- United States

- /

- Electrical

- /

- NYSE:SMR

A Look at NuScale Power’s Valuation as ENTRA1 Partnership Draws Investor Focus Ahead of Q3 Earnings

Reviewed by Simply Wall St

NuScale Power (NYSE:SMR) is in the spotlight as it prepares to report third-quarter earnings. Investors are closely watching its partnership with ENTRA1 Energy and the potential $25 billion in investment tied to the new U.S.-Japan energy framework.

See our latest analysis for NuScale Power.

NuScale Power’s share price has seen some dramatic swings, surging 114.1% year-to-date, only to recently pull back with a 12.2% dip over the past week. Despite that volatility, the three-year total shareholder return of 229.9% speaks to long-term momentum still building behind the story, especially as interest in advanced nuclear rises alongside major deals like the ENTRA1 partnership.

If major energy partnerships get you thinking about what’s next, this could be the right moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With so much growth already factored into recent gains and a high-profile pipeline of deals, the key question now is whether NuScale Power remains undervalued or if all that potential is already reflected in the price. Investors are left to wonder if there is still a buying opportunity or if the market has fully priced in future growth.

Most Popular Narrative: 7.2% Undervalued

With NuScale Power closing at $37.91 and the leading narrative implying a fair value of $40.84, the stage is set for a closer look at the bold quantitative assumptions shaping this outlook.

NuScale's involvement in the RoPower 6-module small modular reactor (SMR) power plant in Romania indicates future meaningful revenue and cash flow through its partnership in the Fluor-led Front-End Engineering and Design (FEED) Phase 2. This project enhances NuScale's revenue prospects.

What’s driving this number? Analysts are betting on a profit transformation and significant revenue growth, based on implied margins and future multiples that rival the most aggressive projections in the sector. Hungry for the numbers that make or break this narrative? Find out what powers that premium price expectation in the full story.

Result: Fair Value of $40.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, securing long-term customer contracts and managing supply chain uncertainties could present challenges to the optimistic growth narrative and affect future earnings projections.

Find out about the key risks to this NuScale Power narrative.

Another View: Looking at Book Value

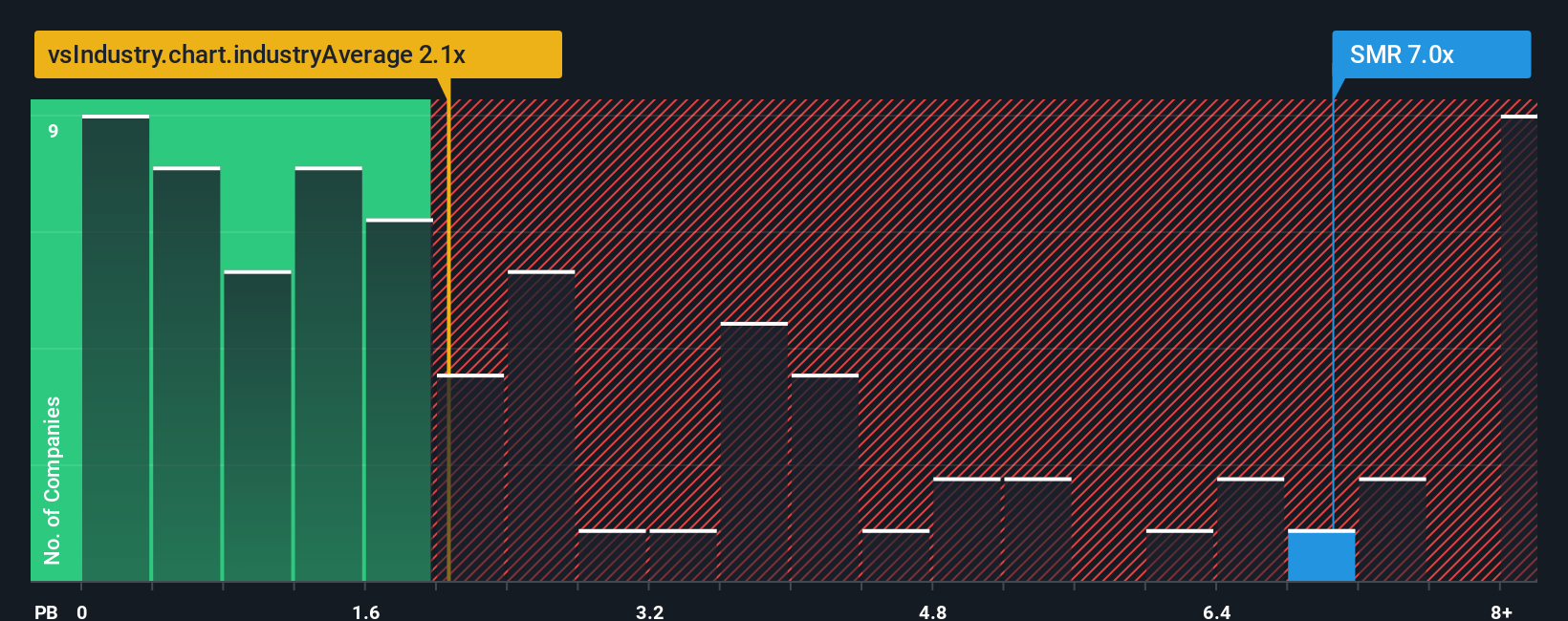

While some see future potential in NuScale Power, its price-to-book ratio stands at 7.3 times. This is much higher than the US Electrical industry average of 2.6 times. Compared to peers as well, NuScale's shares look expensive using this lens, signaling possible valuation risk if expectations change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NuScale Power Narrative

If you have a different perspective or want to shape your own investment thesis, it takes just minutes to craft your personal view, so why not Do it your way?

A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss your chance to tap into fast-moving opportunities. Leverage the power of the Simply Wall Street Screener and target trends before the crowd catches up.

- Maximize your returns with these 842 undervalued stocks based on cash flows that could be trading well below their true worth. This gives you a head start on potential bargains.

- Capitalize on the artificial intelligence boom and seize early growth with these 26 AI penny stocks already transforming industries around the globe.

- Supercharge your portfolio's income by targeting these 20 dividend stocks with yields > 3% offering yields above 3% for strong, consistent cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives