- United States

- /

- Construction

- /

- NYSE:TPC

A Piece Of The Puzzle Missing From Tutor Perini Corporation's (NYSE:TPC) Share Price

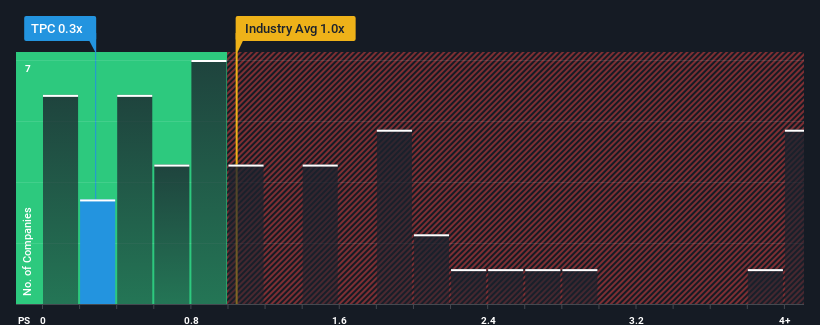

When close to half the companies operating in the Construction industry in the United States have price-to-sales ratios (or "P/S") above 1x, you may consider Tutor Perini Corporation (NYSE:TPC) as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Tutor Perini

How Has Tutor Perini Performed Recently?

Tutor Perini's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Tutor Perini will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Tutor Perini will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Tutor Perini?

The only time you'd be truly comfortable seeing a P/S as low as Tutor Perini's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 14% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 12% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Tutor Perini's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Tutor Perini currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Tutor Perini with six simple checks on some of these key factors.

If you're unsure about the strength of Tutor Perini's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives