- United States

- /

- Chemicals

- /

- NYSE:VHI

Undiscovered Gems in the United States to Watch This August 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 22% over the past year with earnings expected to grow by 15% per annum over the next few years. In this promising environment, identifying lesser-known stocks with strong fundamentals and growth potential can be a rewarding strategy for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Planet Image International | 119.30% | 2.39% | 0.80% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Republic Bancorp (NasdaqGS:RBCA.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Republic Bancorp, Inc. operates as a bank holding company for Republic Bank & Trust Company, offering a range of banking products and services in the United States, with a market cap of approximately $1.24 billion.

Operations: Republic Bancorp generates revenue primarily from Core Banking - Traditional Banking ($223.15 million), Republic Credit Solutions ($39.93 million), and Tax Refund Solutions ($22.68 million). The company also earns from Warehouse Lending ($9.91 million) and Republic Payment Solutions ($17.85 million).

Republic Bancorp, with total assets of US$6.6B and equity of US$955.4M, offers a solid financial foundation. Total deposits stand at US$5.1B while loans are at US$5.2B, supported by a net interest margin of 4.9%. The bank has an appropriate level of bad loans (0.4%) and a sufficient allowance for bad loans (393%). Recent earnings show net income rose to US$25.21M in Q2 2024 from US$21.05M last year, reflecting high-quality earnings growth by 10.8%.

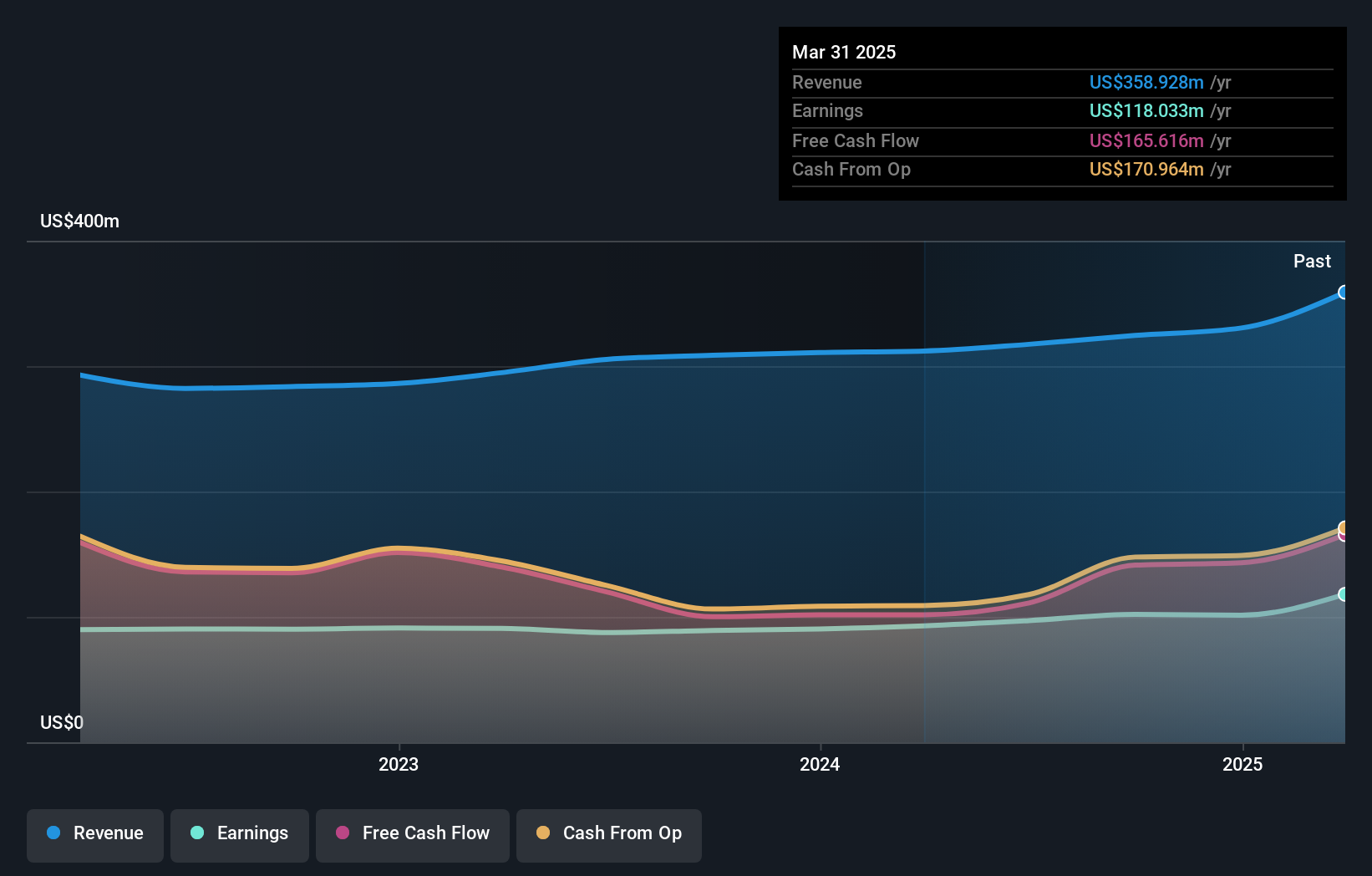

Tennant (NYSE:TNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Tennant Company, along with its subsidiaries, designs, manufactures, and markets floor cleaning equipment globally across the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions and has a market cap of approximately $1.81 billion.

Operations: Tennant generates revenue primarily from the design, manufacture, and sale of products used in the maintenance of nonresidential surfaces, amounting to $1.26 billion. The company has a market cap of approximately $1.81 billion.

Tennant, a smaller player in the machinery industry, has shown impressive earnings growth of 16% over the past year, outpacing the industry's 9.4%. The company's net debt to equity ratio stands at a satisfactory 20.3%, down from 105.6% five years ago. Tennant's interest payments are well covered by EBIT with a coverage ratio of 13x. Despite recent earnings showing net income at US$27.9 million for Q2 compared to US$31.3 million last year, Tennant remains profitable and raised its full-year sales guidance to US$1.28-1.31 billion.

- Unlock comprehensive insights into our analysis of Tennant stock in this health report.

Explore historical data to track Tennant's performance over time in our Past section.

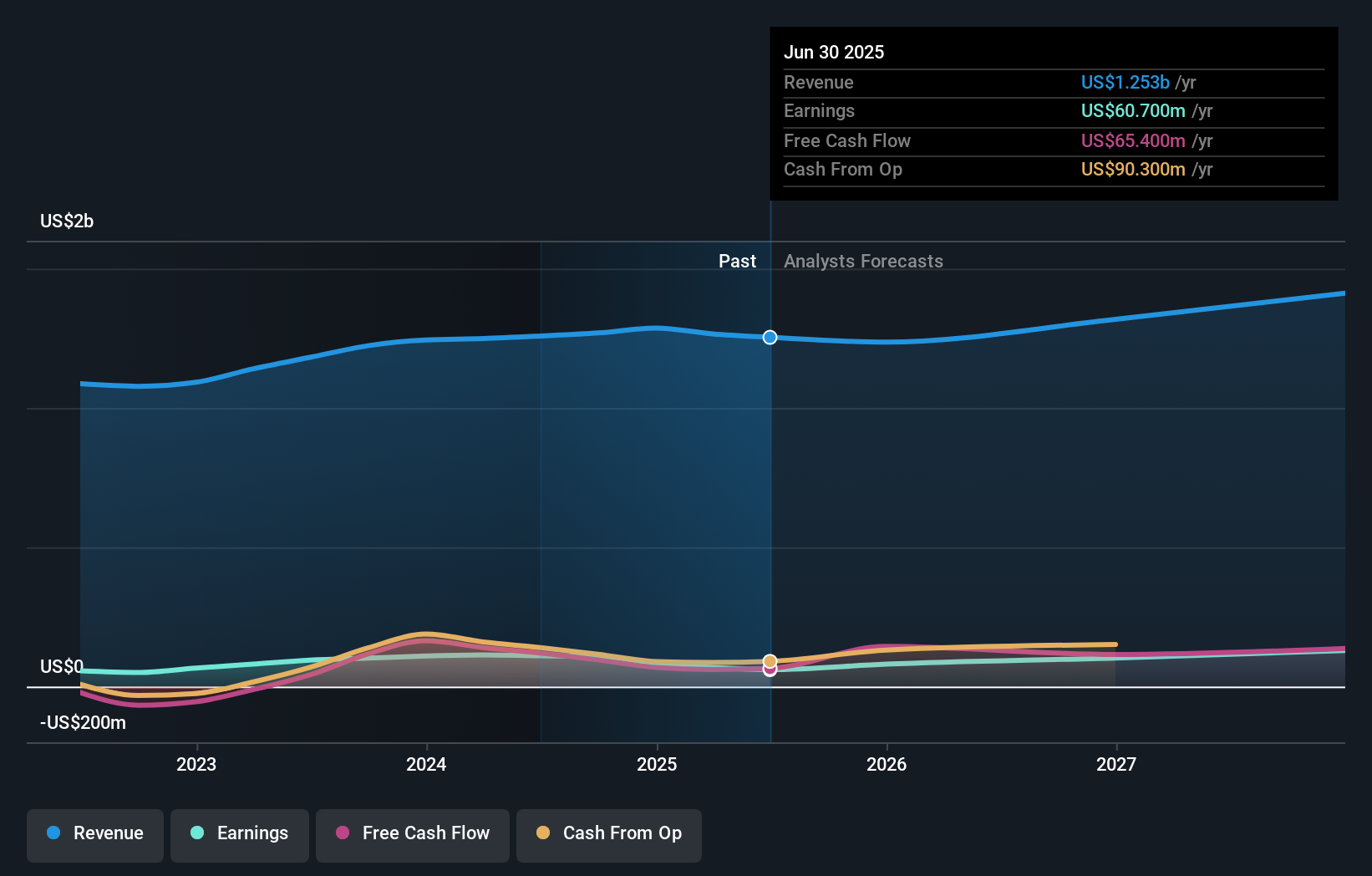

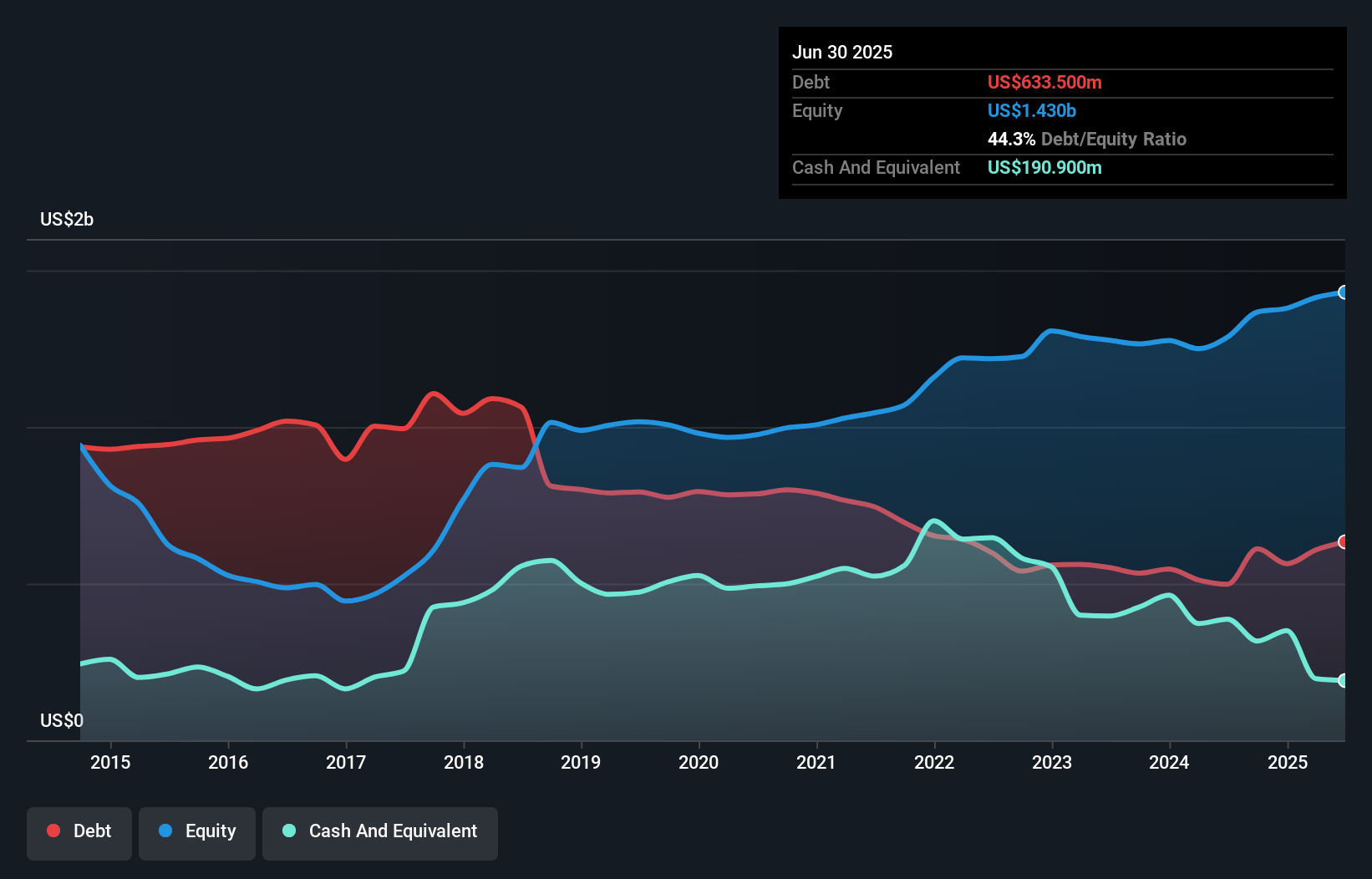

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of approximately $796.22 million.

Operations: Valhi, Inc. generates revenue primarily from its chemicals segment ($1.78 billion), followed by component products ($157.40 million) and real estate management and development ($78.50 million).

Valhi, Inc. has shown impressive earnings growth of 215.4% over the past year, significantly outpacing the chemicals industry's -4.8%. The company’s net debt to equity ratio stands at a satisfactory 8.6%, and its interest payments are well covered by EBIT with a 4.7x coverage. Recently, Valhi announced a quarterly dividend of US$0.08 per share and reported second-quarter sales of US$559.7 million, up from US$507.1 million last year, with net income reaching US$19.9 million compared to a previous net loss of US$3.2 million.

- Get an in-depth perspective on Valhi's performance by reading our health report here.

Assess Valhi's past performance with our detailed historical performance reports.

Taking Advantage

- Click this link to deep-dive into the 221 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VHI

Valhi

Engages in the chemicals, component products, and real estate management and development businesses in Europe, North America, the Asia Pacific, and internationally.

Excellent balance sheet with proven track record.