- United States

- /

- Electrical

- /

- NYSE:ST

Sensata Technologies Holding (NYSE:ST) Is Due To Pay A Dividend Of $0.12

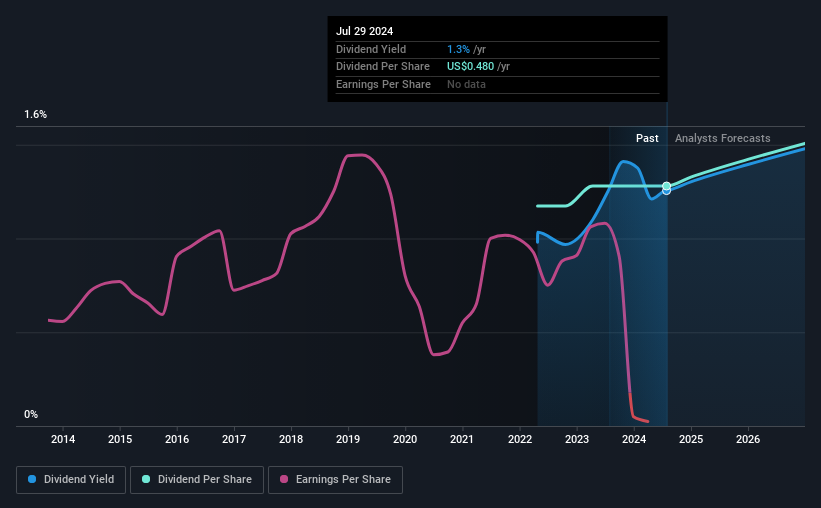

Sensata Technologies Holding plc (NYSE:ST) has announced that it will pay a dividend of $0.12 per share on the 28th of August. The dividend yield is 1.3% based on this payment, which is a little bit low compared to the other companies in the industry.

View our latest analysis for Sensata Technologies Holding

Sensata Technologies Holding Doesn't Earn Enough To Cover Its Payments

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Even though Sensata Technologies Holding isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

The next 12 months is set to see EPS grow by 154.7%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio getting very high over the next year.

Sensata Technologies Holding Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2022, the annual payment back then was $0.44, compared to the most recent full-year payment of $0.48. This means that it has been growing its distributions at 4.4% per annum over that time. Sensata Technologies Holding hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Over the past five years, it looks as though Sensata Technologies Holding's EPS has declined at around 15% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Sensata Technologies Holding's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Sensata Technologies Holding that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ST

Sensata Technologies Holding

Develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives