- United States

- /

- Construction

- /

- NYSE:VMI

Valmont Industries (VMI): Evaluating Valuation After Upbeat Results and Raised 2025 Outlook

Reviewed by Simply Wall St

Valmont Industries (VMI) delivered quarterly results that surpassed expectations and lifted its adjusted earnings outlook for 2025. The company cited continued strength in utility, telecom, and coatings demand even as agriculture sales softened.

See our latest analysis for Valmont Industries.

Valmont Industries’ upbeat outlook and strategic push for selective acquisitions have clearly captured investor interest. After surging more than 28% in share price so far this year, with a 1-year total shareholder return of nearly 16%, the stock’s positive momentum stands out as infrastructure trends create additional tailwinds.

If you want to discover what else is thriving in the industrial space, the aerospace and defense screener is a smart next stop. See the full list here: See the full list for free.

But with shares now up nearly 29% this year and a steady drumbeat of positive news, investors may wonder if there is still value to be found in Valmont Industries or if the market has already priced in all of its future growth.

Most Popular Narrative: 13.6% Undervalued

With Valmont Industries closing at $393.28 and the most popular narrative fair value set at $455, the prevailing consensus suggests meaningful upside from current levels. Market observers are focused on how recent earnings momentum and ongoing capital deployment could sustain premium valuation territory for the stock.

“Infrastructure investment and the accelerating energy transition are driving unprecedented demand in utility and transmission, supported by record customer backlogs and industry-wide capacity constraints. Valmont's advanced investments in capacity, automation, and AI are expected to unlock $350 to $400 million in incremental annual revenue and support higher earnings and margins as this multi-year cycle unfolds.”

Wondering what numbers justify that sky-high price? The narrative's boldest assumptions hinge on earnings power, profit margins, and the future valuation multiple. Find out exactly which financial leaps back this target and how they might reshape expectations for Valmont's valuation story.

Result: Fair Value of $455 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity price swings or structural softness in North American agriculture could threaten Valmont's margin gains and long-term growth trajectory.

Find out about the key risks to this Valmont Industries narrative.

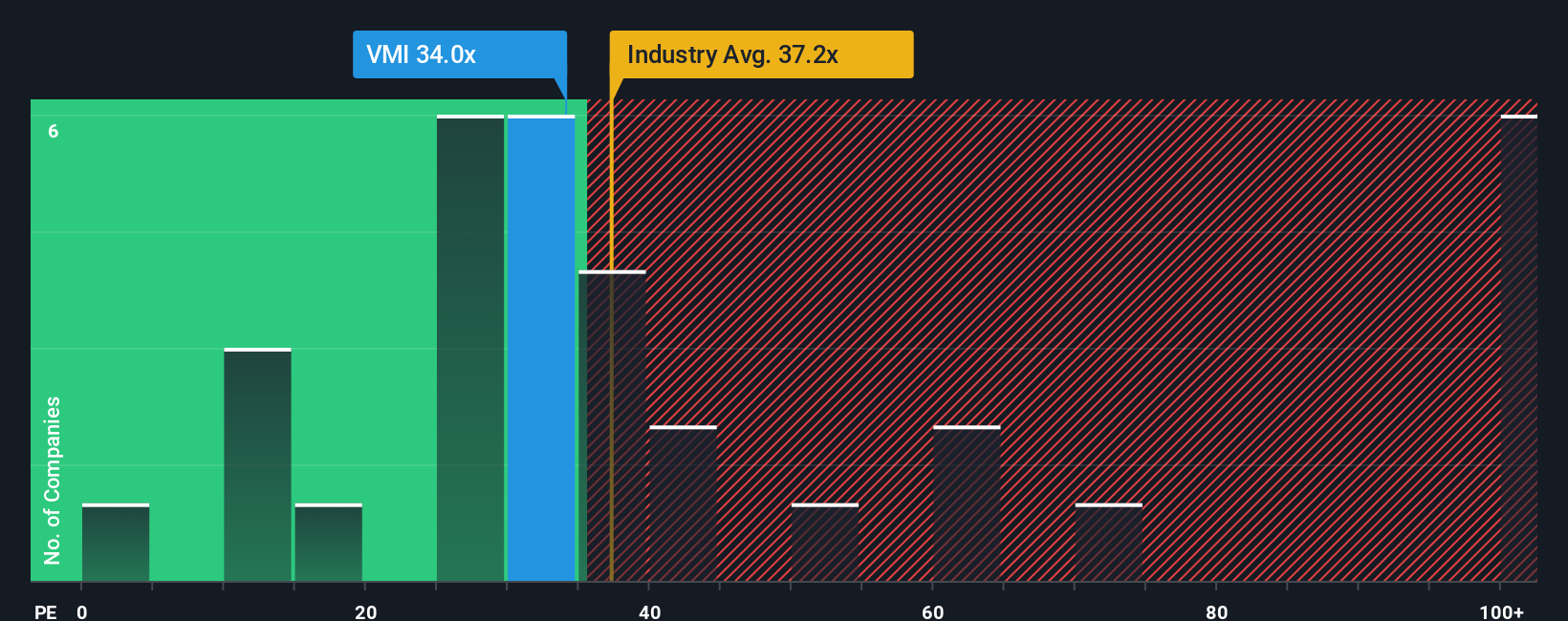

Another View: Multiples Tell a Different Story

Looking through the lens of price-to-earnings, Valmont Industries appears pricey at 33.2x earnings. This is above the industry average of 31.2x and its peers' average of 22.2x. The fair ratio is 29.1x, suggesting that today’s valuation may leave limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valmont Industries Narrative

If you want to dig into the numbers and draw your own conclusions, it's quick and easy to shape your own narrative around Valmont Industries. Do it your way.

A great starting point for your Valmont Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next favorite stock slip through the cracks. Jump into new possibilities with these handpicked ideas that can help you stay one step ahead in this market.

- Boost your income potential by scanning these 16 dividend stocks with yields > 3% that could deliver solid yields above 3% straight to your portfolio.

- Access the next wave of technology innovation with these 26 AI penny stocks leading advancements in artificial intelligence and reshaping tomorrow’s industries today.

- Catch the current of disruptive finance trends with these 81 cryptocurrency and blockchain stocks changing the game in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMI

Valmont Industries

Operates as a manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives