- United States

- /

- Machinery

- /

- NYSE:PRLB

Proto Labs (PRLB) Profit Margin Miss Underscores Ongoing Earnings Volatility Against Bullish Growth Narratives

Reviewed by Simply Wall St

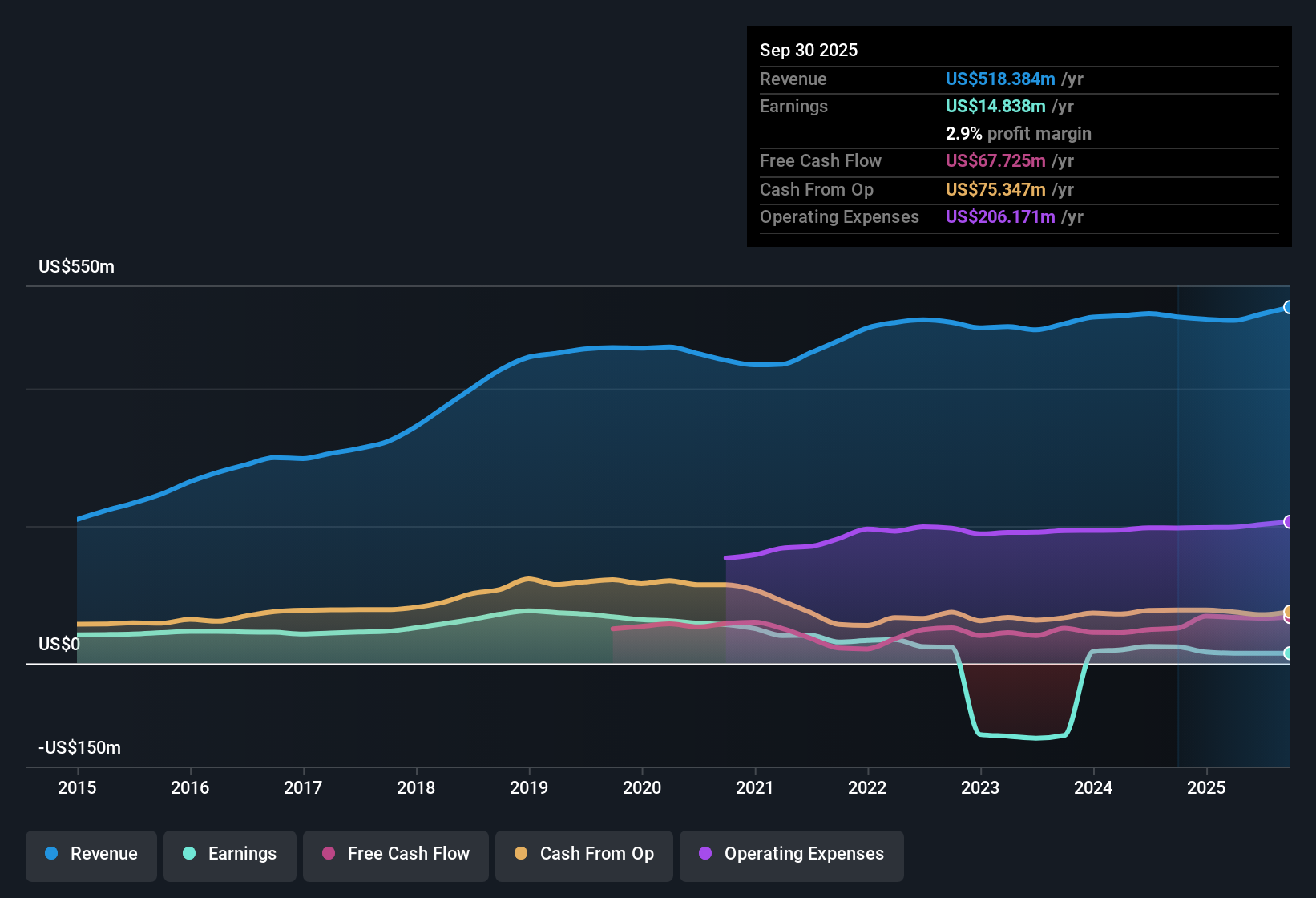

Proto Labs (PRLB) reported a net profit margin of 2.9%, down from 4.9% last year, with profits decreasing by 22.5% per year over the past five years and negative earnings growth in the past year. The latest results were affected by a non-recurring $5.7 million loss, but looking ahead, earnings are forecast to grow 29.7% per year, which is significantly faster than the broader US market.

See our full analysis for Proto Labs.The next section examines these results in detail, comparing them directly to the mainstream narratives circulating around Proto Labs. This will show where the numbers and the story align and where they diverge.

See what the community is saying about Proto Labs

Customer Concentration Drives Revenue Risks

- Aerospace & Defense now makes up over 20% of Proto Labs' business, resulting in significant exposure to a limited set of key accounts. This means that any insourcing by these large clients or loss of major contracts could swiftly impact revenue and earnings.

- Analysts' consensus view highlights that Proto Labs’ strong momentum in advanced manufacturing, especially with CNC machining and sheet metal for high-requirement clients, is fueling sustained revenue growth but also increases the company’s vulnerability to customer concentration risk and economic slowdowns in certain regions.

- For example, European manufacturing weakness has already resulted in a 15% revenue decline and lower factory volumes in that region.

- This concentration underscores the tension between reported growth in target sectors and the threat of outsized volatility if a few large customers shift strategy.

Consensus narrative notes that Proto Labs’ push into regulated sectors brings upside but leaves the company exposed if these few sectors experience downturns. 📊 Read the full Proto Labs Consensus Narrative.

Margin Recovery Hinges on Investment

- While profit margins are currently at 2.9% and expected to rise to 5.7% over the next three years, this improvement is dependent on continuous investment in automation, fulfillment optimization, and digital workflow enhancements.

- Analysts' consensus view considers that Proto Labs’ resilient digital infrastructure and cash-rich, debt-free balance sheet create room to accelerate technology upgrades and global expansion, which could underpin future margin growth as long as investments are well-executed.

- Despite ongoing tariff and competitive pricing pressures, the company's refusal to pass on sudden cost increases to customers protects relationships but also places short-term strain on gross margins.

- This dynamic means that the path to higher profitability is not guaranteed, with the risk that escalating operational and capital expenditures could outpace gains if market share doesn’t materially expand.

Valuation Premium Signals High Expectations

- With shares trading at $49.76, Proto Labs’ price-to-earnings ratio stands at 80.2x, which is much higher than both the US Machinery industry average (24x) and the peer group average (37.4x). This suggests that investors are pricing in aggressive future growth.

- Analysts' consensus view points out that for this high valuation to remain justified, Proto Labs would need to lift earnings from $14.8 million to $33.7 million by 2028 and trade at a PE ratio of 41.0x. Missing on execution or margin expansion could quickly put downward pressure on the stock, since the current share price is only 0.8% above the analyst price target of $50.00.

- The tight gap between share price and target hints that the market already recognizes much of the expected upside, with little room for disappointing progress on growth or margins.

- Investors are paying a premium for innovation and sector leadership, but with recent earnings volatility and competition heating up, expectations are lofty and results must deliver.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Proto Labs on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? In just a few minutes, you can shape your view and share a fresh perspective. Do it your way

A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Proto Labs faces stiff valuation headwinds and profit margin pressures, leaving little room for mistakes as investors expect rapid earnings growth.

If you want a shot at stronger upside and less valuation risk, check out these 832 undervalued stocks based on cash flows where companies trade below fair value based on their cash flows today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives