- United States

- /

- Machinery

- /

- NYSE:RBC

The Bull Case For RBC Bearings (RBC) Could Change Following Record Backlog and Surging Aerospace Demand

Reviewed by Sasha Jovanovic

- RBC Bearings recently reported fiscal second quarter 2026 results, highlighting strong year-over-year revenue and net income growth, primarily driven by exceptional performance in its Aerospace and Defense segment and continued order momentum.

- Management emphasized record backlogs, with customer demand from submarine and aircraft engine programs supporting capacity expansion and long-term contract visibility.

- We'll explore how this record backlog and robust Aerospace and Defense demand impact RBC Bearings' investment narrative and future opportunities.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

RBC Bearings Investment Narrative Recap

For RBC Bearings shareholders, the core investment case centers on sustained growth powered by a record backlog and surging demand in Aerospace and Defense, creating strong near-term revenue visibility. The latest earnings report, with robust sales and order momentum, reinforces this catalyst, while the biggest immediate risk remains any disruption in specialty alloy supply chains, a factor that could quickly impact production and execution. The recent news does not materially alter these near-term drivers.

The company's updated earnings guidance for the third quarter, projecting net sales between US$454.0 million and US$462.0 million, about 15 to 17 percent higher year-over-year, directly supports the short-term growth thesis fueled by ongoing Aerospace and Defense strength. This clear outlook keeps attention focused on whether RBC Bearings can execute on its backlog and manage operational bottlenecks as demand accelerates.

However, investors should also be aware that supply chain vulnerabilities could still create unexpected challenges if...

Read the full narrative on RBC Bearings (it's free!)

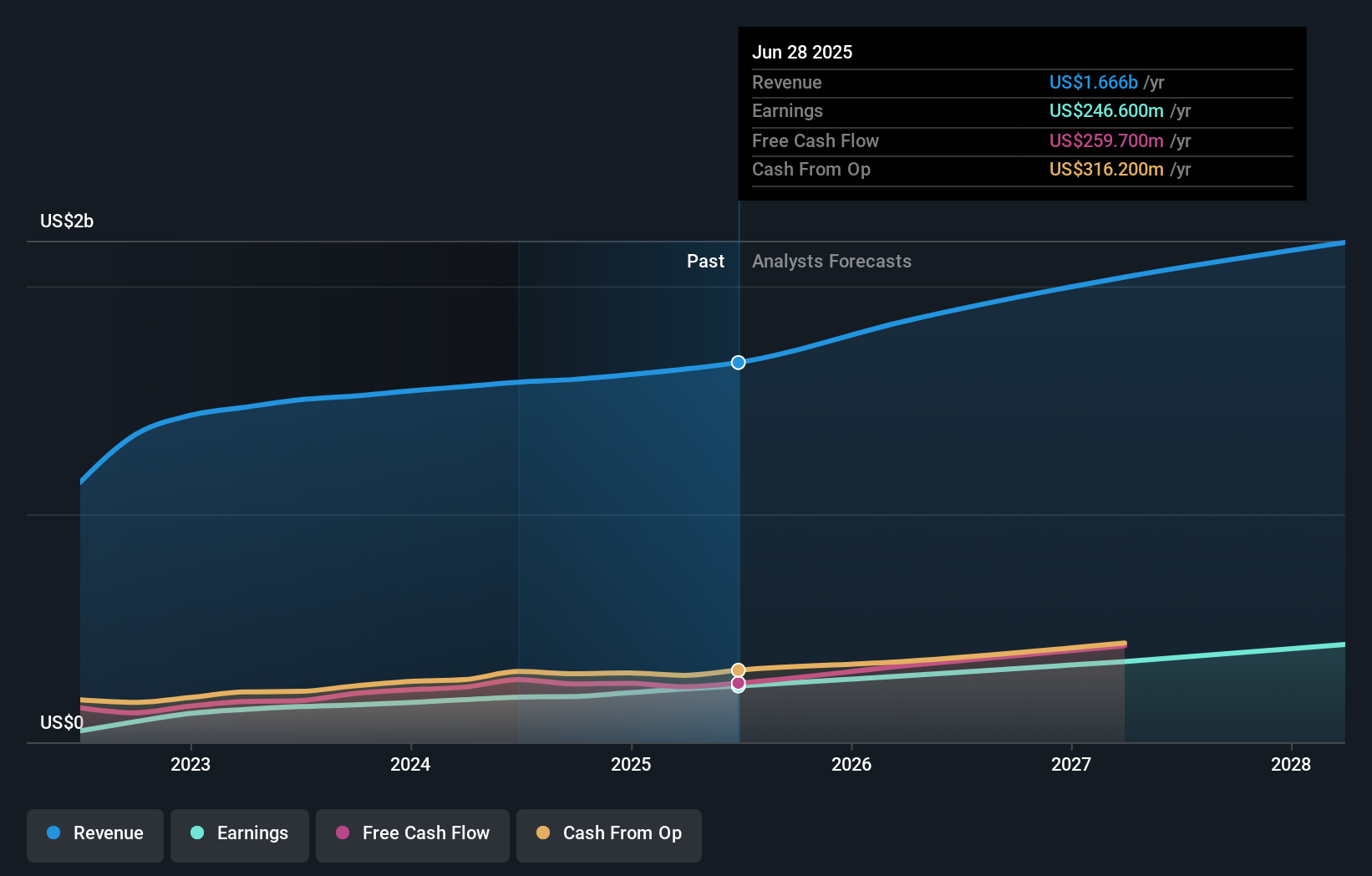

RBC Bearings' narrative projects $2.3 billion revenue and $445.8 million earnings by 2028. This requires 11.1% yearly revenue growth and a $199.2 million earnings increase from $246.6 million today.

Uncover how RBC Bearings' forecasts yield a $458.17 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced two fair value estimates for RBC Bearings, ranging widely from US$312.20 to US$458.17 per share. While many see growth ahead in Aerospace and Defense, the potential for supply chain disruptions could influence actual results, so it pays to consider these diverse viewpoints.

Explore 2 other fair value estimates on RBC Bearings - why the stock might be worth as much as 6% more than the current price!

Build Your Own RBC Bearings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RBC Bearings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free RBC Bearings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RBC Bearings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives