- United States

- /

- Machinery

- /

- NYSE:PRLB

Will Proto Labs' (PRLB) New Certified Raleigh Plant Redefine Its Role in High-Regulation Manufacturing?

Reviewed by Sasha Jovanovic

- Earlier this month, Proto Labs significantly expanded its U.S. manufacturing capacity by opening a 120,000 sq. ft. Raleigh facility dedicated to direct metal laser sintering, featuring nearly 40 advanced printers and annual production capability of more than 96,000 parts.

- The company also achieved ISO 13485 and AS9100D certifications at this site, widening its reach into high-regulation sectors such as medical devices, aerospace, and defense, and signaling a deeper commitment to precision manufacturing.

- We'll examine how the new certifications and enhanced production scale could influence Proto Labs' broader investment case and sector positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Proto Labs Investment Narrative Recap

To believe in Proto Labs as a shareholder right now, you’d likely need confidence that the company can drive long-term growth through specialty manufacturing for highly regulated sectors, especially as mass customization and digital workflows gain traction. The latest expansion in direct metal laser sintering and new industry certifications could bolster near-term momentum in medical devices and aerospace, but the most pressing risk, customer concentration in Aerospace & Defense, remains, as just one large lost contract could weigh heavily despite these wins.

Among recent company news, the October launch of advanced CNC machining features ties directly to growing aerospace and defense demand. Like the Raleigh facility, this upgrade strengthens Proto Labs’ appeal in sectors requiring high precision, which could amplify production-driven catalysts. Execution in scaling these offerings is crucial if the company wants to convert facility investments into a meaningful step-change in revenue diversity and quality. However, it’s important for investors to note a potential pitfall… Despite ramping U.S. production, customer concentration could still threaten revenue stability if key clients scale back commitments.

Read the full narrative on Proto Labs (it's free!)

Proto Labs' narrative projects $592.3 million revenue and $33.7 million earnings by 2028. This requires 5.2% yearly revenue growth and a $18.9 million earnings increase from $14.8 million today.

Uncover how Proto Labs' forecasts yield a $56.67 fair value, a 16% upside to its current price.

Exploring Other Perspectives

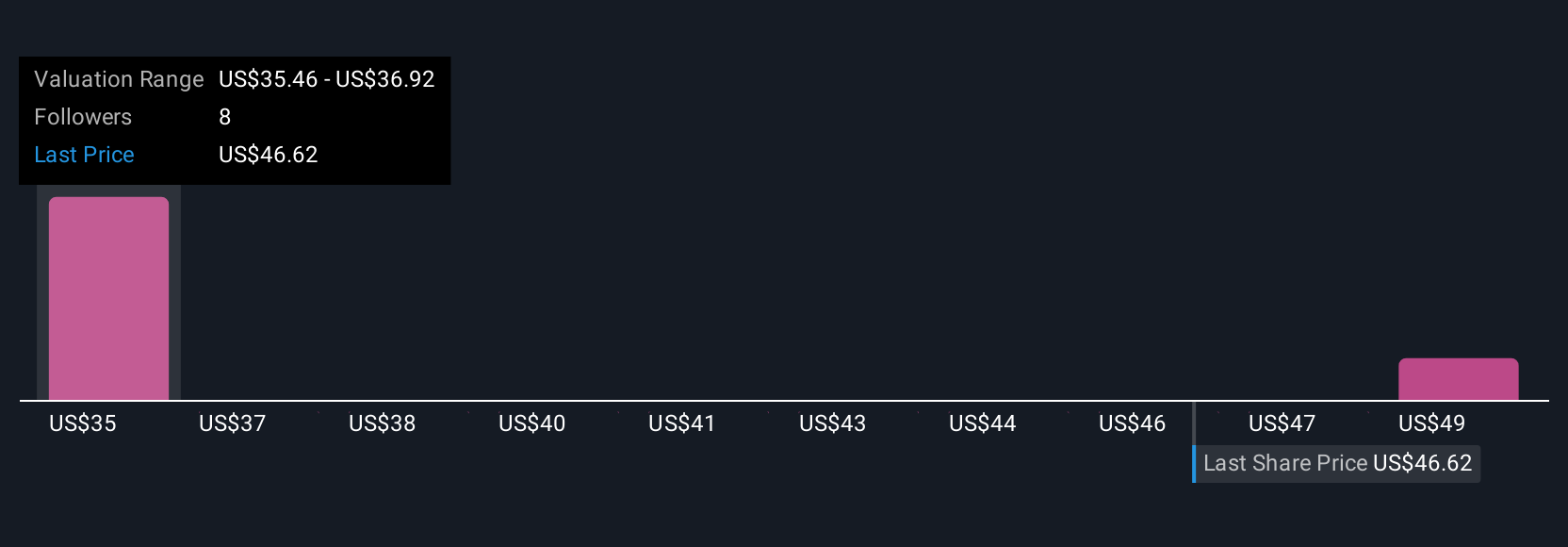

Simply Wall St Community members see fair value estimates for Proto Labs ranging from US$43.90 to US$56.67, reflecting two distinct perspectives. With customer concentration still a clear business risk, these varied opinions show why it’s important to understand how exposed revenues are to a handful of contracts.

Explore 2 other fair value estimates on Proto Labs - why the stock might be worth as much as 16% more than the current price!

Build Your Own Proto Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Proto Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Proto Labs' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives