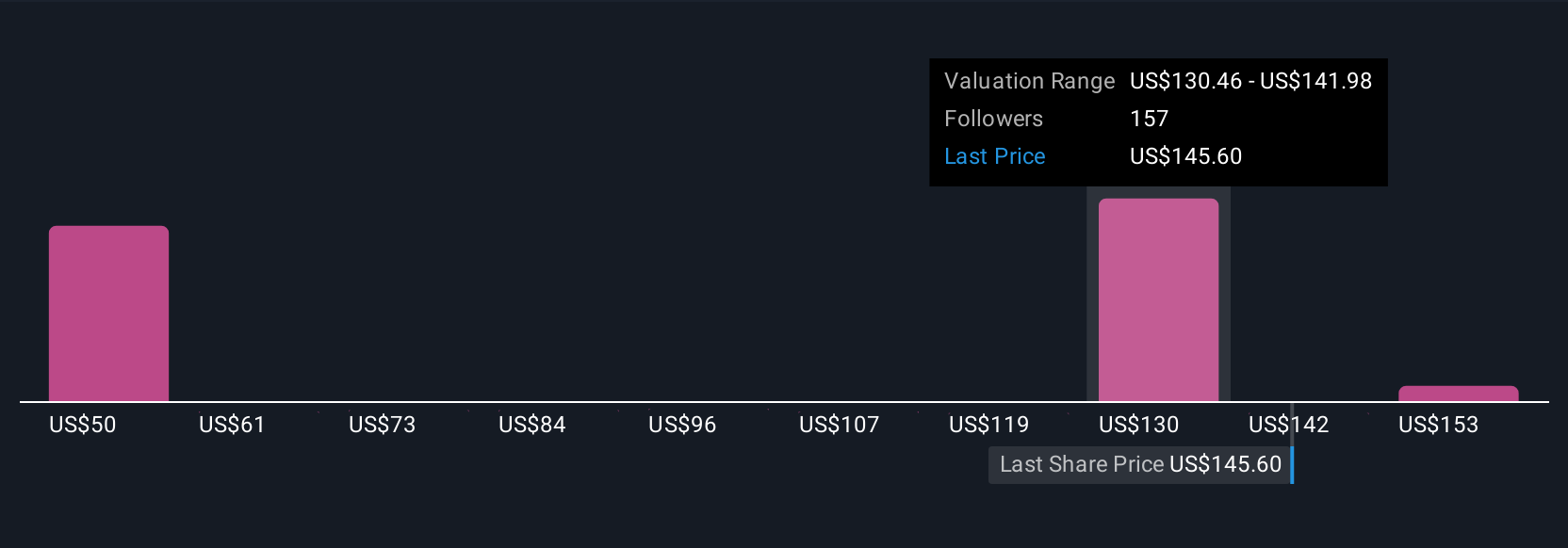

Nineteen members of the Simply Wall St Community estimate fair value for Vertiv between US$123.78 and US$217.75 per share. As many opinions differ, some focus sharply on Vertiv’s capacity to innovate and lead in next-generation cooling and power solutions, underlining important implications for long-term revenue and margin outlook.

Explore 19 other fair value estimates on Vertiv Holdings Co - why the stock might be worth as much as 36% more than the current price!

Build Your Own Vertiv Holdings Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertiv Holdings Co research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vertiv Holdings Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertiv Holdings Co's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives