- United States

- /

- Aerospace & Defense

- /

- NYSE:SARO

A Look at StandardAero's Valuation Following Strong Q3 Earnings and Upgraded 2025 Outlook

Reviewed by Simply Wall St

StandardAero (NYSE:SARO) turned heads this week after posting impressive year-over-year gains in both sales and net income for the third quarter of 2025. The company also raised its full-year revenue forecast, citing growing confidence in its ongoing performance.

See our latest analysis for StandardAero.

After a strong earnings update and news of a major facility expansion supporting aerospace engines, StandardAero's momentum is getting attention. The company's latest moves follow the milestone delivery of its 1,000th GE J85-5 engine to the U.S. Air Force. Even so, the 1-year total shareholder return sits at -11.7%, reflecting the market's shifting expectations. The latest figures hint at renewed interest and possible recovery.

If you're interested in where the next breakout might come from in aerospace and defense, this is an ideal time to discover See the full list for free.

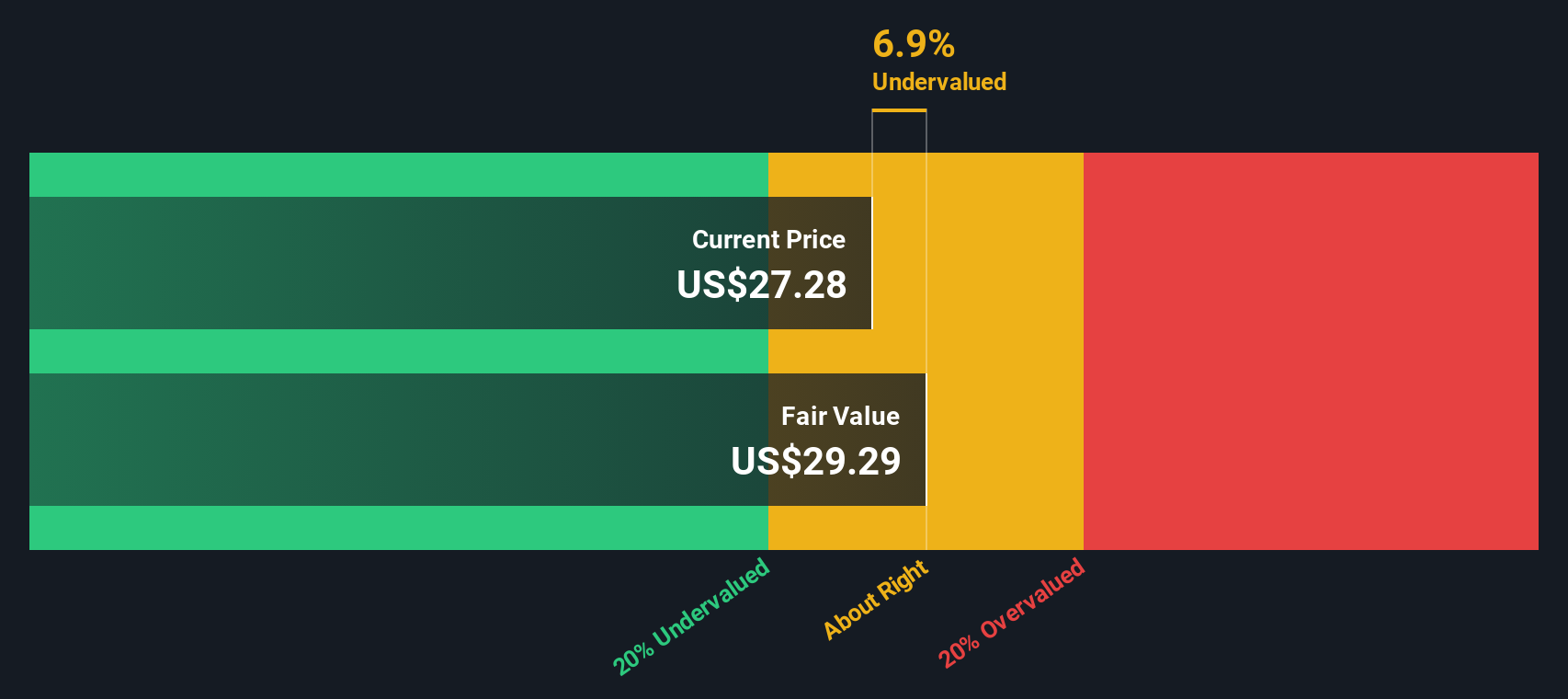

With shares still well below analyst targets despite rising profits and upgraded guidance, the key question is whether StandardAero remains undervalued or if investors are already factoring in its next wave of growth.

Price-to-Earnings of 45.6x: Is it justified?

StandardAero trades at a price-to-earnings (P/E) ratio of 45.6x, well above both its industry peers and our fair value benchmarks, despite recent profit growth and upgraded forecasts.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. In sectors like Aerospace and Defense, it often reflects expectations of future growth, stability, or premium positioning. For StandardAero, this high ratio suggests investors are pricing in major future gains, but it can also mean the stock is vulnerable if those gains do not materialize.

Compared to the US Aerospace & Defense industry average P/E of 36x and a fair P/E estimate of 33.8x, StandardAero looks particularly expensive. The current pricing indicates the market may be overestimating near-term growth potential rather than aligning with underlying fundamentals or historical sector norms.

Explore the SWS fair ratio for StandardAero

Result: Price-to-Earnings of 45.6x (OVERVALUED)

However, slowing 30-day and 90-day returns as well as a persistent disconnect from analyst price targets may challenge the bullish thesis in the near term.

Find out about the key risks to this StandardAero narrative.

Another View: Discounted Cash Flow Perspective

Looking beyond price-to-earnings, the SWS DCF model estimates StandardAero’s fair value at $29.85, which is about 15.6% above its current share price of $25.19. This discount could point to an undervalued opportunity if growth projections hold up. However, is the DCF outlook too optimistic, or is the market wary for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StandardAero for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StandardAero Narrative

If you see things differently or want a fresh perspective, dive into the data yourself and shape your own informed view of StandardAero in just minutes, Do it your way

A great starting point for your StandardAero research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your options. Take charge of your next move by checking out screened opportunities designed to match bold strategies and fresh trends right now.

- Boost your portfolio with steady income streams as you browse these 15 dividend stocks with yields > 3% boasting yields over 3% for reliable returns.

- Catalyze your investments by following these 26 AI penny stocks at the forefront of artificial intelligence innovation and market momentum.

- Enhance your value-hunting skills and pinpoint potential bargains among these 897 undervalued stocks based on cash flows based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SARO

StandardAero

Provides aerospace engine aftermarket services for fixed and rotary wing aircraft in the United States, Canada, the United Kingdom, Rest of Europe, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives