- United States

- /

- Trade Distributors

- /

- NYSE:SITE

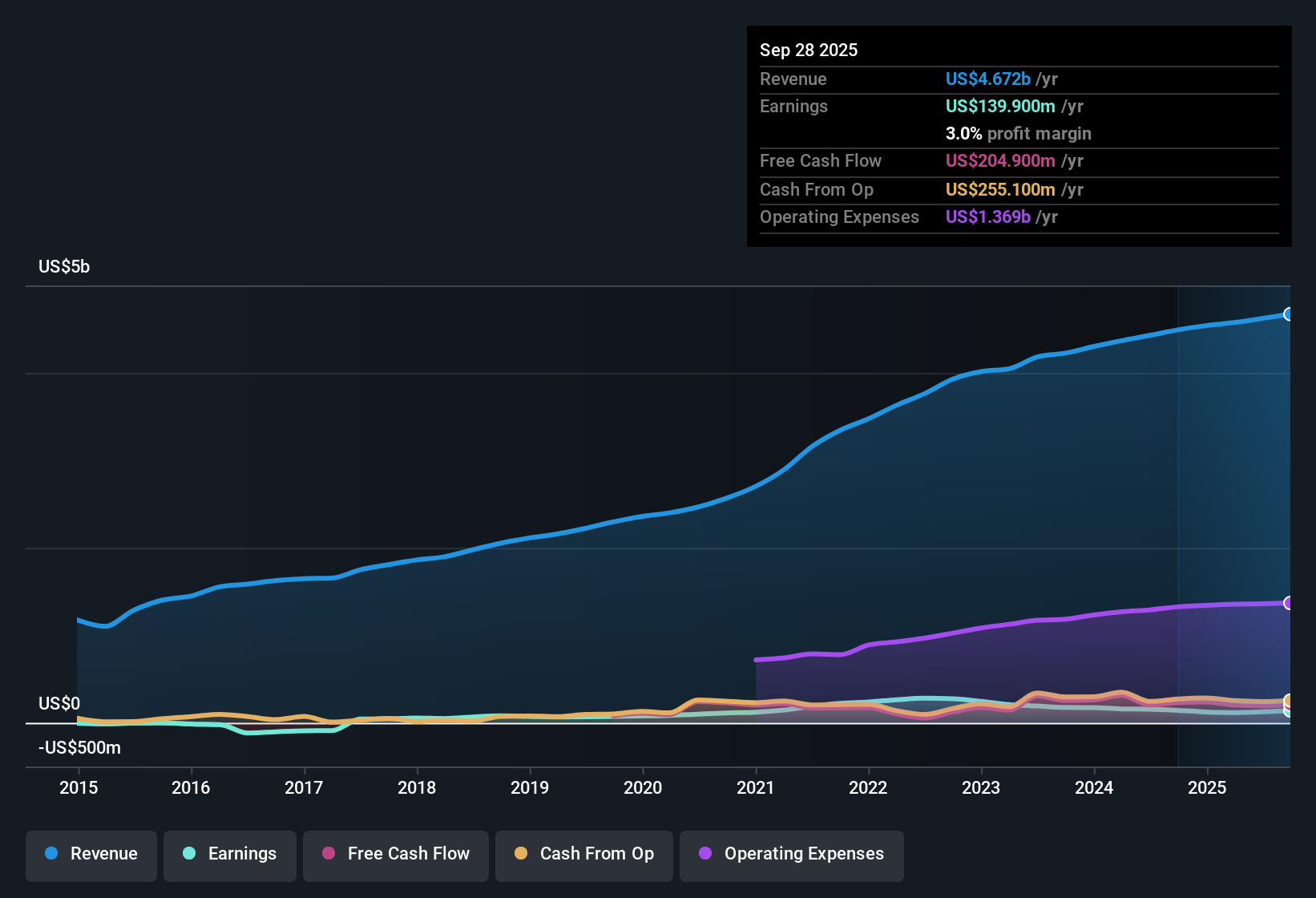

SiteOne Landscape Supply (SITE): Profit Margin Slips to 3%, Challenging Rebound Narrative at High Valuation

Reviewed by Simply Wall St

SiteOne Landscape Supply (SITE) posted a net profit margin of 3%, down from 3.2% a year ago, and has seen average annual earnings decline of 6.5% over the past five years. However, forecasts call for a striking earnings rebound of 21.04% annually, well ahead of the broader US market’s expected 15.7% pace, with revenue set to rise 4.8% per year. As strong profit growth forecasts clash with a premium valuation, investors appear to be weighing optimism about the turnaround potential against a price-to-earnings multiple of 41.4x, which is notably higher than industry benchmarks.

See our full analysis for SiteOne Landscape Supply.Next, we’ll see how these numbers fit the dominant narratives around SITE, highlighting where the facts reinforce expectations and where they set up a debate.

See what the community is saying about SiteOne Landscape Supply

Analysts See Margin Jump to 5.0% by 2028

- Profit margins are expected to rise from 2.7% today to 5.0% within three years, more than reversing recent years’ declines and suggesting improving profitability even as revenue growth slows.

- Analysts’ consensus view highlights two drivers:

- Expansion into private label brands and a continued digital push have already achieved over 30% growth in product lines like Pro-Trade and Solstice Stone, directly supporting the profit margin upgrade scenario.

- Still, the company is banking heavily on operational improvements and strategic acquisitions to deliver margin gains. If integration or cost control stumbles, the path to 5.0% could fall short of consensus optimism.

Acquisition Growth Faces Integration Risk

- SiteOne’s strategy of acquiring smaller, high-margin businesses in a fragmented market is key to its growth playbook, but analysts note this increased reliance could expose margins and future returns if synergy or integration efforts disappoint.

- Bears caution that:

- While previous acquisitions have helped diversify revenue streams and boost gross margin, a lighter pipeline of large deals pushes the company toward smaller, potentially harder-to-integrate targets, raising the odds of execution risks ahead.

- Exposure to cyclical end markets like new residential construction, held back by high rates and soft housing demand, may compound the challenge, especially if acquisition-led growth cannot offset sectoral headwinds.

Trading at a 32% Premium to DCF Fair Value

- With shares priced at $129.73, SITE trades about 32% above its DCF fair value of $97.97, and its 41.4x price-to-earnings ratio remains well above the US Trade Distributors industry average of 22x and peer average of 16x.

- The analysts' consensus view is that:

- The share price sits just 1.7% below the consensus analyst target price of $156.40, indicating limited short-term upside after a strong rally, but also suggesting little market expectation of a steep pullback, given the positive forecast for profit margins and earnings growth.

- This premium valuation makes the stock vulnerable to any disappointment in margin improvement or acquisition performance. This could bring shares closer to the DCF fair value and industry multiple rather than supporting a further move upward.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SiteOne Landscape Supply on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on the numbers? Share your interpretation and shape the story in just a few minutes by clicking Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SiteOne Landscape Supply.

See What Else Is Out There

Despite upbeat growth forecasts, SiteOne’s high valuation and profit margin reliance expose investors to downside risk if operating improvements or acquisitions fall short.

If you’d prefer potential upside without the overvaluation risk and premium pricing, focus on these 848 undervalued stocks based on cash flows to uncover stocks trading below their fair value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SITE

SiteOne Landscape Supply

Engages in the wholesale distribution of landscape supplies in the United States and Canada.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives