- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

How TransDigm Group's (TDG) 2026 Guidance and Buybacks Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- TransDigm Group recently announced its fourth quarter and full-year results for fiscal 2025, reporting increased sales of US$2.44 billion and US$8.83 billion respectively, along with higher net income and earnings per share compared to the prior year.

- The company also completed another tranche of its ongoing share buyback program and issued fiscal 2026 guidance projecting revenue growth, but expects a modest decline in net income due to increased interest expenses from recent financing activities.

- We'll explore how TransDigm's updated guidance for 2026 informs the company's growth story and earnings outlook moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

TransDigm Group Investment Narrative Recap

To be a TransDigm shareholder today, you have to believe in sustained global demand for air travel and the resilience of aftermarket aerospace parts, both of which have historically fueled the company's robust recurring revenues and high margins. The latest full-year results and 2026 outlook reinforce continued sales growth but flag a new headwind: higher interest expense tied to recent debt financing, which is now the most immediate risk to near-term earnings. For now, this updated interest burden does matter for short-term margin expectations, but the company's core catalysts, aftermarket demand and secular industry tailwinds, remain supportive.

The most relevant recent announcement for investors is TransDigm's updated guidance for fiscal 2026, which projects revenue to rise roughly 11.5 percent at the midpoint but a modest dip in net income. This reflects the direct impact of higher interest costs, confirming that the company’s highly leveraged capital structure is a key variable shaping earnings power, particularly as financing costs rise.

However, it's important for investors to be aware of one crucial point: as interest expenses climb and net income growth slows, the risk to TransDigm’s earnings predictability increases if...

Read the full narrative on TransDigm Group (it's free!)

TransDigm Group's outlook anticipates $10.8 billion in revenue and $2.5 billion in earnings by 2028. This is based on an expected 8.0% annual revenue growth rate and a $0.7 billion increase in earnings from the current $1.8 billion.

Uncover how TransDigm Group's forecasts yield a $1558 fair value, a 16% upside to its current price.

Exploring Other Perspectives

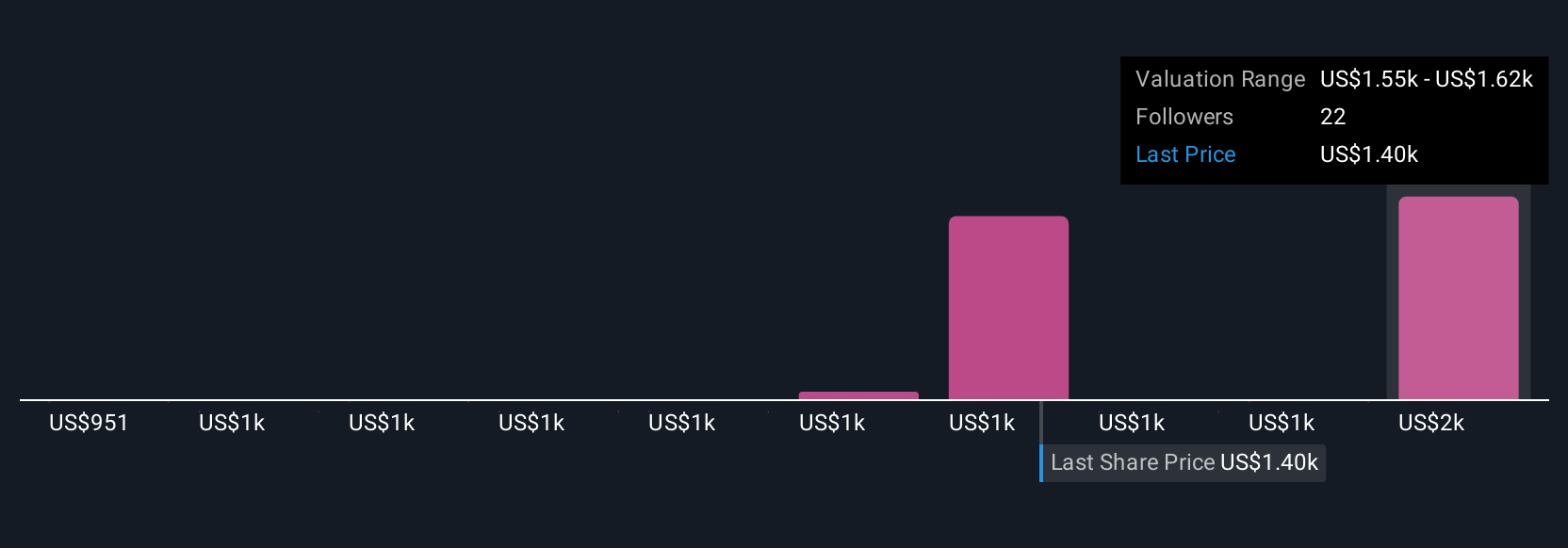

Simply Wall St Community members set fair value estimates for TransDigm between US$1,121 and US$1,558, drawing on five separate analyses. As many weigh the company's rising debt load and forecasted interest expenses, this wide variation underscores how market participants evaluate financial flexibility and potential earnings pressure differently, offering you several ways to rethink the company's outlook.

Explore 5 other fair value estimates on TransDigm Group - why the stock might be worth 17% less than the current price!

Build Your Own TransDigm Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransDigm Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TransDigm Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransDigm Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives