- United States

- /

- Machinery

- /

- NYSE:REVG

REV Group (REVG): Examining Valuation After Strong Multi-Year Shareholder Returns

Reviewed by Simply Wall St

See our latest analysis for REV Group.

REV Group’s one-year share price return has been impressive, but what really stands out is its total shareholder return of 70.48% over the last year. This adds to a remarkable 348.85% return over three years. This strong run suggests that recent momentum and stronger fundamentals are encouraging more investors to pay attention, even as the latest price cooled slightly.

If you’re curious where else strong momentum might be building, it’s a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With this run of strong returns and a recent price pullback, investors are asking whether REV Group is trading below its true value or if the market has already priced in all the expected growth. Could this be the next buying opportunity?

Most Popular Narrative: 16.9% Undervalued

REV Group's most popular valuation narrative sets a fair value notably above the last market close, suggesting there could still be meaningful upside. With the current share price well below the fair value estimate, this perspective emphasizes forward-looking, earnings-driven potential.

Continued operational investments, such as the Spartan Emergency Response facility expansion, enhance production capacity and efficiency. This positions REV Group to capitalize on sustained municipal demand for fire and emergency vehicles as aging fleets require replacement, supporting long-term revenue growth and scale-driven margin improvements. Elevated focus on manufacturing throughput and process innovation enables REV Group to reduce lead times and cycle times. This provides a competitive edge to capture consistent government and institutional orders, especially as urbanization and municipal infrastructure investments underpin a secular increase in specialty vehicle demand. These factors positively impact both revenue visibility and net margins.

What is really powering this bold valuation? Massive investments in efficiency and a strategic edge in specialty vehicles. The real story is in how analysts are projecting future profit margins and growth assumptions unseen by most investors. Unlock the logic driving this optimistic price target; these numbers might surprise you.

Result: Fair Value of $62.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or a stalled merger could impact REV Group’s future margins and cast doubt on the positive outlook presented by analysts.

Find out about the key risks to this REV Group narrative.

Another View: What Do the Numbers Say?

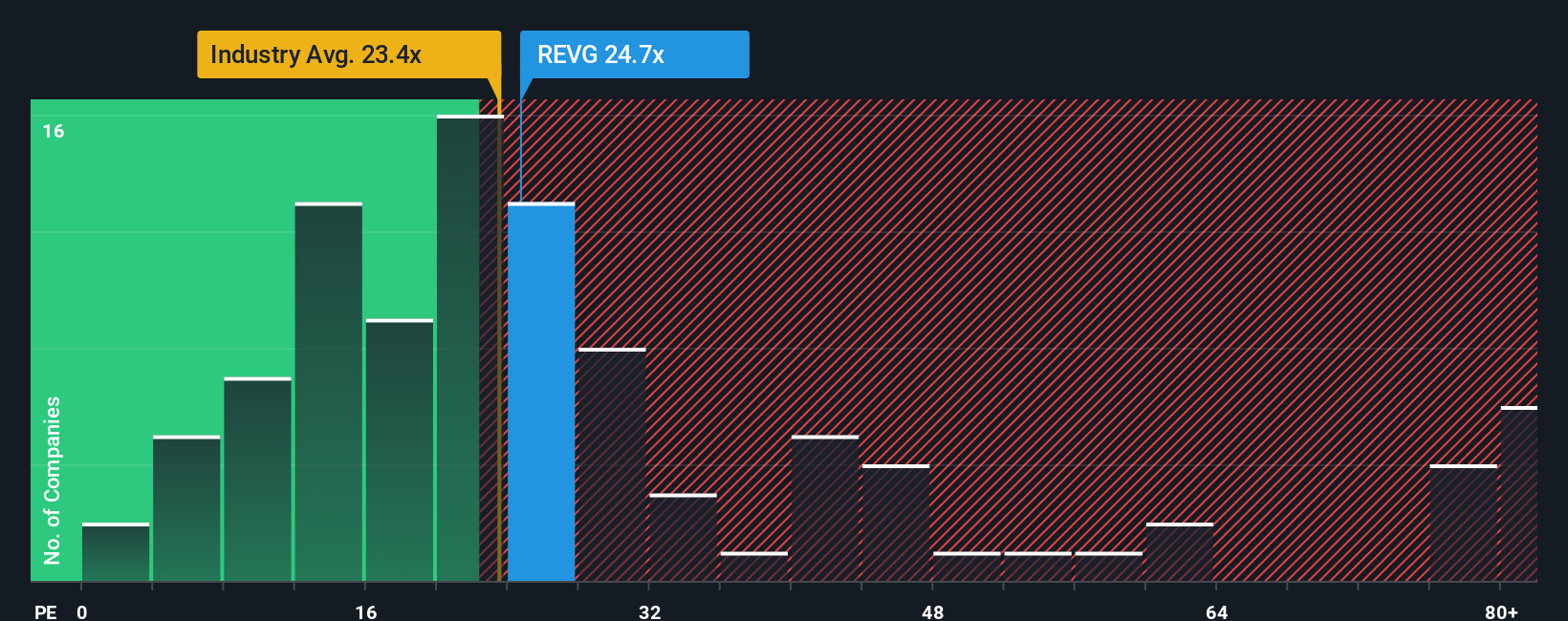

While analyst projections paint an optimistic picture for REV Group, a look at the price-to-earnings ratio shows a more complex story. At 23.6 times earnings, the company is valued higher than its peer average of 16.3 times, but still just below the Machinery industry average of 24.1 times. Compared to a fair ratio of 28.1, there might still be some room for the market to catch up, though not without valuation risk if profits disappoint. Is the premium justified, or is it a warning to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own REV Group Narrative

If you see things differently or want to chart your own course through the numbers, you can dig into the data and build a narrative of your own in just a few minutes. Do it your way

A great starting point for your REV Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by acting now and don’t let these standout investment opportunities pass you by when you can leverage the Simply Wall Street Screener for an edge.

- Capture outsized gains by targeting hidden gems; start with these 3585 penny stocks with strong financials fueling the next wave of growth stories.

- Boost your income stream with reliable returns by scanning these 16 dividend stocks with yields > 3% offering yields above 3% from established businesses with stable cash flows.

- Position yourself ahead of market trends with these 25 AI penny stocks tapping into the explosive innovation powering artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REVG

REV Group

Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives