- United States

- /

- Machinery

- /

- NYSE:SWK

Stanley Black & Decker (SWK) Profitability Returns, Challenging Bearish Narratives After $525.6M Loss

Reviewed by Simply Wall St

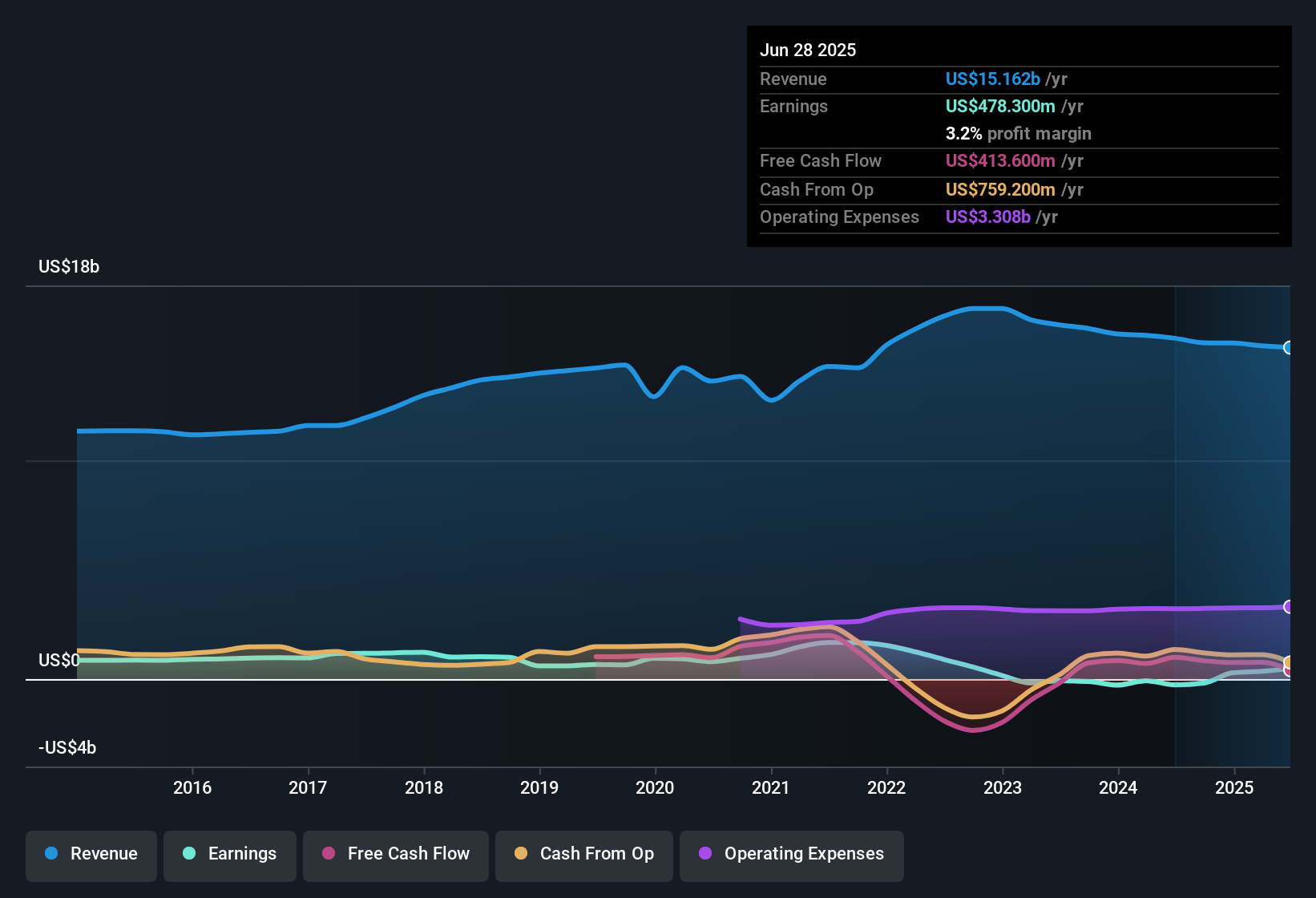

Stanley Black & Decker (SWK) just turned the corner on profitability after years of declining earnings, reporting a projected earnings growth rate of 30.2% per year that outpaces both its industry and the broader US market. Revenue, however, is forecast to grow at a slower clip of 3.9% per year, trailing the US market’s expected 10.5% gain. The company’s return to profitability comes after a notable one-off loss of $525.6 million over the last twelve months, putting renewed focus on the consistency of future profits.

See our full analysis for Stanley Black & Decker.Now, it's time to see how these headline results stack up against the broader narratives about SWK. Some perspectives may be reinforced, while others might get shaken up.

See what the community is saying about Stanley Black & Decker

Margins Poised for Expansion by 2026

- Management expects the supply chain transformation nearing completion to drive gross margin back to 35% or higher by late 2026, a notable improvement from margin levels implied by recent results.

- According to the analysts' consensus view, margin expansion rests on the success of cost reductions, enhanced operational flexibility, and a move towards higher-margin recurring digital revenues.

- Consensus notes that a focus on innovation, such as cordless pro tools and digital workflow products, should enable higher average selling prices. This could support margins if customer adoption matches expectations.

- However, stagnant demand and ongoing macro cost pressures could undermine this effort. Analysts caution that robust margin recovery is not guaranteed if these risks persist.

- Consensus expects these margin drivers to shape the company’s operating leverage, with an eye on how quickly management translates cost saves into sustained profit gains.

Consensus narrative suggests SWK's margin ambitions could alter long-term valuations if targets hold, but ongoing execution risk makes this a must-watch trend. 📊 Read the full Stanley Black & Decker Consensus Narrative.

Profit Targets Hinge on 3-Year Surge

- Consensus projects profit margins will rise from 3.2% today to 7.9% by 2028, translating to earnings climbing from $478.3 million to $1.3 billion over three years.

- Analysts' consensus narrative points to several moving parts:

- Operational improvements and digital initiatives are credited for the ambitious earnings goal, assuming ongoing top-line growth and a steady margin lift.

- Yet there is a material range in analyst estimates, with the most cautious seeing earnings as low as $938 million. This highlights continued debate around execution given recent years of profit volatility and a large $525.6 million loss in the prior twelve months.

Valuation Still Discounts Volatility Risk

- Stanley Black & Decker trades at a forward Price-to-Earnings ratio of 23.5x, below both its peer average of 25.7x and the US Machinery industry average of 23.9x. The current share price of $66.63 is materially below its DCF fair value of $136.49.

- According to the analysts' consensus view, this discount reflects both optimism for future profit growth and lingering wariness around unsustained profitability and one-off losses.

- The consensus target price of $85.96 represents roughly 29% upside from today's price. Analysts underscore that confidence in this valuation is dependent on the company delivering margin recovery and controlling costs as outlined.

- Critics highlight ongoing risks in market demand softness, pricing power constraints, and the execution of cost savings, meaning the relative discount may persist if anticipated improvements do not materialize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Stanley Black & Decker on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? You can shape your perspective into a personal narrative in just a few minutes. Do it your way.

A great starting point for your Stanley Black & Decker research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Stanley Black & Decker’s long history of profit volatility and reliance on margin recovery efforts leave its future earnings power exposed to execution risks and uncertain demand.

If you’re seeking consistent growth and fewer surprises, check out stable growth stocks screener (2077 results) for companies delivering steady expansion in both revenue and earnings year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWK

Stanley Black & Decker

Provides hand tools, power tools, outdoor products, and related accessories in the United States, Canada, Other Americas, Europe, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives