- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (SMR): Evaluating Valuation After Share Authorization Proposal and New Financial Leadership

Reviewed by Simply Wall St

NuScale Power (SMR) has put forward a proposal to raise the number of authorized Class A common shares at its upcoming Special Meeting of Stockholders in December. This step could have a significant impact on the company’s capital structure and financing options in the near term.

See our latest analysis for NuScale Power.

NuScale’s recent moves, including the proposed share authorization increase and the appointment of a new Chief Accounting Officer, come amid a year of notable volatility. Despite a steep 30-day share price return of -47.15%, the stock still boasts an impressive 85.14% three-year total shareholder return. Its one-year total return stands at -28.94%. Short-term momentum has faded, but the long-term picture remains complex as the company recalibrates for future growth and potential capital needs.

If corporate shakeups like this have you thinking about what else is out there, now’s the perfect time to discover fast growing stocks with high insider ownership

With volatile returns and fresh leadership changes in motion, investors may be asking whether NuScale Power is now at bargain levels for forward-looking individuals, or if the current share price already reflects all possible upside from future growth.

Most Popular Narrative: 50.8% Undervalued

NuScale Power's most popular valuation narrative estimates a fair value of $40.50, which is significantly higher than the recent closing price of $19.94. This sharp divergence centers on aggressive future growth assumptions and a bullish view of sector momentum, setting the stage for a complex and high-stakes outlook.

NuScale's involvement in the RoPower 6-module small modular reactor (SMR) power plant in Romania indicates future meaningful revenue and cash flow through its partnership in the Fluor-led Front-End Engineering and Design (FEED) Phase 2. This project enhances NuScale's revenue prospects.

Want to know which outsized growth forecasts and margin expansion assumptions power this massive gap to fair value? The narrative brings together future deployment deals, aggressive revenue expansion, and profit inflection math that few would dare bet against or for without digging deeper. Guess which variables carry the most weight? Follow the full narrative to see the surprising numbers and logic that set this price target apart.

Result: Fair Value of $40.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in securing firm customer orders or supply chain setbacks could quickly undermine even the most optimistic long-term growth projections for NuScale Power.

Find out about the key risks to this NuScale Power narrative.

Another View: What Do Multiples Say?

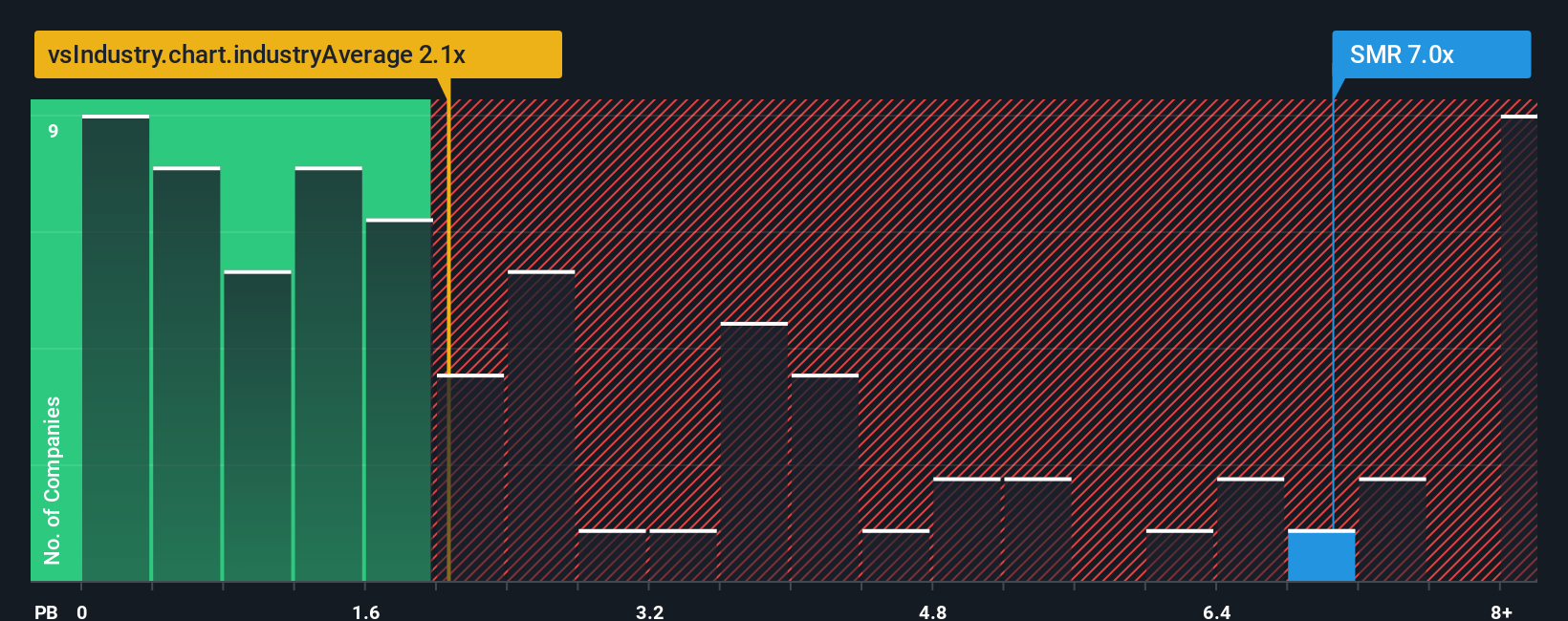

Looking through the lens of the price-to-book ratio, NuScale Power trades at 6.7 times book value. That is much higher than the US Electrical industry average of 2.2 times, but still below the peer group average of 16.8 times. This suggests the market is pricing in a lot of optimism compared to most industry players, but less so than some direct peers. Does this strong valuation signal upside risk or caution for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NuScale Power Narrative

If you see things differently or want to base your story on your own analysis, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss a chance to fuel your portfolio with companies you may not have considered. Use the Simply Wall Street Screener to hunt for dynamic stocks in high-potential sectors.

- Tap into future medical breakthroughs by reviewing these 30 healthcare AI stocks, which are leveraging artificial intelligence in healthcare and diagnostics.

- Accelerate your returns with these 924 undervalued stocks based on cash flows, featuring companies that show strong cash flow fundamentals and are trading at attractive prices right now.

- Seize growth in the fast-evolving blockchain space by analyzing these 81 cryptocurrency and blockchain stocks, which are set to transform industries beyond finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success