- United States

- /

- Machinery

- /

- NYSE:TNC

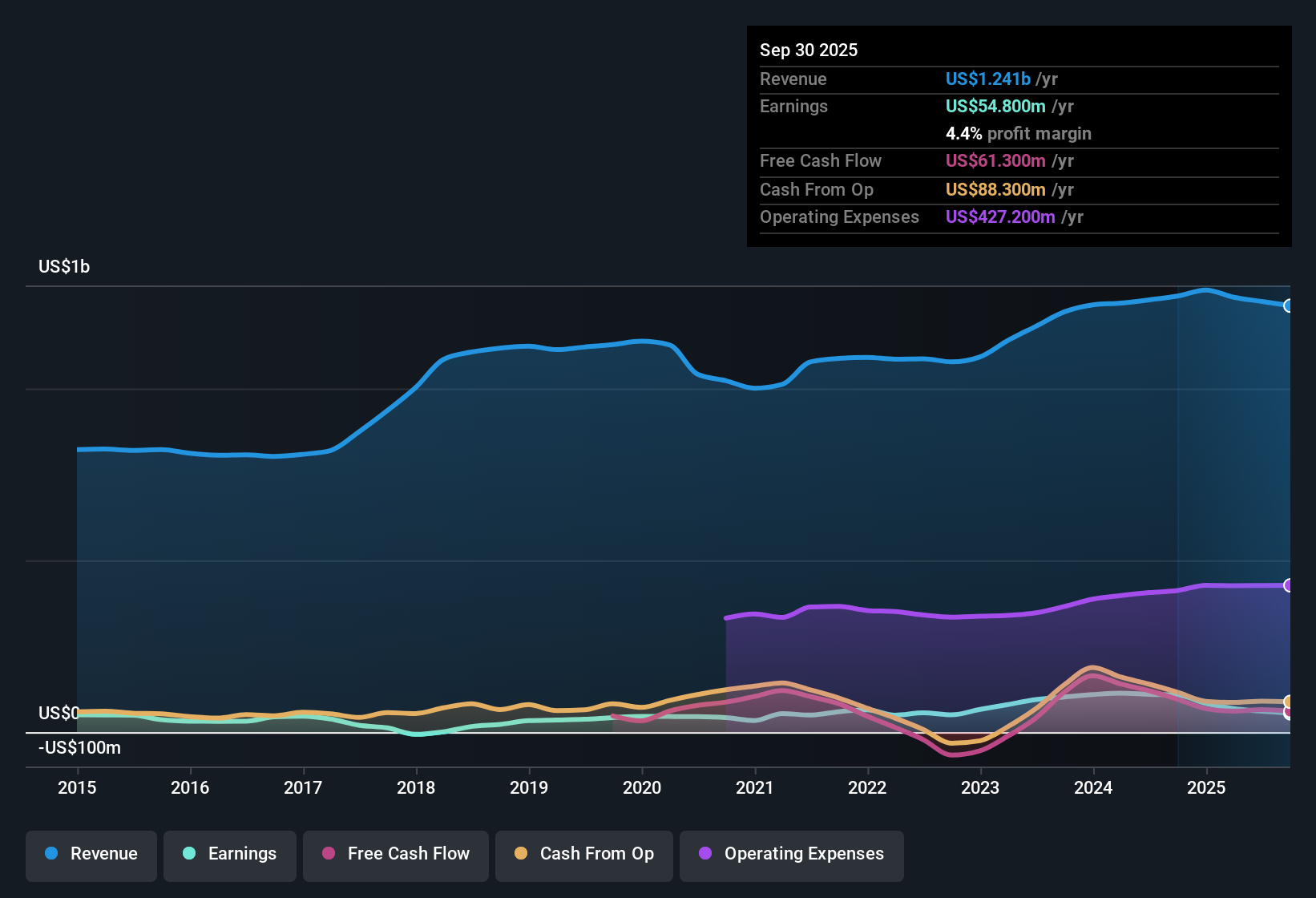

Tennant (TNC): Net Margin Drops to 4.4%, Challenging Bullish Narratives on Profit Growth

Reviewed by Simply Wall St

Tennant (TNC) posted net profit margins of 4.4%, down from 8.5% a year ago, and recorded negative earnings growth over the past twelve months. This is a stark contrast to the company’s longer-term average of 12.9% annual earnings growth over the last five years. Looking forward, earnings are forecast to jump 23% each year, outpacing the US market average of 16%, while revenue is expected to grow at a slower 5.5% per year compared to the market’s 10.5%. Investors will likely be weighing upbeat growth projections and an attractive valuation profile against recent profitability setbacks as they interpret these results.

See our full analysis for Tennant.Next, we’ll see how the numbers measure up to the most widely held narratives about Tennant and whether investor expectations are likely to shift in light of this report.

See what the community is saying about Tennant

Margins Poised for Recovery?

- Analysts project profit margins to nearly double from 4.8% now to 9.5% in three years, despite the fact that margins just fell from 8.5% to 4.4% over the past year.

- According to the analysts' consensus view, management’s focus on launching autonomous and environmentally friendly cleaning solutions is expected to drive long-term margin improvement.

- Expansion into higher-margin, recurring-revenue products like equipment-as-a-service and premium sustainable offerings could help reverse last year’s margin contraction.

- Yet it remains to be seen if these innovations can quickly offset recent margin pressure from inflation and international underperformance.

- Consensus narrative suggests new product launches and cost discipline are key to restoring margins and supporting profit growth.

Discover how these strategies could reshape Tennant's path in our in-depth consensus narrative. 📊 Read the full Tennant Consensus Narrative.

Share Price and Analyst Target Gap

- Tennant’s current share price of $75.29 sits 44% below its DCF fair value estimate of $138.90 and 44% beneath the analyst target price of 108.75.

- The consensus narrative highlights that strong future earnings and margin growth must materialize to justify the analyst target.

- For investors, the sizeable discount to both DCF and analyst fair values presents an opportunity if the company delivers on profit growth forecasts.

- Divergence among analyst targets ($93.00 to $125.00) underscores differing expectations about Tennant’s ability to hit those ambitious milestones.

Trading Premium to Industry, Discount to Peers

- Tennant trades at a price-to-earnings ratio of 25.4x, which is higher than the US Machinery industry average of 23.9x, but still cheaper than the peer group’s 36.2x average.

- Analysts’ consensus view notes that this valuation split reflects Tennant’s position as a quality operator with an attractive dividend profile.

- The company needs to prove that its forecasted earnings rebound justifies the current valuation premium over the industry.

- Negative growth and margin setbacks could put pressure on the stock if future performance does not align with optimistic projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tennant on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on the results? Shape your unique view in just a few minutes and add your own voice to the story. Do it your way

A great starting point for your Tennant research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Tennant faces recent margin pressure and negative earnings growth, which raises questions about its ability to sustain performance as forecasts depend on a turnaround.

If you want more consistent performance, discover stable growth stocks screener (2079 results) to quickly find companies that have delivered steady revenue and earnings growth through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tennant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNC

Tennant

Designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives