- United States

- /

- Construction

- /

- NYSE:TPC

Even though Tutor Perini (NYSE:TPC) has lost US$117m market cap in last 7 days, shareholders are still up 178% over 1 year

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Tutor Perini Corporation (NYSE:TPC) share price has soared 178% in the last 1 year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 44% over the last quarter. It is also impressive that the stock is up 67% over three years, adding to the sense that it is a real winner.

While the stock has fallen 8.5% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Tutor Perini

Tutor Perini isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

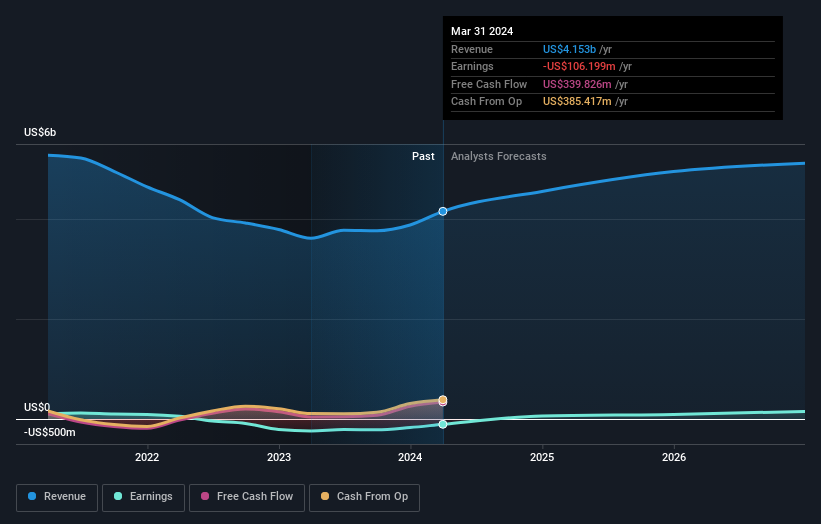

Over the last twelve months, Tutor Perini's revenue grew by 15%. We respect that sort of growth, no doubt. The revenue growth is decent but the share price had an even better year, gaining 178%. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Tutor Perini stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Tutor Perini shareholders have received a total shareholder return of 178% over the last year. That's better than the annualised return of 18% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Tutor Perini is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies in the United States and internationally.

Undervalued with adequate balance sheet.