- United States

- /

- Construction

- /

- NYSE:TPC

Market Might Still Lack Some Conviction On Tutor Perini Corporation (NYSE:TPC) Even After 35% Share Price Boost

Tutor Perini Corporation (NYSE:TPC) shares have continued their recent momentum with a 35% gain in the last month alone. The annual gain comes to 258% following the latest surge, making investors sit up and take notice.

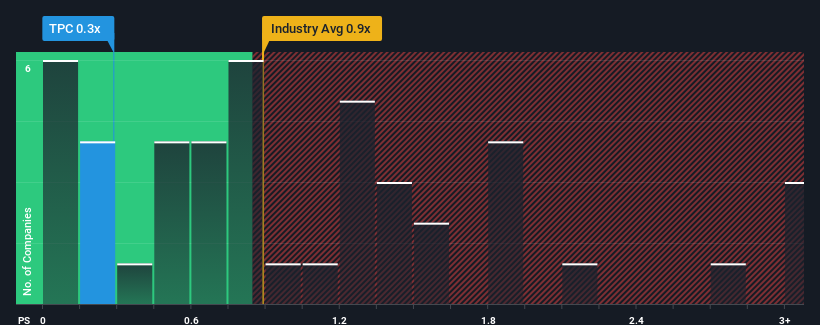

Although its price has surged higher, it would still be understandable if you think Tutor Perini is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in the United States' Construction industry have P/S ratios above 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Tutor Perini

What Does Tutor Perini's Recent Performance Look Like?

Recent revenue growth for Tutor Perini has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Tutor Perini will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Tutor Perini's to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 12% as estimated by the two analysts watching the company. That's shaping up to be similar to the 10.0% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Tutor Perini's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Despite Tutor Perini's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Tutor Perini's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Tutor Perini that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives