- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (SMR) Is Down 19.4% After Wider Losses and $750 Million Equity Offering - What's Changed

Reviewed by Sasha Jovanovic

- NuScale Power recently reported third quarter results with revenue of US$8.24 million but a substantially higher net loss of US$273.32 million, and the company also announced a US$750 million at-the-market equity offering.

- Significant institutional and insider share sales have accompanied analyst downgrades, raising questions about the company’s outlook amid ongoing project delays and financial pressures.

- We'll explore how disappointing quarterly results and rising funding needs affect NuScale Power's investment narrative and future prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

NuScale Power Investment Narrative Recap

NuScale Power stock represents a bet on the future commercialization of small modular reactor (SMR) technology, supported by regulatory progress and demand for carbon-free energy. However, recent heavy losses and a substantial US$750 million equity raise signal intensified short-term funding pressures, the biggest immediate risk remains the timeline and certainty of securing commercial power plant orders. The latest news on executive appointments and bylaw changes, while important for governance, does not materially shift the path toward obtaining those critical customer agreements.

The most relevant recent announcement is the US$750 million at-the-market equity offering, reinforcing the focus on financial stability as the company ramps up investment in project development. This move underscores how NuScale is addressing its capital needs while managing delays related to its prominent Romanian project, a key growth catalyst if successful.

In sharp contrast to long-term optimism, investors should be aware of the company’s ongoing liquidity challenges and what further delays may mean for...

Read the full narrative on NuScale Power (it's free!)

NuScale Power's narrative projects $402.3 million revenue and $42.2 million earnings by 2028. This requires 121.5% yearly revenue growth and a $178.8 million earnings increase from the current earnings of -$136.6 million.

Uncover how NuScale Power's forecasts yield a $40.84 fair value, a 90% upside to its current price.

Exploring Other Perspectives

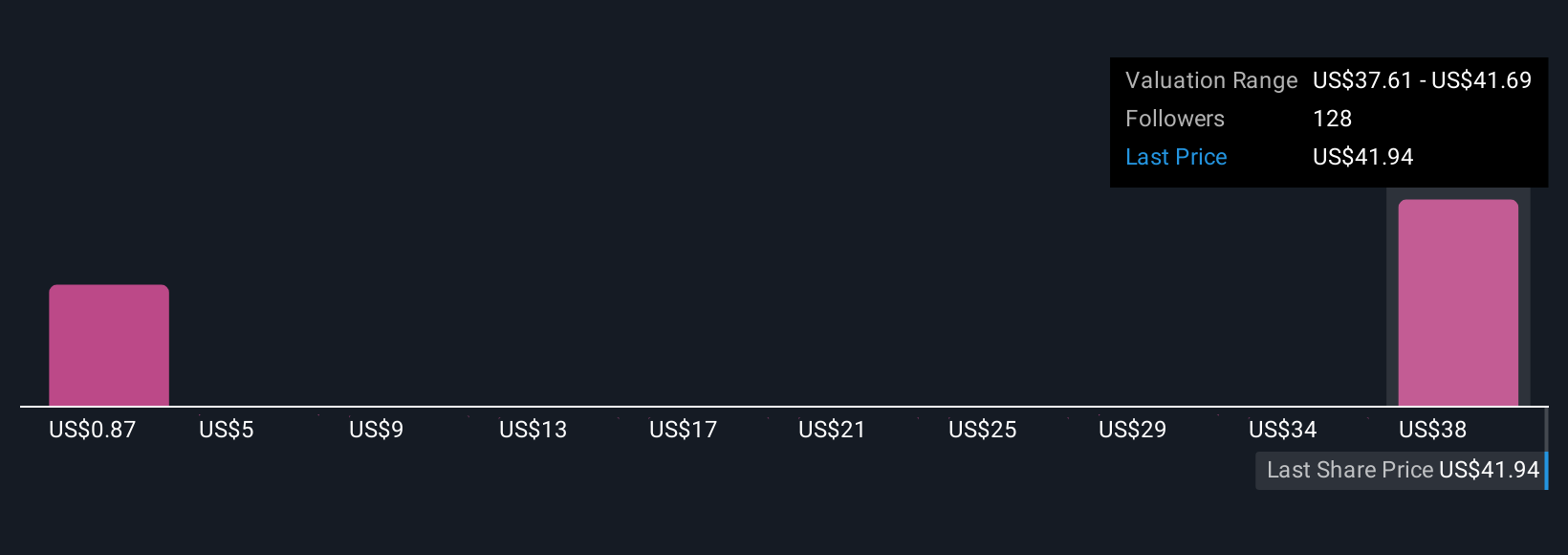

Thirteen private members of the Simply Wall St Community estimated NuScale’s fair value from as low as US$1.21 to as high as US$40.84 per share. As ongoing project delays remain a core risk, you can explore how different investors interpret these challenges in their forecasts and reasoning.

Explore 13 other fair value estimates on NuScale Power - why the stock might be worth as much as 90% more than the current price!

Build Your Own NuScale Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free NuScale Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuScale Power's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives