- United States

- /

- Construction

- /

- NYSE:PWR

How a 10 Percent Dividend Hike at Quanta Services (PWR) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Quanta Services announced on November 18, 2025, that its Board of Directors approved a quarterly cash dividend increase to US$0.11 per share, payable on January 12, 2026, to shareholders of record as of January 2, 2026.

- This approximately 10% dividend increase highlights the company’s continued focus on shareholder returns and signals management’s confidence in its financial outlook.

- We’ll explore how this dividend boost underscores Quanta Services’ capital return priorities and what it could mean for the company’s investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Quanta Services Investment Narrative Recap

Quanta Services appeals to investors who see long-term value in infrastructure expansion, driven by the electrification of the economy, renewable energy, and grid modernization. While the new dividend increase to US$0.11 per share may reinforce confidence in capital returns, it does not materially affect the most immediate risk, successful integration of recent acquisitions and associated margin pressures, or the main catalyst, which remains robust backlog conversion amid strong power demand trends.

Among recent announcements, Quanta’s long-term agreements with American Electric Power, supporting a significant US$72 billion capital plan, stand out as most relevant. This partnership further strengthens Quanta’s project pipeline and ties directly to the same secular trends underpinning its investment case, notably the large-scale utility and transmission build-outs that remain key near-term catalysts for backlog growth.

Yet, despite the upbeat news, investors should not overlook the heightened risk that comes from complex acquisition integration, where...

Read the full narrative on Quanta Services (it's free!)

Quanta Services' narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028. This requires 12.9% yearly revenue growth and a $728 million earnings increase from $971.8 million today.

Uncover how Quanta Services' forecasts yield a $472.80 fair value, a 10% upside to its current price.

Exploring Other Perspectives

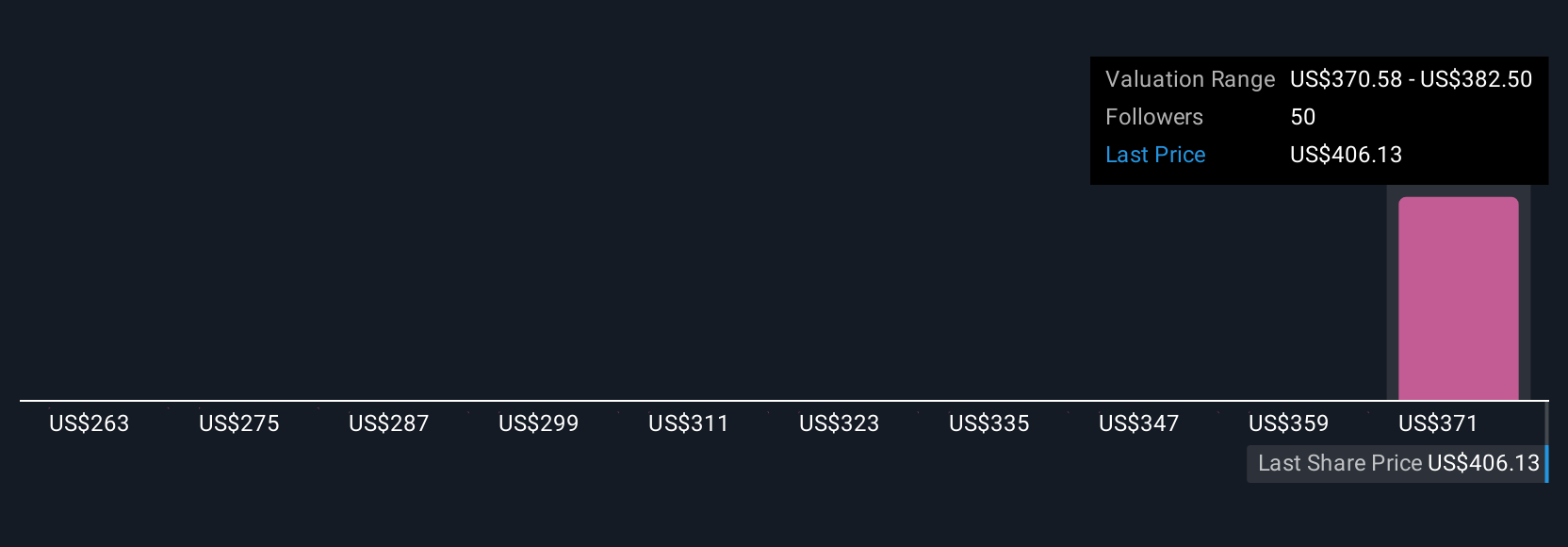

Four Simply Wall St Community fair value estimates for Quanta Services range widely from US$263 to US$473 per share. With views differing significantly, consider how acquisition integration risks could influence future performance and compare several perspectives for a fuller picture.

Explore 4 other fair value estimates on Quanta Services - why the stock might be worth as much as 10% more than the current price!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives