- United States

- /

- Trade Distributors

- /

- NYSE:SITE

A Look at SiteOne Landscape Supply's Valuation After Strong Q3 Profit and Sales Growth (NYSE:SITE)

Reviewed by Simply Wall St

SiteOne Landscape Supply (NYSE:SITE) delivered strong third quarter 2025 results, surprising the market with profit and organic revenue growth above expectations. The company’s sales rose year over year, thanks to improved gross margin and cost controls.

See our latest analysis for SiteOne Landscape Supply.

Shares of SiteOne Landscape Supply surged 10% after the latest earnings beat, reflecting renewed optimism from investors who were encouraged by strong profit growth, solid organic sales, and a series of strategic acquisitions. While the 1-year total shareholder return stands at -8.6%, three-year total returns remain firmly positive at 19%. This signals that momentum is recovering after a softer spell earlier this year and could set the stage for longer-term gains as the business executes on expansion plans.

If this turnaround story has you interested in what else the market has to offer, now's a great time to discover fast growing stocks with high insider ownership.

Yet with the recent rally and analysts keeping targets close to current prices, the question remains: is SiteOne still undervalued after this earnings beat, or is future growth already reflected in the stock price?

Most Popular Narrative: 17% Undervalued

With SiteOne’s fair value estimate pegged at $156.40, which is well above the last close price of $129.77, analyst consensus points to meaningful upside but leans on some ambitious growth projections. Let’s see what is driving this bullish outlook directly from the narrative itself.

"Ongoing acquisition of smaller, high-margin businesses in a fragmented market allows SiteOne to consolidate market share, introduce higher-margin products, and leverage operational synergies, leading to long-term revenue growth and potential margin expansion."

Want to know the real fuel behind this target? The most popular narrative hinges on a leap in sales, expanding profits, and an aggressive future earnings multiple. Which precise trends and forecasts are making bulls bet big on SiteOne's future? You’ll need to read the full narrative for the inside details.

Result: Fair Value of $156.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro headwinds and tougher competition could pressure SiteOne’s margins and growth outlook if demand weakens or if pricing power erodes further.

Find out about the key risks to this SiteOne Landscape Supply narrative.

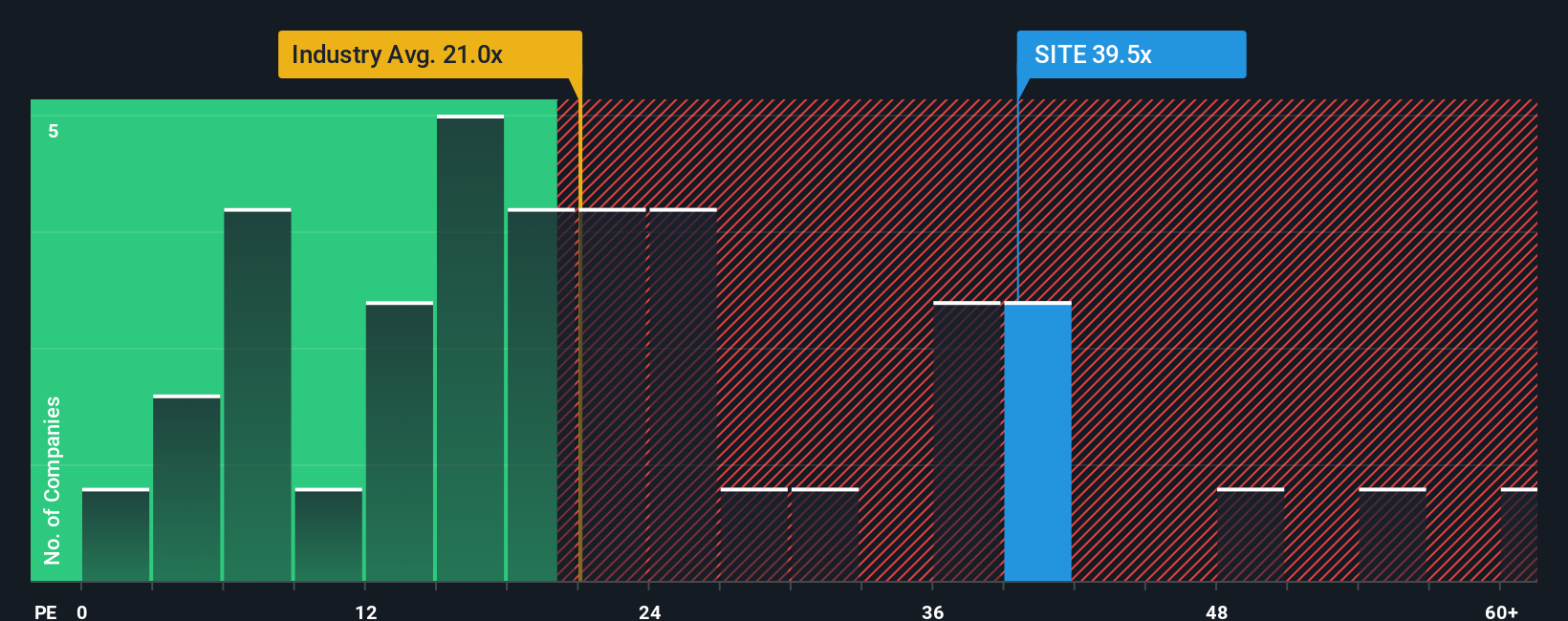

Another View: Challenging the Upside

While the popular analyst consensus sees SiteOne as undervalued, a closer look at its price-to-earnings ratio paints a much tougher picture. SiteOne trades at 41.3 times earnings, which is sharply higher than both its industry average of 21.9x and the wider peer group at 15.9x. Even the fair ratio for SiteOne is calculated at a much lower 29.9x. This suggests that the market could easily pull back if growth expectations are not met. So which side of the valuation debate will win out first?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiteOne Landscape Supply Narrative

If you have a different perspective or want to investigate the numbers for yourself, you can build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SiteOne Landscape Supply.

Looking for more investment ideas?

Act fast and uncover the market’s hidden gems. Use Simply Wall Street’s screeners to tap into strategies that others may overlook and supercharge your investing journey today.

- Capitalize on undervalued opportunities before others catch on by examining these 832 undervalued stocks based on cash flows, which offers attractive price-to-cash flow potential.

- Claim your edge in artificial intelligence innovation by assessing these 26 AI penny stocks, a selection at the forefront of smart automation and disruptive growth.

- Enjoy the potential of reliable income streams by checking out these 22 dividend stocks with yields > 3%, featuring yields above 3% for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SITE

SiteOne Landscape Supply

Engages in the wholesale distribution of landscape supplies in the United States and Canada.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives