- United States

- /

- Building

- /

- NYSE:TT

A Look at Trane Technologies (TT) Valuation Following Leadership Addition from Global Giants

Reviewed by Simply Wall St

Trane Technologies (TT) has named Gary Guo as its new Chief Integrated Supply Chain Officer, effective November 18. He brings experience from The Coca-Cola Company, 3M, Amazon, and Alibaba to its executive team.

See our latest analysis for Trane Technologies.

Trane Technologies’ decision to bring in a heavyweight like Gary Guo comes as the company’s share price shows healthy momentum this year, rising nearly 10% year-to-date. While the one-year total shareholder return is flat, long-term investors have enjoyed impressive gains, with the three-year total return surging 144%. Leadership changes and steady results suggest the market still sees growth potential, even after such a strong multi-year run.

If this kind of executive shakeup has you wondering what other opportunities are out there, you might want to take a look at fast growing stocks with high insider ownership.

With shares hovering near all-time highs and a robust management team in place, the key question is whether Trane Technologies is trading below its true value or if the market already reflects the company’s future growth prospects.

Most Popular Narrative: 14.9% Undervalued

The most followed narrative puts Trane Technologies' fair value at $482, notably above the recent closing price of $410. This sizable gap underscores optimism among analysts about the company’s long-term growth outlook.

The strategic emphasis on innovation and a direct sales force enables Trane Technologies to consistently outgrow its end markets. This approach supports long-term revenue expansion and potential margin improvement due to enhanced market positioning and customer engagement.

Want to see what’s fueling this bullish price target? The headline number here hinges on some aggressive growth and profitability forecasts few companies can match. Find out what wild assumptions justify expecting Trane Technologies to deliver at a level that outpaces even top-tier industrial peers.

Result: Fair Value of $482 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained growth is not guaranteed. Unexpected slowdowns in data centers or challenges in passing higher costs to customers could undermine these bullish forecasts.

Find out about the key risks to this Trane Technologies narrative.

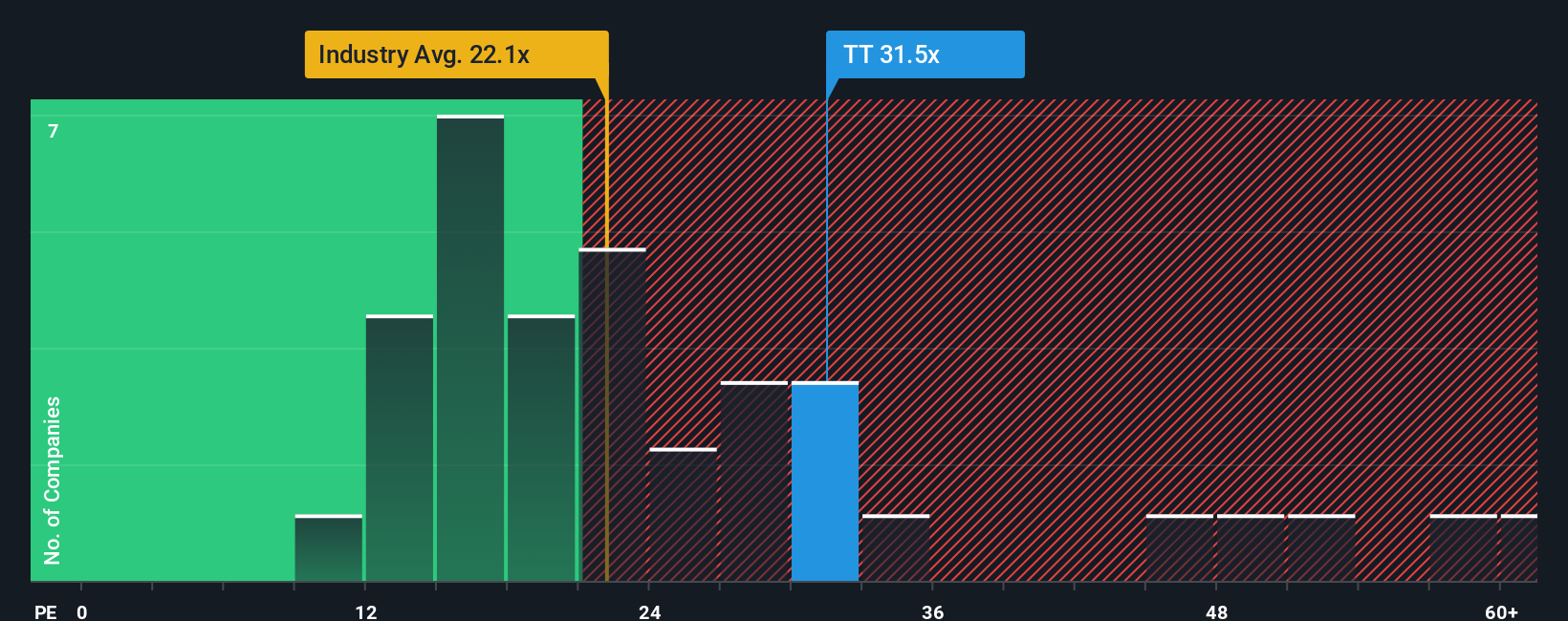

Another View: Multiples Raise Eyebrows

Taking a different approach, Trane Technologies looks expensive when comparing its current price-to-earnings ratio of 30.8x to the US Building industry average of 17.3x and its peers at 28.4x. Even compared to its own fair ratio of 30.2x, the shares appear richly valued, suggesting less margin for error if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trane Technologies Narrative

If you see the numbers differently or want to test your own assumptions, you can quickly build your own narrative in just a few minutes. Do it your way

A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investments rarely come from standing still. The right opportunity could be just one smart screen away. Make sure you’re not missing out on the best ideas with Simply Wall Street Screener.

- Find fresh potential with companies trading below their true worth by checking out these 919 undervalued stocks based on cash flows for undervalued gems based on strong cash flow.

- Get ahead of tech shifts and emerging industries by tapping into these 26 AI penny stocks with AI trendsetters making waves in innovation.

- Secure consistent income streams by spotting these 15 dividend stocks with yields > 3% offering yields over 3% for a reliable boost to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trane Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TT

Trane Technologies

Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives