- United States

- /

- Machinery

- /

- NYSE:PRLB

Proto Labs (PRLB): Evaluating Valuation After a Strong Year and Recent Market Pullback

Reviewed by Simply Wall St

Proto Labs (PRLB) has seen shares edge slightly lower this week, even as the stock remains up nearly 31% over the past year. Investors may be weighing recent financial performance and what it signals for future growth.

See our latest analysis for Proto Labs.

This year’s momentum for Proto Labs has been impressive, with a 28.4% year-to-date share price return. However, the recent 6% single-day drop hints at renewed market caution or shifting expectations. Looking longer-term, the 1-year total shareholder return of nearly 31% stands in strong contrast to a steep five-year total return decline. This underscores how shifts in sentiment can create pockets of opportunity or risk.

If you’re interested in expanding your search for high-potential stocks, now’s a great time to check out fast growing stocks with high insider ownership.

But is Proto Labs now trading at a bargain that underestimates its growth potential, or have recent gains already accounted for what lies ahead, leaving little room for upside? Is this a real buying opportunity, or is the market already anticipating future growth?

Most Popular Narrative: Fairly Valued

With Proto Labs last closing at $49.76 and the analyst consensus price target set at $50.00, the current price closely shadows the narrative’s estimate, making it one of the tightest gaps in recent quarters. This setup puts heightened emphasis on the drivers underlying the fair value calculation.

Digital infrastructure, resilient supply chains, and strong financial health enable investments in automation and global expansion, supporting margin improvement and long-term earnings growth.

Curious what powers this razor-thin margin? The narrative hints at ambitious goals built on automation, stronger margins, and expanding reach. But what numbers fuel this valuation? Does the future justify today’s price? Uncover the projections shaping this call.

Result: Fair Value of $50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sizable risks remain, including persistent European manufacturing weakness and reliance on a handful of major Aerospace and Defense accounts, which heighten exposure to sudden setbacks.

Find out about the key risks to this Proto Labs narrative.

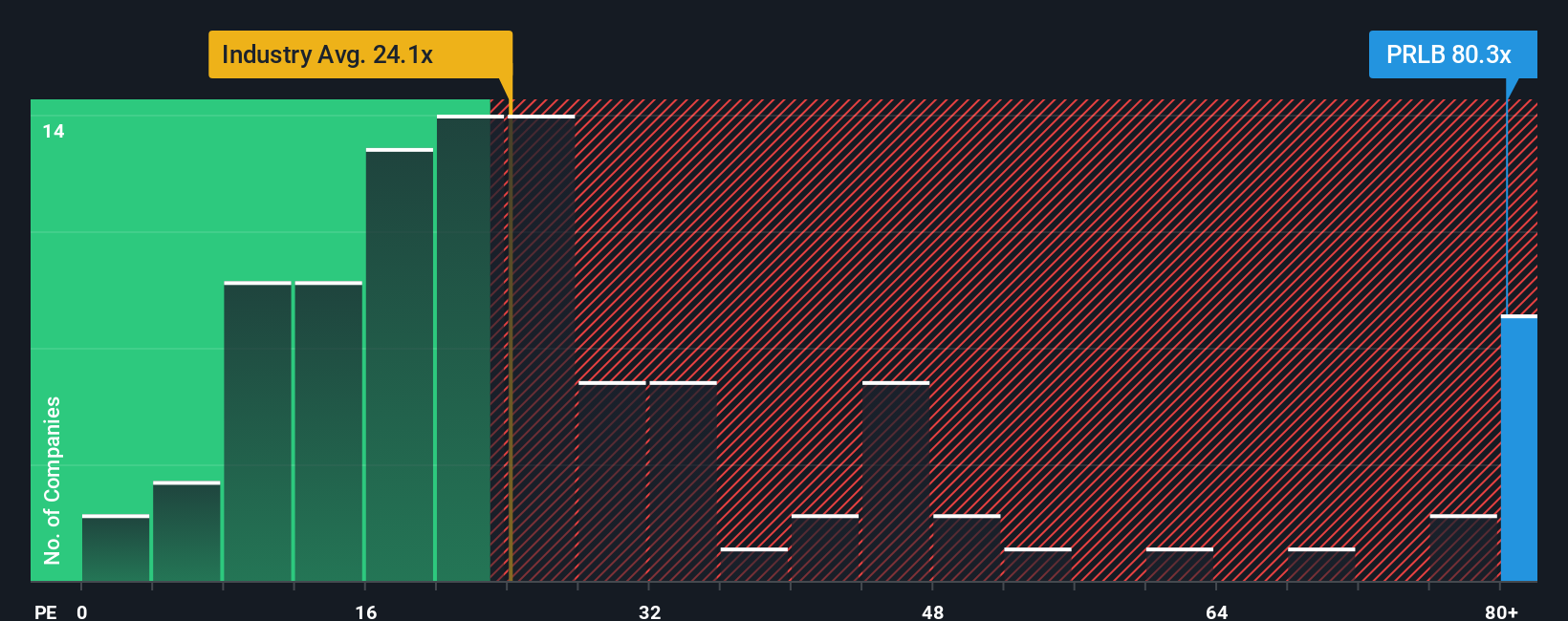

Another View: A Caution Around Earnings Multiples

When we look at valuation through the lens of earnings-based ratios, Proto Labs commands a price that far outpaces both its industry and peer averages. Its current price-to-earnings multiple is around 79x, compared to the industry at approximately 24x and a fair ratio of 34x. This signals elevated expectations and a risk if growth does not materialize. Does the market’s optimism stand on solid ground, or does this leave little room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Proto Labs Narrative

If you see the story differently, or want to dig into the numbers on your own terms, it’s easy to craft your own take in just minutes with Do it your way.

A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities are always just a few clicks away. Don’t let today’s momentum pass you by, and boost your portfolio by checking out these unique stock ideas right now:

- Capture the potential of high-yield investments when you check out these 22 dividend stocks with yields > 3%, delivering income streams beyond the ordinary market picks.

- Accelerate your portfolio with disruption by following these 27 AI penny stocks, shaping tomorrow's world through artificial intelligence breakthroughs and rapid growth stories.

- Capitalize on innovation at the intersection of computing and science; scan these 28 quantum computing stocks that are changing the rules in advanced technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives