- United States

- /

- Trade Distributors

- /

- NYSE:SITE

Should Investors Reconsider SiteOne After a 17.5% Drop and Shifting Market Dynamics?

Reviewed by Bailey Pemberton

- Wondering whether SiteOne Landscape Supply stock is truly a bargain, overpriced, or somewhere in between? You are definitely not alone in trying to make sense of what the latest numbers are really saying about its value.

- The stock price has slipped recently, with a 6.0% drop over the past week and a 17.5% decline in the last year. This hints at shifting investor sentiment and potentially new risks or opportunities.

- This downward move has closely followed reports of changing market dynamics within the landscaping supplies sector. Analysts have flagged supply chain updates and competitive shifts among major players. These developments are adding more complexity for anyone tracking SiteOne’s long-term prospects.

- Right now, SiteOne scores a 1 out of 6 on our valuation checks, making it important to look well beyond headline metrics. Let’s walk through different ways to value the company, and stick around for a more insightful, big-picture approach at the end of the article.

SiteOne Landscape Supply scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SiteOne Landscape Supply Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and then discounting those amounts back to today's dollars. This approach aims to answer what SiteOne Landscape Supply is worth based on its ability to generate cash in the future.

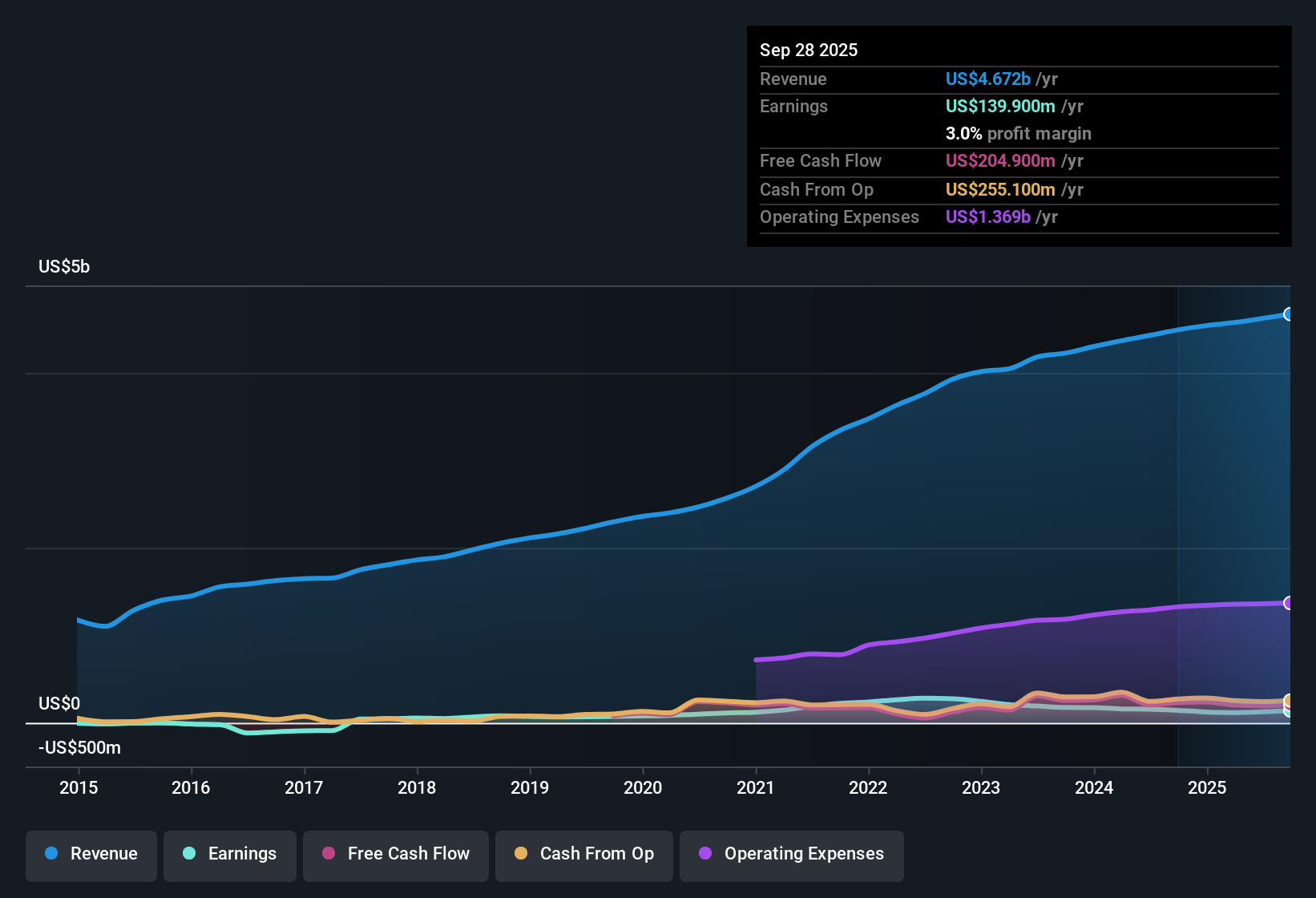

Currently, SiteOne’s Free Cash Flow stands at $209.2 million. Analyst forecasts indicate a moderate pace of growth, with projected Free Cash Flow reaching $291 million by 2035. It is worth noting that analysts provide estimates up to five years out. Figures beyond that are extrapolated to create a long-term picture. All Free Cash Flow values are calculated in U.S. Dollars.

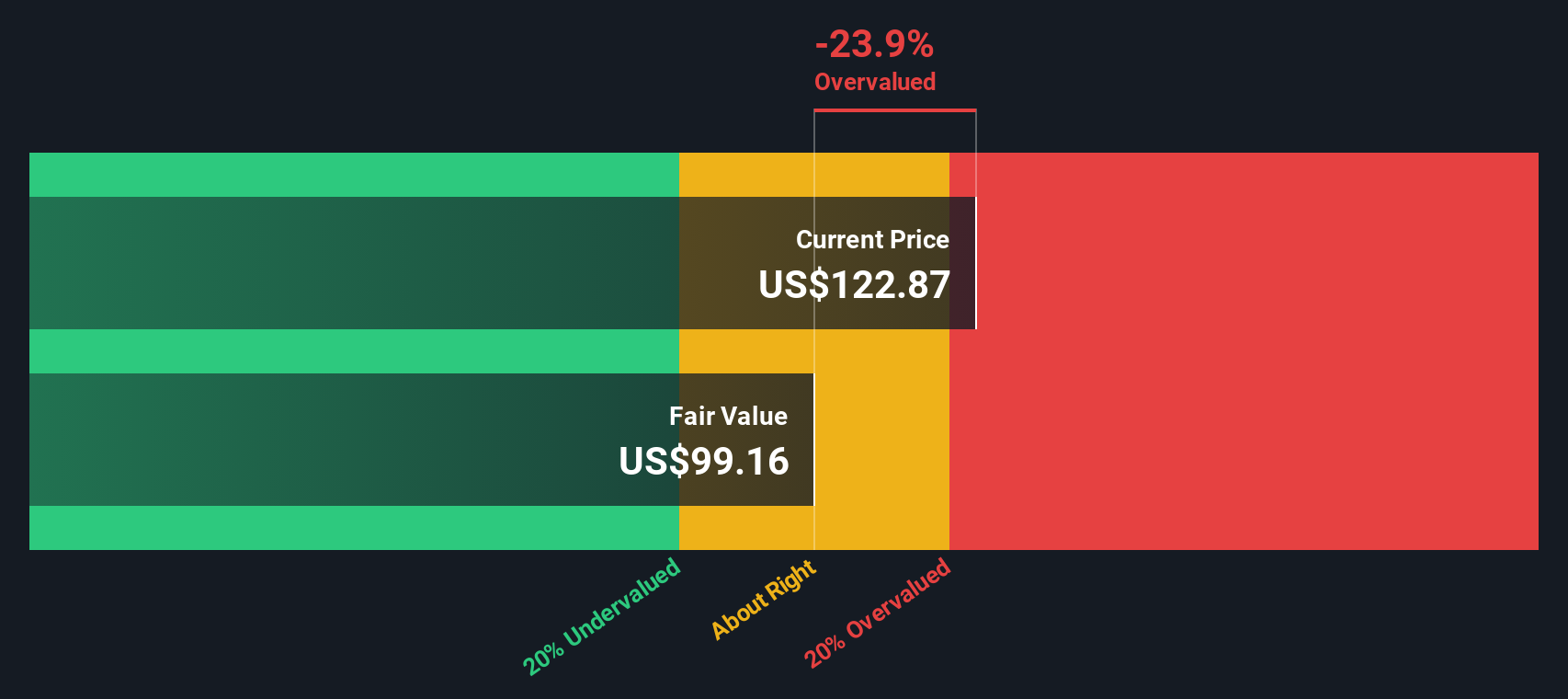

The DCF model applied here arrives at an estimated intrinsic value of $99.91 per share. Compared to recent share prices, this suggests the stock is about 24.3% overvalued based on forecasted cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SiteOne Landscape Supply may be overvalued by 24.3%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SiteOne Landscape Supply Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is an especially relevant metric for valuing profitable companies like SiteOne Landscape Supply because it shows how much investors are willing to pay for each dollar of earnings. It offers a quick gauge of market expectations, particularly for businesses with established revenue and profit streams.

Growth expectations and risks play a central role in shaping a “normal” or “fair” PE ratio. Higher expected earnings growth usually commands a premium and elevates the PE ratio, while greater uncertainty or sector risks can push it downward. Comparing a company’s PE ratio against benchmarks can help reveal whether its stock price reflects future growth or possibly overlooks some risks.

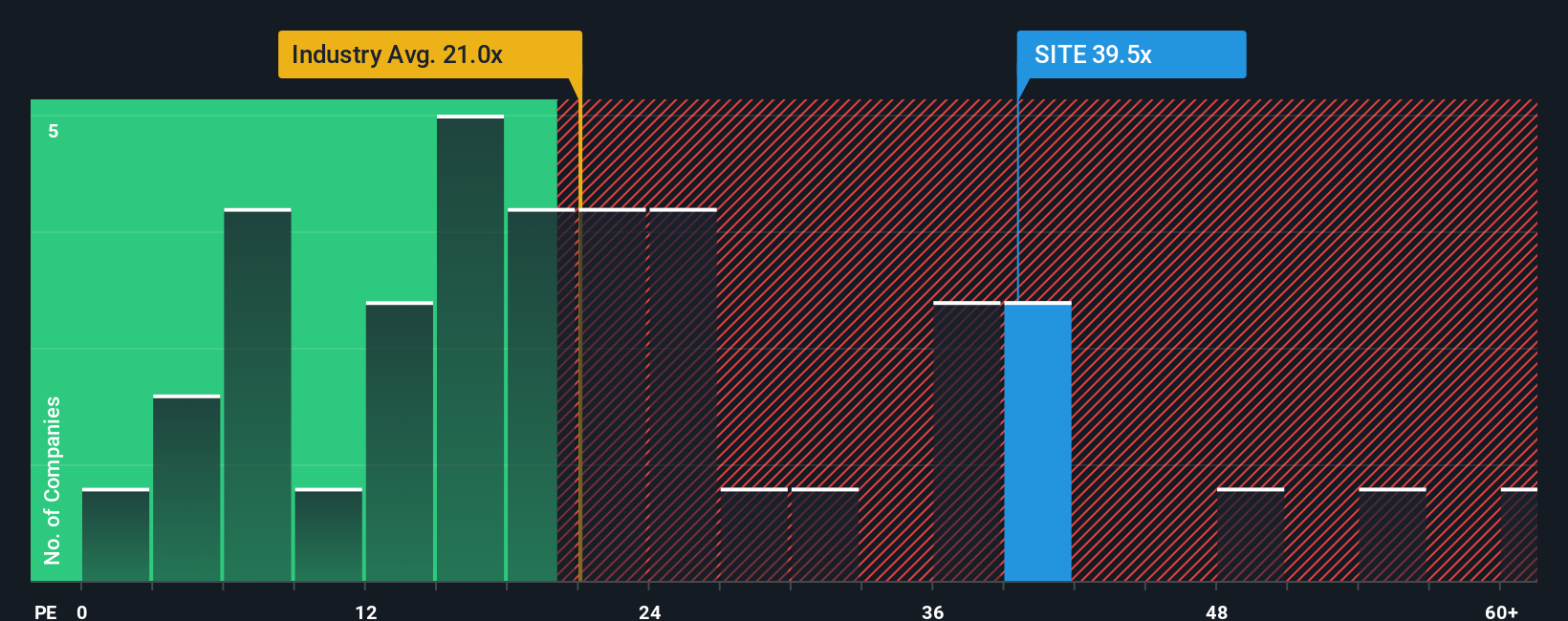

SiteOne currently trades at a PE ratio of 39.5x. For perspective, the average for other Trade Distributors is 21.0x, and the average among close peers sits at 15.7x. At first glance, SiteOne’s multiple is significantly higher than both these reference points.

However, Simply Wall St’s Fair Ratio for SiteOne is 29.6x. This proprietary measure is designed to be more accurate than a straight comparison with peers or industry, since it factors in a wider range of essentials such as future growth potential, profit margins, business risks, the size of the company, and dynamics unique to the industry.

Comparing SiteOne’s actual PE ratio (39.5x) to its Fair Ratio (29.6x) suggests the stock is trading at a premium versus what would typically be warranted by its profile. This indicates that the market may be pricing in more optimism than is supported by fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SiteOne Landscape Supply Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your unique story about SiteOne Landscape Supply, including the assumptions you make about its future, such as how quickly revenue will grow, what profit margins could look like, or how competitive the market may become. Narratives let you link this story directly to a set of financial forecasts and, ultimately, to your own fair value for the stock.

Unlike traditional valuations, Narratives are an accessible feature available on Simply Wall St’s Community page, where millions of investors share and update their perspectives. They make investment decisions much easier by directly connecting your view of SiteOne’s future to its fair value and then comparing that result to the current share price. This process helps you spot when a stock becomes attractive or starts to look risky.

Best of all, Narratives evolve automatically as new data, news, or earnings reports come in, so your thesis is always grounded in the latest reality. For example, one Narrative might forecast steady expansion and robust margins thanks to ongoing acquisitions and digital growth, resulting in a bullish fair value near $185. Conversely, a more cautious view that sees integration risks and environmental headwinds could generate a lower value closer to $106. Narratives reflect real investor perspectives, letting you make smarter decisions with confidence.

Do you think there's more to the story for SiteOne Landscape Supply? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SITE

SiteOne Landscape Supply

Engages in the wholesale distribution of landscape supplies in the United States and Canada.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives