- United States

- /

- Aerospace & Defense

- /

- NYSE:SPR

Valuation Check: Is Spirit AeroSystems (SPR) Undervalued After Recent Share Price Dip?

Reviewed by Simply Wall St

See our latest analysis for Spirit AeroSystems Holdings.

Spirit AeroSystems Holdings’ 1-year total shareholder return of 12.66% points to meaningful progress, even though the past month saw a 6.4% share price pullback from recent highs. Momentum has cooled a bit lately, but the longer-term numbers reflect steady gains and a market that continues to acknowledge the company’s turnaround and revenue strength.

If the aerospace sector’s recent volatility has you wondering what else is taking flight, it might be a smart move to check out the See the full list for free..

With strong revenue gains but a recent share price dip, the key question for investors is whether Spirit AeroSystems is trading at a discount, or if the stock already reflects expectations for future growth.

Price-to-Sales of 0.7x: Is it justified?

At a price-to-sales ratio of 0.7x, Spirit AeroSystems sits well below its US Aerospace & Defense sector peers, yet the company remains unprofitable at present. The last close price of $35.87 reflects a significant discount to both the industry average and the company’s robust annual revenue growth.

The price-to-sales ratio compares a company’s stock price to its revenues, offering investors a way to value businesses that might not yet be profitable. In aerospace manufacturing, this multiple can reveal whether the market is pricing in future growth, operational turnaround, or ongoing risks.

Spirit AeroSystems’ 0.7x price-to-sales ratio is not just low in absolute terms; it is substantially cheaper than the sector, where peers average 2.9x. Even compared to the peer group’s 2.5x, SPR stands out as a relative bargain. If the market shifts back toward the sector fair ratio, there could be notable upside.

Explore the SWS fair ratio for Spirit AeroSystems Holdings

Result: Price-to-Sales of 0.7x (UNDERVALUED)

However, persistent net losses and ongoing sector volatility could continue to weigh on Spirit AeroSystems’ valuation and limit near-term momentum.

Find out about the key risks to this Spirit AeroSystems Holdings narrative.

Another View: What Does the DCF Model Say?

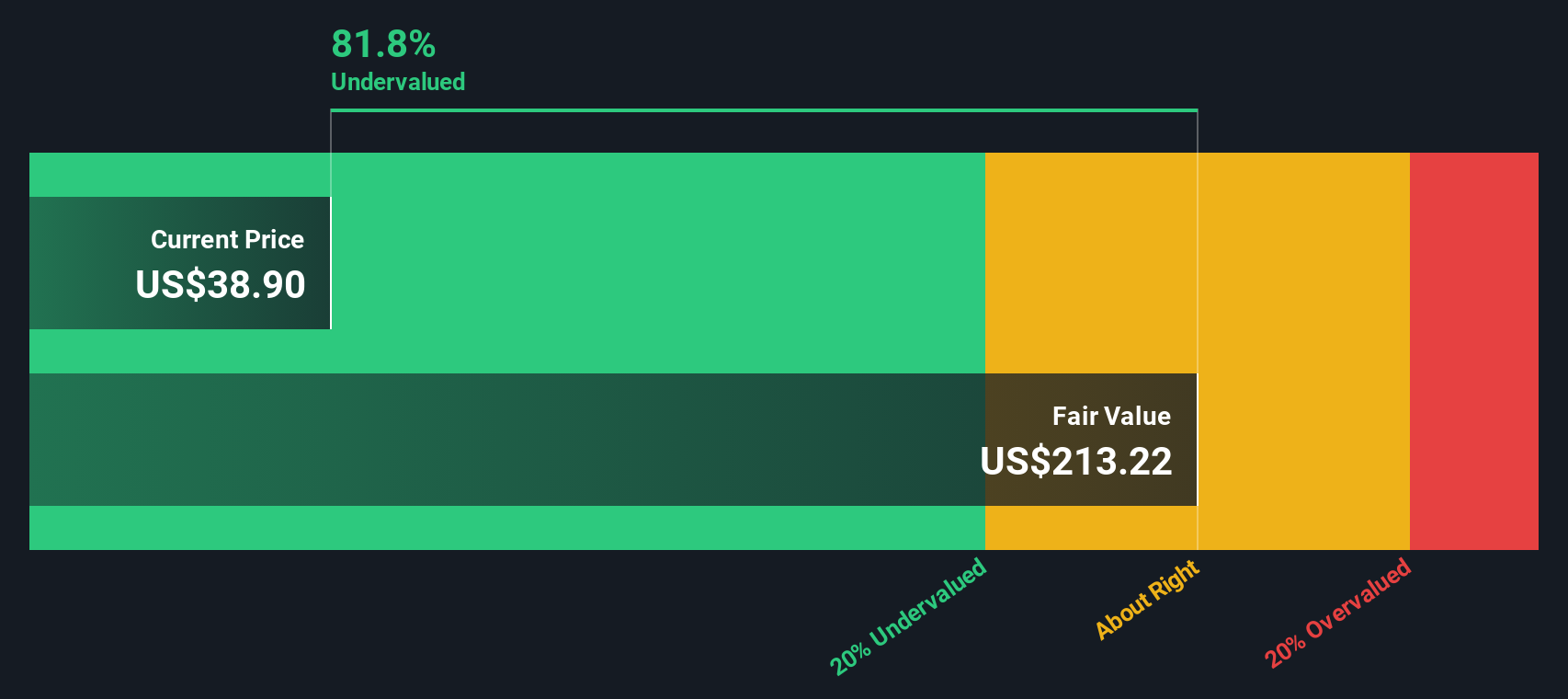

While the low price-to-sales ratio hints at a bargain, our SWS DCF model offers a different perspective. It estimates Spirit AeroSystems’ fair value to be much higher than today’s share price. This suggests the stock might be deeply undervalued if future cash flows are realized as forecast. But can the company deliver on those lofty expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Spirit AeroSystems Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Spirit AeroSystems Holdings Narrative

If you want to dive deeper or prefer a hands-on approach, you can review the numbers and build an independent view for yourself in just minutes: Do it your way.

A great starting point for your Spirit AeroSystems Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more ways to unlock your investing potential?

Your next smart move could be just around the corner. Uncover stocks that offer unique growth, reliable income, or innovative breakthroughs by using our handpicked screeners below.

- Boost your portfolio’s earning power by targeting companies with consistent yields through these 18 dividend stocks with yields > 3%.

- Take the lead in one of the hottest sectors when you access these 27 AI penny stocks and explore artificial intelligence innovation.

- Spot tomorrow’s undervalued opportunities early by researching these 909 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPR

Spirit AeroSystems Holdings

Engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives