- United States

- /

- Machinery

- /

- NYSE:RBC

Can RBC Bearings Sustain Its Momentum After Recent Stock Rally in 2025?

Reviewed by Bailey Pemberton

If you’re holding shares of RBC Bearings, or thinking about jumping in, chances are you’re watching those price swings and wondering: is there more gas in the tank, or is it time to tap the brakes? Even with a minor dip of -2.6% in the past week and -3.4% over the past month, the stock is still up an impressive 25.7% year-to-date. Zoom out to a wider lens, and that momentum looks even stronger with returns of 30.6% over a year, 72.8% over three years, and a whopping 193.1% over five years, signaling this company has been on quite a run.

Lately, several market developments have kept the spotlight on RBC Bearings, especially as investors grow more selective amid shifting sector trends. Not every news headline packs the same punch, but these broader currents help set the stage for the next big move in the stock’s story.

The million-dollar question now is valuation. On the surface, RBC Bearings has a value score of 1, which means it’s considered undervalued by just 1 out of 6 key valuation checks. That might not scream “bargain,” but we’ll dig deeper into what that means for your investment decision. Next, let’s break down the valuation approaches to see how RBC Bearings stacks up, and stick with me to the end for a smarter, fuller perspective on what valuation really means in this context.

RBC Bearings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: RBC Bearings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a stock’s intrinsic value by forecasting a company’s future cash flows and discounting them back to today’s dollars. This method focuses on how much cash the business is likely to generate for shareholders in years to come.

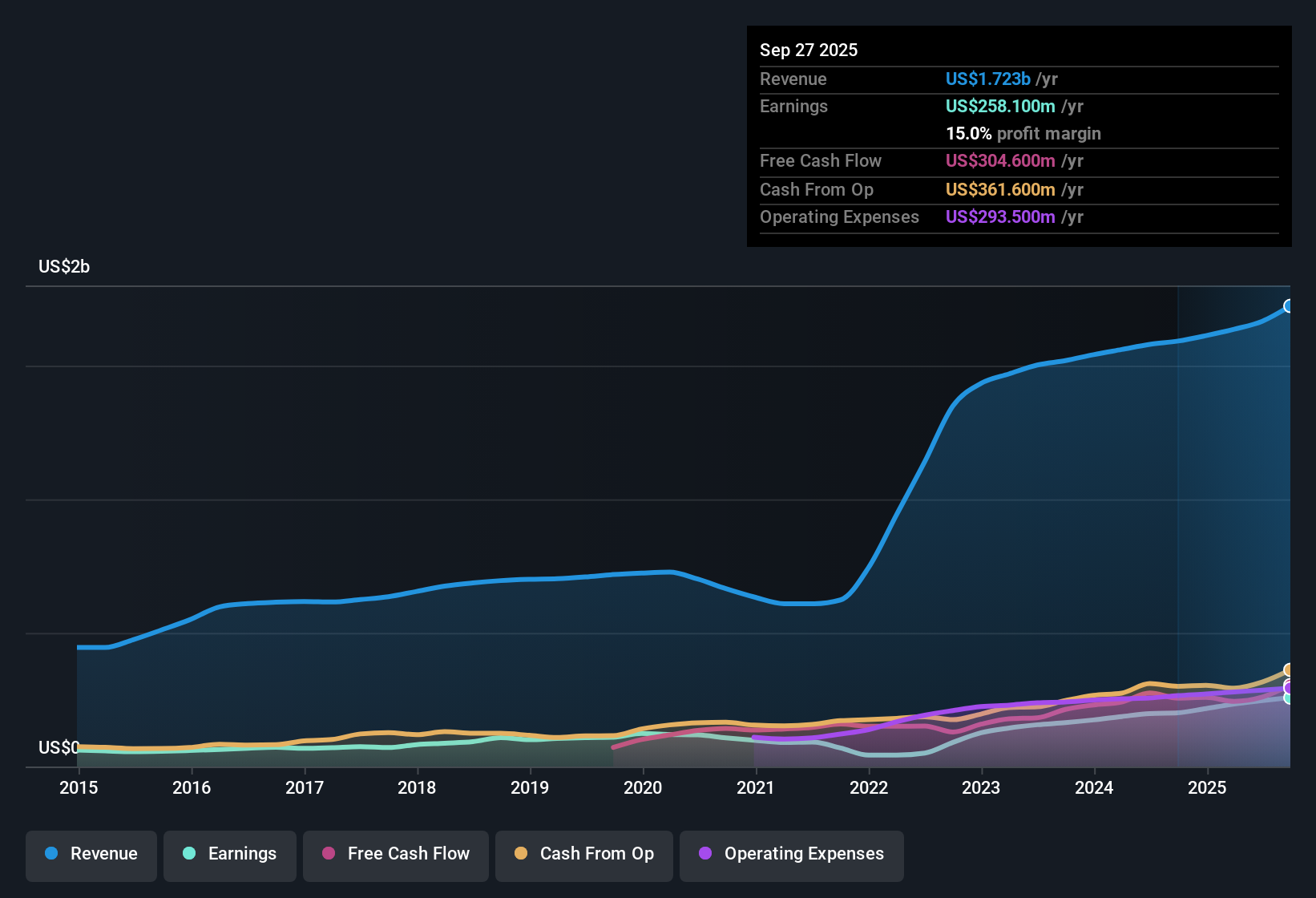

For RBC Bearings, current free cash flow stands at $269.6 Million, with projections reflecting steady growth ahead. By 2027, free cash flow is expected to reach $423.2 Million, based on analyst data. Although analysts forecast out only a few years, Simply Wall St extrapolates that free cash flow could climb to roughly $739.2 Million by 2035, with steadily increasing annual estimates along the way.

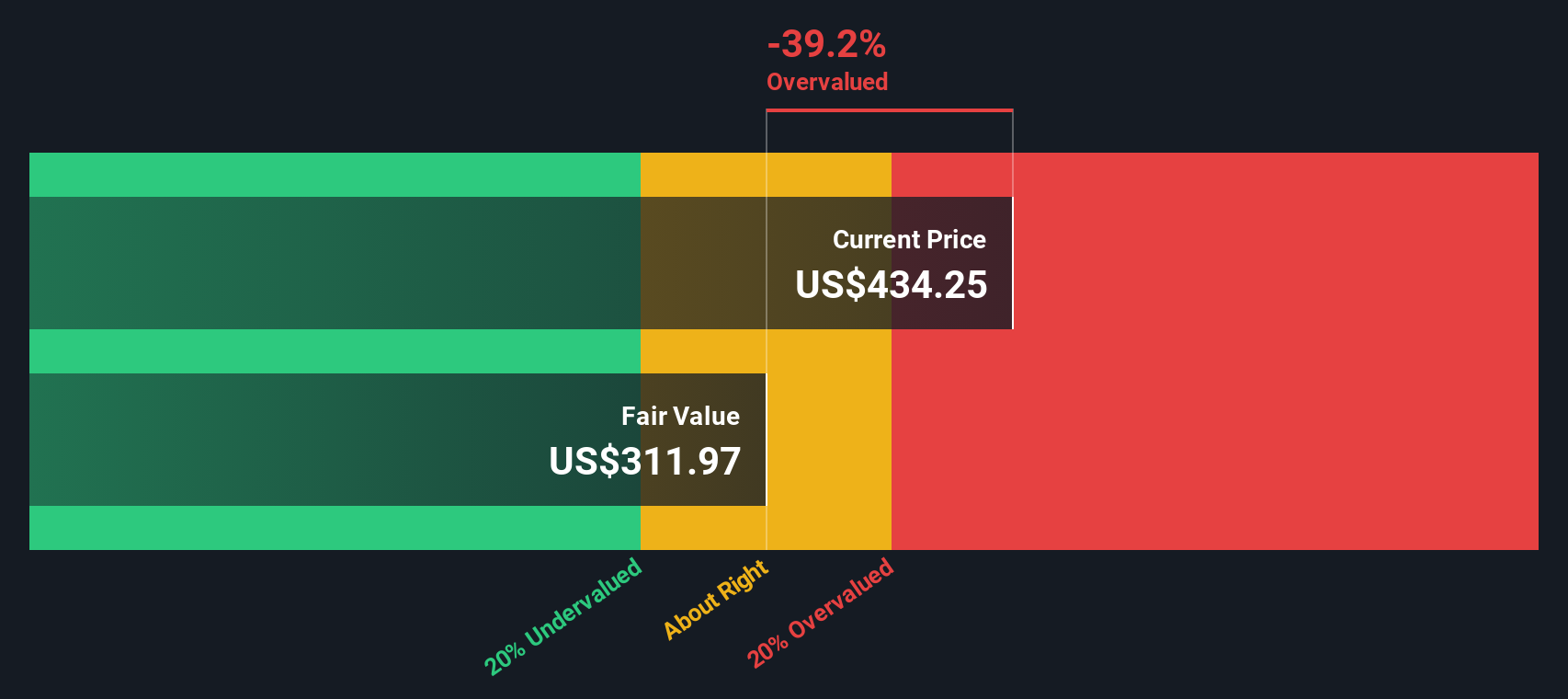

After running these projections through a DCF model (using a two-stage Free Cash Flow to Equity approach), the resulting intrinsic value lands at $329.43 per share. This price represents a 13.7% premium compared to the current market value. According to this model, RBC Bearings stock is somewhat overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests RBC Bearings may be overvalued by 13.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: RBC Bearings Price vs Earnings

For profitable companies like RBC Bearings, the price-to-earnings (PE) ratio is a widely used way to judge valuation because it directly ties a company’s worth to how much profit it produces. Investors tend to pay more for each dollar of profit when they expect strong growth or see the business as relatively low risk. In contrast, sluggish earnings or higher risk will usually drag the "normal" PE ratio lower.

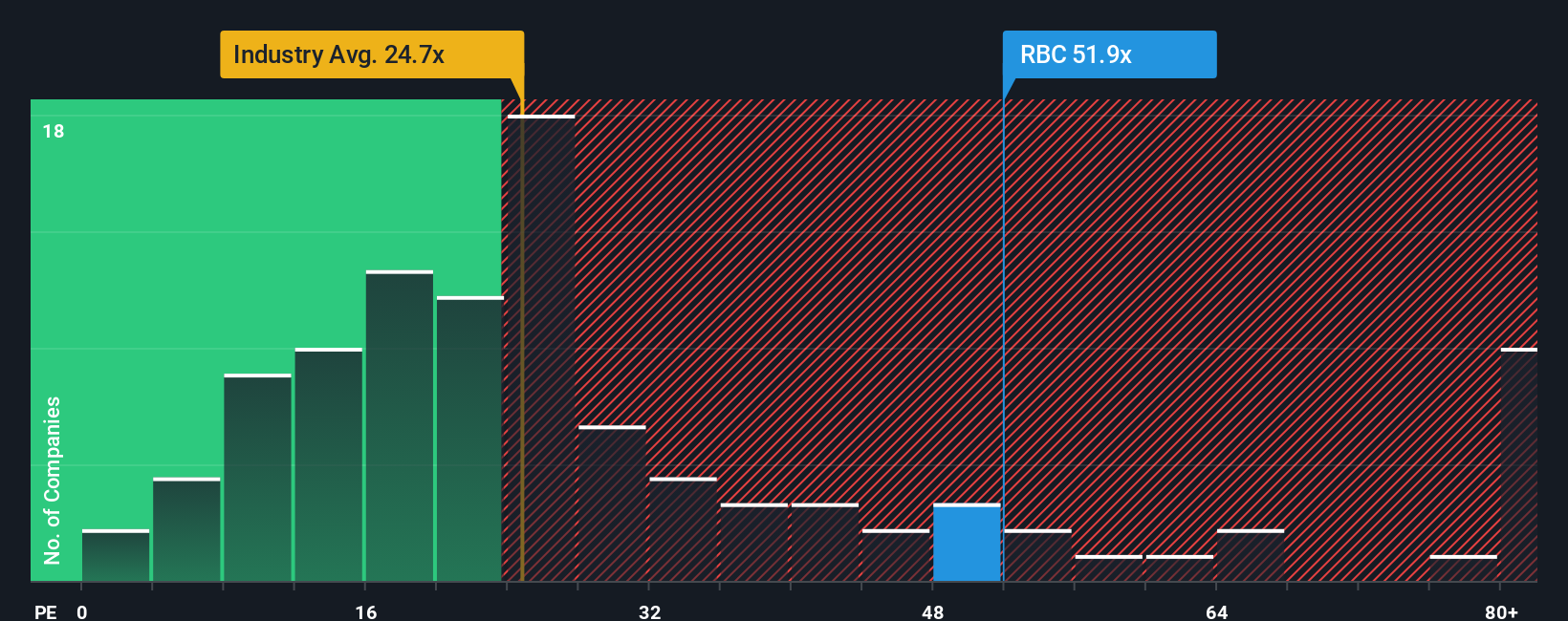

Currently, RBC Bearings trades at a lofty 47.7x PE ratio, which is well above the industry average of 24.1x and the typical peer at 27.2x. At first glance, that kind of premium suggests the market has high expectations for RBC’s future, but it raises a flag when compared to its machinery sector peers.

This is where Simply Wall St's “Fair Ratio” comes in. Unlike simple comparisons with peers or industry averages, the Fair Ratio reflects what you would expect to pay after considering RBC Bearings’ growth profile, profit margins, market cap, and risk factors. For RBC Bearings, the Fair Ratio is 28.2x, making it a tailored benchmark that adjusts for traits unique to the company.

Since the current PE ratio (47.7x) is significantly higher than the Fair Ratio (28.2x), the stock looks overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your RBC Bearings Narrative

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story and perspective about a company, connecting your assumptions about future revenue, earnings, and margins to your own fair value estimate.

Narratives let you bring together what you know and believe about RBC Bearings, whether that's bullishness about defense spending, concern over supply chain risks, or optimism about margin expansion, and see those beliefs reflected in calculated fair values based on your financial forecasts.

This approach links a company’s real-world story directly to your financial outlook, making the investment process more dynamic and relevant to you. On Simply Wall St's platform, Narratives are easy to create and available to millions of investors right within the Community page, serving as both inspiration and reference for your own decisions.

With Narratives, you can instantly see whether your personal fair value suggests buy, hold, or sell by comparing it with the current share price. These Narratives update automatically whenever new news or earnings come out, keeping your estimates and the shared community perspectives fresh.

For example, RBC Bearings’ Community Narratives currently range from a bullish $500 price target, reflecting high confidence in defense-driven growth, down to a more cautious $425, highlighting margin and supply chain risks. The choice of Narrative is yours, and it has never been easier to see your investment story turned into actionable numbers.

Do you think there's more to the story for RBC Bearings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives