Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Tutor Perini Corporation (NYSE:TPC) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Tutor Perini

What Is Tutor Perini's Net Debt?

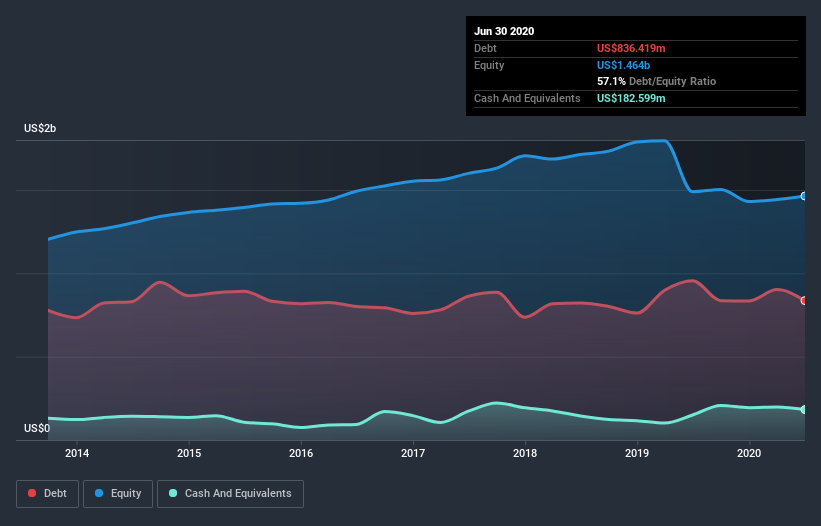

The image below, which you can click on for greater detail, shows that Tutor Perini had debt of US$836.4m at the end of June 2020, a reduction from US$956.2m over a year. However, because it has a cash reserve of US$182.6m, its net debt is less, at about US$653.8m.

A Look At Tutor Perini's Liabilities

We can see from the most recent balance sheet that Tutor Perini had liabilities of US$2.54b falling due within a year, and liabilities of US$758.1m due beyond that. Offsetting this, it had US$182.6m in cash and US$3.32b in receivables that were due within 12 months. So it can boast US$200.3m more liquid assets than total liabilities.

This luscious liquidity implies that Tutor Perini's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Tutor Perini has net debt worth 2.4 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 2.8 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Unfortunately, Tutor Perini saw its EBIT slide 5.7% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Tutor Perini can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Tutor Perini's free cash flow amounted to 37% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

When it comes to the balance sheet, the standout positive for Tutor Perini was the fact that it seems able to handle its total liabilities confidently. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to cover its interest expense with its EBIT. When we consider all the elements mentioned above, it seems to us that Tutor Perini is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Tutor Perini (including 1 which is is a bit unpleasant) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Tutor Perini, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives