- United States

- /

- Machinery

- /

- NYSE:SWK

Did Softer Earnings Guidance and Peer Miss Just Shift Stanley Black & Decker’s (SWK) Investment Narrative?

Reviewed by Sasha Jovanovic

- Stanley Black & Decker recently reported flat third-quarter revenues alongside continued growth in its DEWALT brand and margin expansion, but its full-year earnings guidance fell short of analyst expectations.

- Despite solid operational performance, the company underperformed its professional tools and equipment peers in meeting analyst estimates, which may have impacted investor sentiment.

- We'll look at how the earnings guidance shortfall and peer underperformance could shape Stanley Black & Decker's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Stanley Black & Decker Investment Narrative Recap

To be a shareholder in Stanley Black & Decker right now, you have to believe in the company’s ability to reignite organic growth while delivering on efficiency and margin expansion, despite recent revenue softness and a full-year earnings guidance that missed expectations. The latest results reinforce that flat revenues and lighter forward guidance remain the key short-term challenge, outweighing margin progress and brand momentum, and this looks to be the most important near-term risk, with little material change from the reported news events.

Of the recent announcements, Stanley Black & Decker’s confirmed fourth-quarter earnings webcast on December 4 is particularly relevant. This presentation provides direct management insight at a critical time, offering investors a chance to gauge commentary on market trends, operational execution, and potential shifts in strategy as the company contends with cautious guidance, a significant opportunity if near-term catalysts or risks are addressed with clarity.

On the other hand, with declining DIY demand and channel concentration risks still present, investors should closely watch for signals of...

Read the full narrative on Stanley Black & Decker (it's free!)

Stanley Black & Decker's narrative projects $16.8 billion revenue and $1.3 billion earnings by 2028. This requires 3.5% yearly revenue growth and a $821.7 million increase in earnings from the current $478.3 million.

Uncover how Stanley Black & Decker's forecasts yield a $85.30 fair value, a 29% upside to its current price.

Exploring Other Perspectives

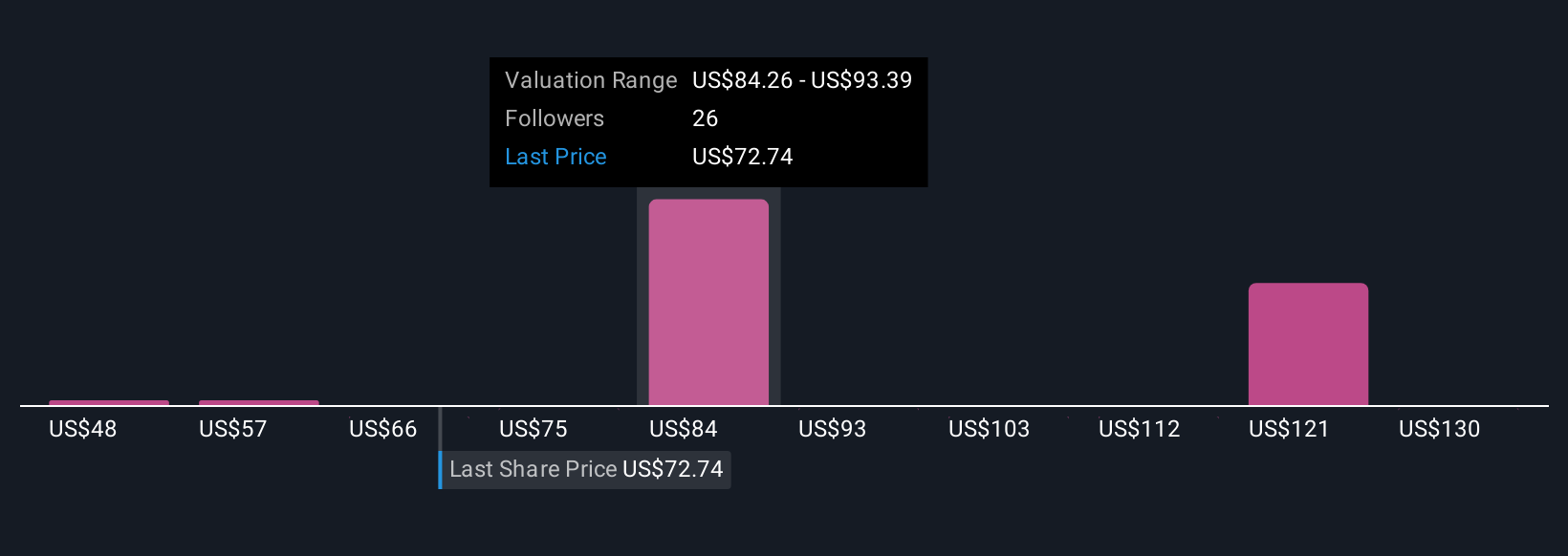

Ten individual fair value estimates from the Simply Wall St Community suggest a broad range for Stanley Black & Decker, from US$47.77 to US$177.03 per share. As you consider this breadth of opinion, keep in mind that macro pressures and flat sales forecasts may factor heavily into how performance meets or misses individual expectations.

Explore 10 other fair value estimates on Stanley Black & Decker - why the stock might be worth over 2x more than the current price!

Build Your Own Stanley Black & Decker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stanley Black & Decker research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Stanley Black & Decker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stanley Black & Decker's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWK

Stanley Black & Decker

Provides hand tools, power tools, outdoor products, and related accessories in the United States, Canada, Other Americas, Europe, and Asia.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives