- United States

- /

- Machinery

- /

- NYSE:TNC

A Fresh Look at Tennant (TNC) Valuation Following New T360 Scrubber Launch

Reviewed by Kshitija Bhandaru

Tennant (NYSE:TNC) just rolled out its new T360 mid-sized scrubber, focusing on easier operation, stronger cleaning performance, and productivity for facility owners and operators. The launch signals Tennant’s ongoing push to enhance its product lineup.

See our latest analysis for Tennant.

Tennant’s launch of the T360 comes at a time when momentum surrounding the stock has been mixed, with the share price at $79.96 and a 1-year total shareholder return of -13.77%. Still, its three- and five-year total returns remain solidly positive, which suggests enduring potential even as recent results reflect investor caution.

If this kind of steady innovation sparks your curiosity, now is a great chance to broaden your search and discover fast growing stocks with high insider ownership

With Tennant trading well below analyst price targets and showing improving fundamentals, the question becomes clear: Is the current price a rare bargain, or is the market already expecting stronger growth ahead?

Most Popular Narrative: 26.6% Undervalued

With Tennant’s most popular narrative assigning a fair value of $109 compared to its last close of $79.96, the stock stands out as notably discounted. This sets the scene for a key perspective about what is driving this outlook.

Accelerated adoption of autonomous mobile robots (AMRs) and equipment-as-a-service programs is expanding Tennant's recurring revenue base, supported by robust customer demand amid labor shortages and higher labor costs. This combination is expected to drive both future revenue growth and margin expansion. Heightened focus on hygiene and cleanliness standards in facilities globally, especially post-pandemic, is enlarging Tennant's addressable market and supporting stronger order pipelines, which is anticipated to translate into steady sales growth over time.

Want to dig into the financial engine behind that discount? The most closely watched narrative signals that robust top-line growth and margin expansion could rewrite expectations and anchor a surprising target price. Uncover the detailed projections and the bold assumptions that fuel this optimistic scenario.

Result: Fair Value of $109 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant international market weakness or escalating input costs could derail recent gains, which raises questions about whether current optimism is justified.

Find out about the key risks to this Tennant narrative.

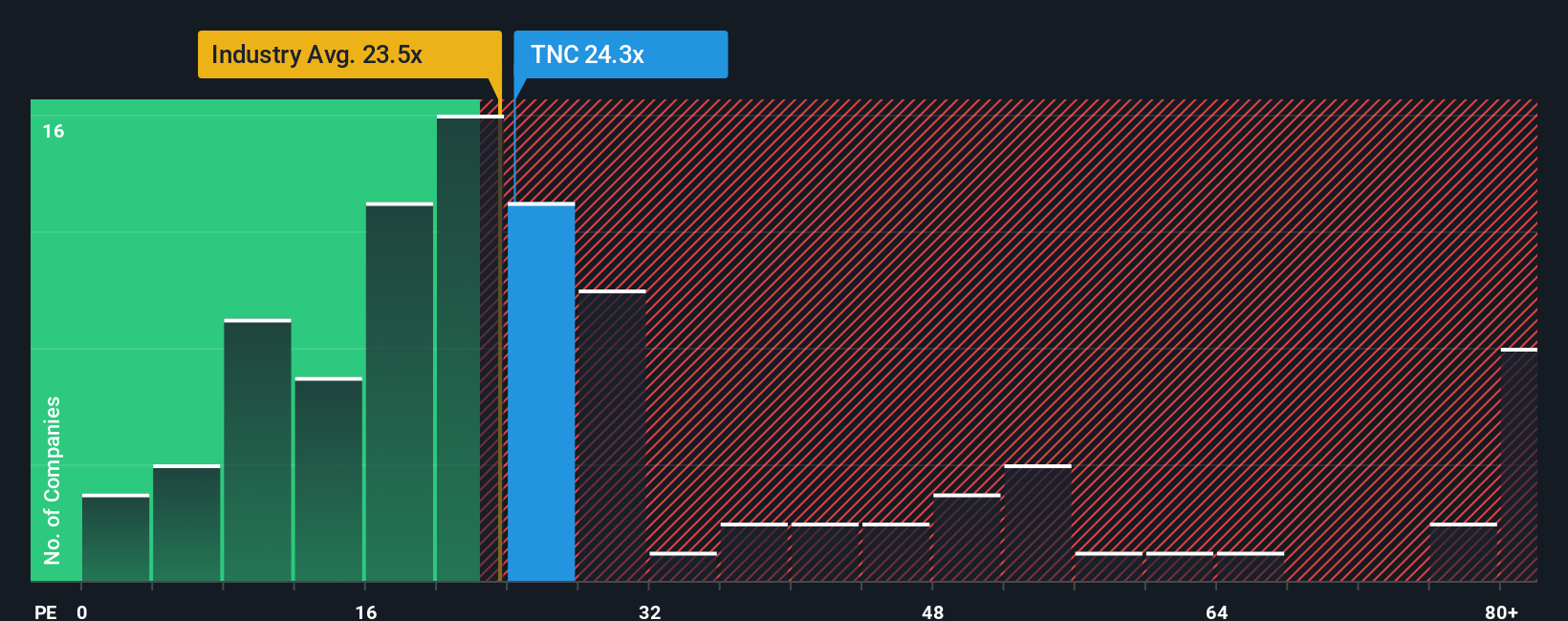

Another View: Market Multiples Paint a Cautious Picture

While our earlier analysis highlights Tennant as undervalued, the price-to-earnings ratio tells a different story. Tennant trades at 24.3x earnings, slightly higher than the Machinery industry average of 23.8x and well above its fair ratio of 22.3x. This could limit upside if the market turns cautious. How will Tennant bridge this valuation gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tennant Narrative

If you find yourself forming a different conclusion or want to dive into the numbers personally, you can build your own story in just a few minutes. Do it your way

A great starting point for your Tennant research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to give your portfolio an edge. These hand-picked opportunities are moving fast, and missing out could mean missing the next big winner.

- Uncover fresh growth potential by tapping into these 24 AI penny stocks poised to lead with groundbreaking artificial intelligence innovations.

- Boost your passive income strategy and lock in attractive yields with these 18 dividend stocks with yields > 3% offering consistently strong payouts.

- Gain early access to digital transformation by checking out these 79 cryptocurrency and blockchain stocks that are pioneering advances in blockchain and crypto technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tennant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNC

Tennant

Designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives